IRVINE, CALIF. — Irvine-based IRA Capital, in partnership with funds managed by Oaktree Capital Management, has purchased 12 medical outpatient buildings totaling 600,000 square feet. The transaction includes two separate institutional sellers and features a mix of single and multi-tenant medical buildings in California, Texas, Florida and Oregon. Terms of the transaction were not released. The Class A portfolio is anchored by health systems and medical providers including UC Davis Health, Palomar Health, UCLA, CommonSpirit, Ascension, McKesson and SCA Health, which collectively occupy approximately 50 percent of the space.

Western

SALT LAKE CITY — Stos Partners has entered the Salt Lake City market with the acquisition of an industrial complex located at 900 W. 2900/2950/3100 S in Salt Lake City for $35 million, or $118 per square foot. The name of the seller was not released. Stos Partners plans to immediately implement a capital improvement program to stabilize and re-tenant the asset. Situated on 14.5 acres, the 279,233-square-foot facility features 22-foot clear heights, 49 dock-high doors and 18 drive-in ground-level doors. Eli Priest, Jeff Heaton and Kyle Roberts of Newmark are handling leasing for the property. Alex Harrold of Mathews Real Estate represented Stos Partners in the off-market transaction.

KeyBank Funds $45.4M Financing for Camas Flats Affordable Housing Project in Oak Harbor, Washington

by Amy Works

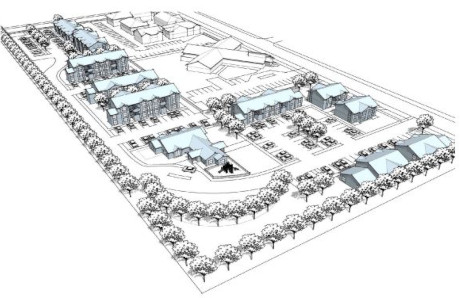

OAK HARBOR, WASH. — KeyBank Community Development Lending and Investment (CDLI) has provided $17.9 million in federal Low Income Housing Tax Credit equity and a $19.3 million construction loan for the construction of Camas Flats, an affordable residential property in Oak Harbor, located on an island north of Seattle. KeyBank Commercial Mortgage Group also arranged an $8.2 million Fannie Mae MTEB permanent loan for the project. Shelter Resources Inc., a Bellevue-based affordable housing developer, is the borrower. Additionally, Opportunity Council (OC) will service as the nonprofit general partner for the project, providing supportive services and case management to tenants on site. Camas Flats will consist of 10 garden-style, walk-up apartment buildings offering a mix of one-, two- and three-bedroom units, as well as one manager’s unit. Community amenities will include a playground, park and community building. The community will provide 81 affordable housing units for residents earning between 30 percent and 80 percent of area median income. Camas Flats will also include eight units that are specifically Permanent Supportive Housing (PSH) for those experiencing homelessness and two units for veterans. For the PSH units, OC will offer full-time case management services that are focused on wellness, medical health and behavioral health …

TEMPE, ARIZ. — LBA Logistics has completed the disposition of University Logistics Center, an industrial and logistics building on nine acres in Tempe. Setna iO and Setnix, an owner/occupier, acquired the asset for $27.5 million. Located at 1345 S. 52nd St., the 112,300-square-foot facility features 3,500 square feet of office space, 32-foot clear heights, three dock-high doors, 10 drive-in load doors, three truck wells, a concrete truck court, 18 new windows, storefront entry for will call, new LED lighting for the interior space and parking areas, secured parking and trailer storage and multiple points of ingress/egress. Additionally, the property offers 494 parking spaces. The buyer plans to use the facility to expand its operations, which focuses on aftermarket aircraft parts supply and high-tech airplane parts machining and repair. Mike Haenel, Andy Markham and Phil Haenel of Cushman & Wakefield represented the seller, while Todd Hamilton of Citywide Commercial Real Estate, along with Denise Stain Chaimovitz of Entre Commercial Realty, represented the buyer in the deal.

Lument Provides $38.8M Freddie Mac Refinancing for Carlton Senior Living Portfolio in California

by Amy Works

FREMONT AND SAN JOSE, CALIF. — Lument has provided $38.8 million in Freddie Mac refinancing loans for Carlton Senior Living, one of Northern California’s largest senior living providers with 11 independent living, assisted living, and memory care communities in operation. The loans are spread across two separate properties — $13.5 million to refinance a 123-unit senior living property in Fremont and $25.3 million to refinance a 126-unit senior living property in San Jose. Both loans feature a fixed interest rate, 10-year term and 30-year amortization. One loan also provides funds for renovations to improve the San Jose property. Lument’s Nick Hamilton and Casey Moore, both based in San Diego, led the transaction.

Sudberry Properties Completes Second Phase of Otay River Business Park in Chula Vista, California

by Amy Works

CHULA VISTA, CALIF. — Sudberry Properties has completed Phase II at the 50-acre Otay River Business Park in Chula Vista, just south of San Diego. The second phase consists of two manufacturing and warehouse buildings totaling 205,435 square feet. The 97,230-square-foot building is located at 2995 Faivre St., and the 108,205-square-foot building is located at 2855 Faivre St. The buildings offer 28- to 32-foot clear heights, dock-high and grade-level doors, 4,000 amps of 277/480-volt power and flexible spaces ranging from approximately 25,000 square feet to more than 108,000 square feet. PGW Auto Glass, a supplier of auto glass and shop accessories with more than 120 distribution branches in the United States and Canada, has leased approximately 23,500 square feet of warehouse space at 1995 Faivre St. The 137,500-square-foot Phase One is fully leased to variety of tenants, including Starbucks Coffee, SuperStar Car Wash, Jamba Juice, Menuderia Guadalajara, Knockaround Sunglasses, Colonna’s Shipyard Inc., Sunbelt Rentals, Luv Sola wood flowers, Shore Total Office and Boochcraft hard kombucha. The final phase of Otay River Business Park will include 108,700 square feet of manufacturing/warehouse space. Michael Mossmer of Voit Real Estate Services is handling leasing for the buildings. The project team includes San Diego-based TFW …

BOTHELL, WASH. — Security Properties has completed the disposition of Woodstone Apartments, a multifamily property located at 16520 North Road in the Seattle suburb of Bothell. An undisclosed buyer acquired the asset for $34.7 million. Eli Hanacek, Mark Washington, Kyle Yamamoto and Natalie Kasper of CBRE represented the seller in the deal. Built in 1989 on 6.4 acres, Woodstone Apartments features 124 one-, two- and three-bedroom units, 86 percent of which are renovated. Community amenities include a pool, spa, fitness center, playground and clubhouse.

LOS ANGELES — BOLOUR Associates has acquired a site with three retail buildings in the Los Angeles Mid City submarket for $6 million. Located at 601, 611 and 619 S. Fairfax Ave., the buildings offer more than 11,500 square feet of net rentable area, including a former 99 Cents Only store. BOLOUR purchased the 99 Cents Only property through a bankruptcy auction after Number Holdings Inc., the parent company of 99 Cents Only Stores LLC, filed for Chapter 11 bankruptcy earlier this year and closed all of its stores. The company will renovate the three buildings to cater to gallery, design, furniture and showroom uses. In the long-term, BOLOUR plans to redevelop the site into 120 multifamily residential units. Hilco Global represented the undisclosed seller, while BOLOUR was self-represented in the deal.

MARANA, ARIZ. — Ascent Cos. and Vanderbuild, along with Bryten Real Estate Partners as property manager, have opened Amavida Marana, an apartment community in Marana. Located at 5555 W. Ina Road, Amavida Marana features 200 one-, two- and three-bedroom units with upgraded in-home amenities including smart thermostats, nine-foot ceilings, stainless steel appliances and vinyl wood flooring. Community amenities include a private, four-acre, gated community park with four pickleball courts, a playground, a walking and jogging loop and an enclosed dog park. The property also includes electric vehicle charging stations, an indoor/outdoor fitness center, swimming pool, hot tub, pet washing stations and a clubhouse.

SAN DIEGO — Marcus & Millichap has arranged the sale of North Park Retail, a restaurant property at 2884 University Ave. in San Diego’s North Park neighborhood. Carlos Partners LLC sold the asset to 1295 University Family LP for $1.9 million. Built in 1948, North Park Retail features 3,200 square feet of space. The single-tenant property was renovated in 2014 for Saiko Sake and Sushi Bar’s tenant build out. After operating for 10 years, Saiko Sushi will close when its lease expires in October. The buyers plan to lease out the property after Saiko Sake and Sushi Bar’s vacates. Ross Sanchez and Nick Totah of The Totah Group of Marcus & Millichap represented the seller, while Nate Benedetto of Next Wave Commercial procured the buyer in the transaction.