In the first half of 2024, high interest rates led to decreased demand, higher vacancy rates, reduced construction starts and lower property sales in industrial and office, according to Lee & Associates’ 2024 Q2 North America Market Report. Meanwhile, retail saw minimal development and continued low vacancies. Retail rent growth was particularly strong in the South and Southwest. Finally, high demand for multifamily, coupled with a sudden influx of supply in the second quarter of the year, has created a market where outcomes are highly tied to region. Midwest and Northeast multifamily markets have remained stronger than their counterparts in the South and Southwest, while Western markets saw mixed growth. Lee & Associates has made their full market report available here (with complete breakdowns of cap rates by city, market rents, vacancy rates, square footage information and more). The summaries for the industrial, office, retail and multifamily sectors below provide detailed insight into the trends and trajectories likely through the end of 2024. Industrial Overview: Activity, Growth Checked by High Interest Rates Industrial market performance across North America continued to downshift in the first half of this year. Although net absorption remains positive, demand for industrial space has fallen to the lowest levels …

Western

AcquisitionsContent PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Okland Capital, San Tan Development Break Ground on $100M Northside at SanTan Village Mixed-Use Project in Gilbert, Arizona

by Amy Works

GILBERT, ARIZ. — Okland Capital and San Tan Development Group have broken ground on Phase I of Northside at SanTan Village, a mixed-use development in the Phoenix suburb of Gilbert. The first phase will feature 37,245 square feet of retail and restaurant space spread across six buildings. Completion of phase one is slated for mid-2025, with a grand opening expected in fall 2025. The hotel component is scheduled to deliver shortly after and future uses are currently being designed. At full build-out, Northside at SanTan Village will span 20 acres and feature a 134-key hotel, retail, restaurants and community green space. Development costs were estimated at $100 million. The project team includes Okland Construction as general contractor and Aline Architecture Concepts as architect for the retail center. Bryan Babits and Alberto Caballero of Western Retail Advisors are handing leasing for the project’s retail and restaurant spaces.

BROOMFIELD, COLO. — Mile High Labs has completed the disposition of 2555 W. Midway Boulevard, a R&D and manufacturing property within Atlas Industrial Park in Broomfield, a suburb north of Denver. ScanlanKemperBard acquired the asset for an undisclosed price. Situated on 20 acres, the 436,534-square-foot asset features a 411,034-square-foot building and a 25,500-square-foot building. The buildings offer office, manufacturing, processing, packaging, laboratory and climate-controlled warehouse areas, as well as general engineering areas and an employee cafeteria. Additionally, the buildings collectively feature nearly 12,000 amps of power. Rick Egitto of Avison Young, along with Justin Rayburn of Fountainhead Commercial, represented the seller, while the buyer was self-represented in the deal.

HAYWARD, CALIF. — BKM Capital Partners has acquired North Cabot Industrial Park, located at 19707-19845 Cabot Blvd. in the East Bay city of Hayward. A non-profit entity sold the asset for $10.5 million, or $206 per square foot. Situated on 3.8 acres, North Cabot Industrial Park consists of two buildings offering a total of 51,038 square feet with 13 units ranging in size from 2,794 square feet to 6,936 square feet. The asset features two dock-high and 15 grade-level doors, 14-foot clear heights, sprinkler systems and ample parking. At the time of sale, the property was 91 percent occupied. BKM plans to invest about $685,000 on capital improvements to bring the asset to its brand standards. Planned improvements include upgrades and/or replacements of the roofs, HVAC systems, parking lot, paint, signage and landscaping. The company will invest $49,000 on speculative tenant improvements to modernize a 4,580-square-foot unit with new carpeting, paint, fixtures, millwork and lighting. BKM was self-represented in the transaction, while Robert Ferraro, Michael Barry and Ken Morris of CBRE represented the seller.

LeClaire-Schlosser Group Brokers Sale of 668-Unit Astrozon Self Storage in Colorado Springs

by Amy Works

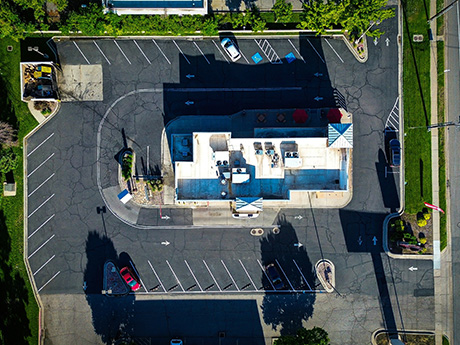

COLORADO SPRINGS, COLO. — The LeClaire-Schlosser Group of Marcus & Millichap has arranged the sale of Astrozon Self Storage, a self-storage facility in Colorado Springs. Terms of the transaction were not released. Located at 3710 Astrozon Blvd., the 53,200-square-foot facility features 668 single-story, drive-up access units. Charles LeClaire and Adam Schlosser of Marcus & Millichap’s Denver office represented the seller, a local limited liability company, and secured the buyer, a New York-based, privately held real estate investment company, in the deal.

EL CAJON, CALIF. — Marcus & Millichap Capital Corp. (MMCC) has arranged a $5.6 million loan for the refinancing of a retail property located at 13578 Camino Canada in El Cajon, a suburb of San Diego. Tenants at the property include Wells Fargo, Subway, Panda Express, The UPS Store and H&R Block. Chad O’Connor of MMCC’s San Diego office secured the financing with a local credit union on behalf of a private client. Terms of the 10-year loan include a 6.5 percent fixed interest rate with 30-year amortization and a loan-to-value ratio of 65 percent.

Tinder Founder Justin Mateen Leads $211M Acquisition of Wilshire Rodeo Plaza Office/Retail Property in Beverly Hills

by Katie Sloan

BEVERLY HILLS, CALIF. — Tinder founder Justin Mateen, his brother Tyler Mateen and their brother-in-law Pouya Abdi have acquired Wilshire Rodeo Plaza, a Class A office and retail complex located at the corner of Rodeo Drive and Wilshire Boulevard in the posh Los Angeles suburb of Beverly Hills. Nuveen sold the asset for $211 million. The 300,000-square-foot property includes three six-story office and retail buildings along Wilshire Boulevard and a three-story office building along Rodeo Drive. The buyers plan to rebrand the property as One Rodeo, as well as upgrade and re-program the buildings to cater to luxury retail and office tenants. Current tenants include Merrill Lynch/Bank of America, USB, William Morris Endeavor and Encore Recordings. The Mateen brothers and Abdi view the acquisition as a generational property, and hope to take advantage of the “flight to quality” in a struggling office sector with limited new Class A supply. “Iconic buildings such as One Rodeo will continue to benefit from increased demand as the trend toward high-quality assets continues to unfold in a post-COVID world,” says Tyler Mateen, who is CEO of Cannon TTM, a Los Angeles-based real estate investment firm. “We are grateful to be acquiring these buildings at …

Venture West Development Underway on 196-Acre Jackrabbit Crossing Mixed-Use Project Near Bozeman, Montana

by Amy Works

BELGRADE, MONT. — Venture West Development is underway on Jackrabbit Crossing, a 196-acre mixed-use project in Belgrade, roughly 10 miles northwest of Bozeman. Rosauers Supermarkets, which recently signed a long-term lease, will anchor the property. Plans for the development, which is located three miles from the Bozeman Yellowstone International Airport, also include a proposed 53,000-square-foot Amazon distribution center.

Bridge Investment Group Divests of 288-Unit Equestrian Multifamily Property in Tucson, Arizona

by Amy Works

TUCSON, ARIZ. — Bridge Investment Group has completed the disposition of Equestrian, a multifamily property in Tucson. Investors Capital Group acquired the asset for an undisclosed price. Built in 2008, Equestrian features 288 apartments with fully equipped kitchens, granite countertops, in-unit washers and dryers, nine-foot ceilings, large walk-in closets and private patio or balconies. Community amenities include a leasing office, business center, resort-style swimming pool, clubhouse, fitness center, covered parking and 70 private detached garages. Clint Wadlund, Hamid Panahi, Steve Gebing and Cliff David of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the seller and procured the buyer in the deal.

NAI Capital, Lee & Associates Negotiate $28.2M Acquisition of Two Office Buildings in San Gabriel Valley, California

by Amy Works

DIAMOND BAR AND MONTEREY PARK, CALIF. — NAI Capital Commercial has arranged the sale of two separate office buildings in Diamond Bar and Monterey Park, both located in the San Gabriel Valley east of Los Angeles. The assets sold for a total consideration of $28.2 million. Ryan Campbell of NAI Capital Commercial’s Investment Services Group and Tony Naples of Lee & Associates represented the buyer, a private investor, in the transactions. In the first deal, the 80,753-square-foot building at 21680 Gateway Center Drive in Diamond Bar sold for $18.9 million, or $234 per square foot. Situated on a 13.3-acre campus, the fully renovated asset is fully leased to 13 diverse tenants. In the second transaction, a 39,233-square-foot facility at 1100 Corporate Center Drive in Monterey Park sold for $9.3 million, or $237 per square foot. The two-story standalone building features ample parking. The seller or sellers were not disclosed.