SANTA CLARA AND SAN JOSE, CALIF. — Gantry has secured an $11 million permanent loan to refinance two industrial properties in Santa Clara and San Jose. Totaling 78,250 rentable square feet, the properties are a flex-industrial building at 3175 De La Cruz Blvd. in Santa Clara and a single-tenant industrial facility at 1941 Ringwood Ave. in San Jose. Murphy Osborne and Alex Poulos of Gantry’s San Francisco office represented the borrower, a private real estate investor, in the financing. The 10-year, fixed-rate, cross-collateralized loan was secured through one of Gantry’s correspondent life company lenders. Terms include prepayment flexibility and 25-year amortization.

Western

SCOTTSDALE, ARIZ. — CBRE has brokered the sale of Scottsdale Executive Square, an office property located at 13951 N. Scottsdale Road in Scottsdale. A Southern California-based private buyer acquired the asset from an undisclosed seller for $4.8 million. Built in 1993, the two-story, 29,806-square-foot Scottsdale Executive Square was 98.1 percent leased at the time of sale to 19 local and regional office and medical tenants. Geoffrey Turbow and Philip Wurth of CBRE represented the seller in the deal.

DAUM Commercial Brokers Sale of 5,000 SF Mama Lu’s Dumpling House in Arcadia, California

by Amy Works

ARCADIA, CALIF. — DAUM Commercial Real Estate Services has arranged the purchase of a 5,000-square-foot restaurant space in Arcadia. Dream1212 LLC, the owner of Mama Lu’s Dumpling House, acquired the property from an undisclosed seller for $4 million. The traditional Chinese restaurant occupies the restaurant space at 1212 S. Baldwin Ave. The Arcadia property serves as Mama Lu’s sixth location. Rudy Lara, Nick Peukpiboon, Nathan Lara and Andrew Lara of DAUM represented the buyer in the deal.

COSTA MESA, CALIF. — Liberated Brands, a licensed operator of several sport, outdoor and lifestyle apparel brands, has initiated Chapter 11 bankruptcy proceedings, according to court documents filed in Delaware. Liberated Brands’ portfolio of retailers includes Volcom, Billabong, Quiksilver, ROXY, Honolua Surf, RVCA, Beachworks, Becker Surfboards, ZJ Boarding House, Spyder and Boardriders. According to Gordon Brothers, which is providing real estate advisory services to the retailer, Liberated Brands plans to close its 122 stores throughout the country. Gordon Brothers — which earlier this year entered into a sales transaction with Big Lots upon the latter’s Chapter 11 bankruptcy filing — has initiated closing sales at each of the 122 retail locations. In a statement, Liberated Brands CEO Todd Hymel cited “a series of major headwinds and challenges,” including the rise in interest rates, inflation, supply chain delays, declining consumer demand, shifting customer preferences and substantial fixed costs. Additionally, in December 2024, the company’s North American license rights for its wholesale operations under the Volcom, RVCA and Billabong brands were terminated due to a default. Founded in 2019 by Hymel, Costa Mesa-based Liberated Brands briefly enjoyed a sharp increase in product demand during the COVID-19 pandemic, with revenue increasing from $350 million in …

CARSON AND CARLSBAD, CALIF. — Westport Properties has acquired a self-storage portfolio comprising two StorQuest Self Storage-managed assets in Carson and Carlsbad. Terms of the transaction were not released. Built in 2006 on 4.5 acres, the Carson property is located at 17106 Avalon Blvd. The Carlsbad property is located at 2500 Campbell Place and was built in 2008 on 3.4 acres. The portfolio totals 270,841 rentable square feet and 2,284 self-storage units. At the time of sale, the portfolio was 90 percent leased. Greg Wells, Kevin Cuff, Luke Elliott and Mike Mele of Cushman & Wakefield’s Self Storage Advisory Group represented the undisclosed seller in the transaction.

CALABASAS, CALIF. — Gemdale USA has completed the disposition of 4500 Park Granada, a three-story Class A office building in Calabasas, to a joint venture between Cross Ocean Partners and Palisade Group for an undisclosed price. Situated on 20 acres, the 222,667-square-foot property offers courtyards, landscaped gardens and executive parking. Originally developed as a corporate headquarters facility for Lockheed Martin and later serving as the headquarters for Countrywide, the asset operated as a single-tenant campus for nearly 20 years. Recently, the building underwent an extensive renovation to improve efficiency and sustainability, as well as conversion to a multi-tenant office building. At the time of sale, 4500 Park Granada was fully leased to seven tenants across diverse industries, including consumer goods (44 percent), insurance (30 percent), hospitality (14 percent), coworking (8 percent) and financial services (3 percent). Kevin Shannon, Ken White, Rob Hannan, Michael Moll, Laura Stumm and Alex Beaton of Newmark represented the seller in the deal. Jonathan Firestone, Blake Thompson and Henry Cassiday of Newmark Global Debt & Structured Finance offered market financing guidance during the sale.

CHANDLER, ARIZ. — A joint venture between Ryan Cos. and Alidade Capital has closed financing and broken ground on Chandler Freeways Business Park, located southeast of Loop 202 and Interstate 10 in Chandler. The project includes converting a former office building, which was originally built by Ryan Cos. in 2003, into an 87,600-square-foot, single-story Class A industrial building, and constructing a 102,875-square-foot Class A industrial building. Chandler Freeways Business Park will feature full concrete truck courts, reinforced speed bays, speculative office suites, warehouse lighting, the capacity for high power, a total of 26 dock-high doors and 301 vehicle parking stalls. Butler Design Group is the architect of record. Mark Krison, Luke Krison and Armand Doost of CBRE are marketing the project for lease.

Colliers Mortgage Provides $19.3M HUD-Insured Loan for Seniors Housing Project in Erie, Colorado

by Amy Works

ERIE, COLO. — The Minneapolis office of Colliers Mortgage has provided a $19.3 million HUD 213 loan for the construction of Village Cooperative of Erie, an age-restricted cooperative residential property in Erie. The borrower is Village Cooperative of Erie. The property will feature 64 one-, two- and two-bedroom plus den units with stainless steel appliances, nine-foot ceilings and in-unit washers/dryers. Community amenities will include underground heated parking, a fitness center, community room with serving kitchen and private meeting room, hobby room, parcel/mail room, on-site management, an elevator, community deck and garden plots.

ESCONDIDO, CALIF. — RAF Pacifica Group (RPG) has completed the development of Escondido Logistics Center, located at lots 10-18 within Escondido Technology and Research Park. The $60 million, 146,000-square-foot project includes two free-standing buildings featuring 28-foot clearances, heavy power and above-standard loading positions. San Diego Water Authority, represented by Colliers, acquired the 88,000-square-foot building upon completion of the project. The 58,000-square-foot building is being marketed for lease or sale by Aric Stark and Drew Dodds of Cushman & Wakefield.

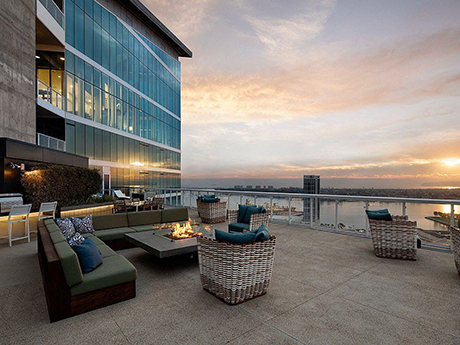

SAN DIEGO — MG Properties has acquired Park 12 Apartments, a 35-story multifamily tower located in downtown San Diego, for $309 million. The transaction is the largest multifamily acquisition in San Diego since 2020 and the third-largest multifamily acquisition in the city’s history, according to the locally based buyer. Built in 2018, the community is located adjacent to Petco Park, home of the San Diego Padres Major League Baseball team, and within the Ballpark Village master-planned community. The property offers a mix of studio, one-, two- and three-bedroom units, including penthouse apartments with exclusive access to a lounge on the 32nd floor. Shared amenities include saltwater and heated pools with poolside event space, a 24-hour fitness center, golf simulator and putting green, sun deck and spa, dog park, coffee and herbal tea bar, clubroom, sports lounge, game room and courtyards with outdoor seating, grilling areas and fire pits. Joseph Smolen and Geoff Boler of Eastdil Secured represented the seller, Charleston, S.C.-based Greystar, in the transaction. Greg Stampley and Lee Redmond, also with Eastdil Secured, originated a Fannie Mae acquisition loan of an undisclosed amount on behalf of MG Properties. San Diego-based MG Properties is a privately owned real estate firm specializing …