LOS ANGELES — BridgeCore Capital has provided $6.5 million in refinancing for a multifamily property on the border of the Koreatown and MacArthur Park neighborhoods in Los Angeles. The undisclosed borrower will use loan proceeds to refinance a matured loan and to pay outstanding property taxes. BridgeCore structured the loan with a six-month prepaid interest reserve to cover the shortfall between net operating income and BridgeCore’s debt service and to avoid payment default by the undisclosed borrower during the loan term. The loan features a 74 percent loan-to-value ratio. Information about the property was not disclosed.

Western

Continental Realty Corp. Acquires 630,000 SF Crossroads of Taylorsville Retail Center Near Salt Lake City

by Amy Works

TAYLORSVILLE, UTAH — Continental Realty Corp. (CRC) has entered the Utah market with the purchase of The Crossroads of Taylorsville, a shopping center in Taylorsville, for an undisclosed price. The asset was purchased with funds from Continental Realty Opportunistic Retail Fund I, a closed-end fund for which approximately $323 million has been raised. Totaling nearly 630,000 square feet, The Crossroads at Taylorsville is located at 5400 S. Redwood Road, 12 miles south of Salt Lake City. The property consists of 10 buildings and seven separate outparcels or multi-tenant strip buildings, all of which is surrounded by a free surface parking lot that can accommodate nearly 3,900 vehicles. At the time of sale, the property was 94 percent leased. Current tenants include Target, T.J.Maxx, HomeGoods, Ross Dress for Less, EOS Fitness, Regal Cinema, PetSmart, Dollar Tree, Guitar Center, King Buffet, Lifetime Products, Mr. Mac, Rockler Woodworking and Sierra Trading Post. Mark Damiani of Eastdil Secured represented the seller, TriGate Capital, in the deal. With this transaction, Baltimore-based CRC has now acquired more than $700 million in retail real estate since the beginning of 2021.

JLL Arranges Sale of 276,529 SF Lakeview Innovation Center Flex Campus in Thousand Oaks, California

by Amy Works

THOUSAND OAKS, CALIF. — JLL Capital Markets has arranged the all-cash sale of Lakeview Innovation Center, a flex campus on 22.1 acres in Thousand Oaks. An undisclosed seller sold the asset to a partnership between Alta West Partners, an affiliate of Glendon Capital Management and A2 Capital Management for an undisclosed price. Michael Leggett, Jeffrey Bramson, Andrew Harper and William Poulsen of JLL represented the seller in the transaction. Renovated in 2023, Lakeview Innovation Center offers 276,529 square feet of research-and-development (R&D) and office space. The campus includes an onsite Equinox fitness club, Earthbar, pickleball court, walking trails, a tenant lounge and multiple outdoor patio and collaborative spaces. The tenant roster includes Marvell Technologies and Rawlings, which benefit from the property’s infrastructure, including lab-grade HVAC, excess power capacity, ample clear heights, loading docks and backup generators. Additionally, the asset offers expansion opportunities with M2 zoning, supporting up to 123,000 square feet of additional density for life sciences, R&D or office uses. The new ownership team plans to upgrade the common areas, restrooms, signage and landscaping.

MODESTO, CALIF. — Aspen Real Estate Financial (AREF), in partnership with Stanislaus Regional Housing Authority and California Affordable Housing Agency (CalAHA), has acquired the 50-unit Rumble Road Apartments in Modesto for $17 million, or $340,000 per unit. AREF handles 100 percent of the total capitalization of the acquisition, along with reserves to cover lease payments and operating expenses. The program is a long-term lease to own, where AREF donates all equity and upside value to Stanislaus Regional Housing Authority. Stanislaus Regional Housing Authority, on a 35-year lease to own the property, will begin implementing a workforce housing platform at the property where the rent levels are structured to fall within moderate income housing as defined by HUD at 80 percent to 120 percent of area median income. Located at 2531 W. Rumble Road, the community offers 10 one-bedroom units and 40 two-bedroom apartments with air conditioning, ceiling fans, stainless steel appliances, double-pane windows, walk-in closets, full-size washers/dryers and tankless water heaters. Community amenities include a clubhouse with a fitness center, play area and onsite property manager. AREF has provided funds to gate the entire community. Matt Benwitt of Lee & Associates LA North/Ventura represented the buyer, while Marcus & Millichap …

SRS Negotiates $5.4M Sale of Learning Experience Retail Property in Firestone, Colorado

by Amy Works

FIRESTONE, COLO. — SRS Real Estate Partners has negotiated the sale of a retail building located at 10935 Colorado Blvd. in Firestone. An East Coast-based developer sold the asset to a local private investor for $5.4 million. The Learning Experience occupies the 10,000-square-foot building, which was built in 2023, under a new 15-year lease. Ryan Tomkins of SRS Capital Markets represented the seller in the deal.

Marcus & Millichap Brokers Sale of 131-Room La Quinta Inn Hotel in Westminster, Colorado

by Amy Works

WESTMINSTER, COLO. — Marcus & Millichap has arranged the sale of La Quinta Inn by Wyndham Denver Northglenn, a three-story hotel at 345 W. 120th Ave. in Westminster. A private seller sold the asset to a local buyer for an undisclosed price. Built in 1986 and renovated in 2023, La Quinta Inn offers 131 guest rooms and is centrally located between Boulder, Colo., and downtown Denver. Skyler Cooper and Christy McDougall of Marcus & Millichap represented the seller and procured the buyer in the deal. Adam Lewis served as Marcus & Millichap’s broker of record in Colorado.

Alexandria Real Estate Equities Sells Life Sciences Facility in Seattle to Fred Hutch Cancer Center for $150M

by Amy Works

SEATTLE — Alexandria Real Estate Equities, through an affiliate, has completed the sale of 1165 Eastlake Avenue East in Seattle’s Lake Union submarket to long-standing tenant Fred Hutch Cancer Center for $150 million. Alexandria developed and delivered the 100,086-square-foot, single-tenant, Class A life sciences building in 2021. Proceeds from the disposition of 1165 Eastlake will be reinvested into Alexandria’s leased development and redevelopment pipeline, which consists of research-and-development centers for top life sciences companies, including Bristol Myers Squibb and Novo Nordisk. As part of the transaction, Alexandria, through an affiliate, entered into a strategic joint venture partnership with Fred Hutch for nearby 1201 and 1208 Eastlake Avenue East, aggregating 206,031 rentable square feet, through a transfer of partial interests from the prior joint venture partner to Fred Hutch. Alexandria’s ownership interest in each 1201 and 1208 Eastlake remains unchanged at 30 percent. Fred Hutch executed early renewals at both properties, including a 15-year lease extension at 1201 Eastlake, where it occupies the entire building. These two life sciences facilities support the cancer center in its efforts to translate cancer and infectious disease discoveries into treatments and cures.

PHOENIX — ViaWest Group has completed the disposition of Canyon Corporate Plaza, a Class A office campus located on 11.6 acres in Phoenix, for an undisclosed price. The buyer is CaliberCos Inc., a Scottsdale, Ariz.-based financial services company in the alternative asset management space. Steve Lindley and Alexandra Loye of Cushman & Wakefield’s Capital Markets team represented the seller in the deal. Canyon Corporate Center offers 311,706 square feet of office space within a transit-oriented location in Phoenix’s I-17 Corridor and close to two stops on the newly opened light rail extension. At the time of sale, the property was nearly vacant.

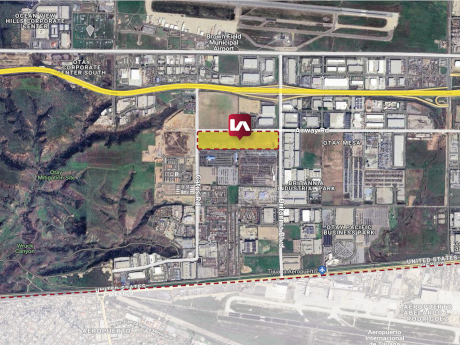

Lee & Associates Negotiates $58M Purchase of Industrial Land in San Diego’s Otay Mesa District

by Amy Works

SAN DIEGO — Lee & Associates has arranged the acquisition of 37.9 acres of industrial land at 5761 Airway Road in San Diego’s Otay Mesa neighborhood. Hyundai Translead purchased the asset for $58 million in an off-market transaction. The site will support Hyundai Translead’s operations in San Diego, which will allow the company to continue to utilize the location of Otay Mesa as a thoroughfare for its cross-border operations. Rusty Williams, Chris Roth, Jake Rubendall and Andrew Kenny of Lee & Associates – NSDC, as well as Eugene Kim of Lee & Associates LA North/Ventura, represented the buyer in the transaction.

SEATTLE — Gantry has secured a total of $34.3 million of loans to refinance four Seattle-area assets owned by different and unaffiliated entities. Each transaction was placed with one of Gantry’s life company correspondent lenders and each structure provided the borrowers with non-recourse, fixed-rate loans. Mike Wood of Gantry represented three of the borrowers. The financings included: