NORTH PLAINS, ORE. — Colliers has arranged the completion of a 10-year lease agreement with DB Schenker, as the tenant, and the forward sale of North Plains Logistics Center to STAG Industrial Holdings. Far West Fibers sold the asset for an undisclosed price. Situated on 10.5 acres in North Plains, located within Oregon’s Silicon Forest submarket just west of Portland, North Plains Logistics Center features 201,750 square feet of industrial space. Jerry Matson and Colin Russell of Colliers, along with West Industrial Capital Markets’ Michael Kendall and Gian Bruno, represented the seller in the deal. Matson and Cole Hooper of Colliers represented tenant, DB Schenker, in the site selection and lease negotiations. Matson and Russell also represented the landlord in lease negotiations.

Western

SAN DIMAS, CALIF. — CBRE has brokered the sale of Arrow Pines Business Park, an industrial business park in San Dimas. Arrow SD LLC acquired the asset from SoCal Industrial LLC, a joint venture between Birtcher Anderson Davis & Associates and Belay Investment Group, for $9.2 million. Built in 1987, Arrow Pines Business Park offers three buildings ranging in size from 11,240 square feet to 16,473 square feet, with unit sizes varying from 960 square feet to 3,192 square feet. The 44,125-square-foot property features 12- to 15-foot clear heights and 32 grade-level doors. The property is situated on 3.1 acres at 210 and 260 W. Arrow Highway and 440 S. Cataract Ave. CBRE Investment Properties’ Mark Shaffer, Anthony DeLorenzo, Gerand Poutier and Dylan Rutigliano, along with CBRE National Partners’ Barbara Perrier and Eric Cox, represented the seller in the deal.

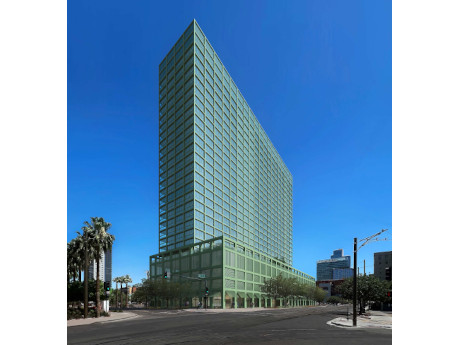

PHOENIX — JLL Capital Markets has arranged $120 million in construction financing for the development of Ray Phoenix, a 26-story residential building in downtown Phoenix. Michael Gigliotti, Brad Miner and Frank Choumas of JLL Capital Markets Debt Advisory secured the financing for the borrower, VeLa Development Partners and Ray, through an affiliate of RXR Realty Investments LLC. Located at 777 N. Central Ave., Ray Phoenix will offer 401 studio, one- and two-bedroom apartments, including duplex and penthouse units with floor-to-ceiling windows, custom cabinetry and luxury flooring and bathroom tiles. The property will feature 20,000 square feet of amenity space, including a large fitness center, yoga studio, resort-style pool, communal kitchen, fireplace lounge, sunken lounge with theater experience, dog wash stations, indoor and outdoor gardens, and workspaces. Situated within an Opportunity Zone, Ray Phoenix will be located on the Phoenix light-rail line and less than a mile north of the Footprint Center and Chase Field.

Formation Interests, Crescent Real Estate Break Ground on 427,000 SF Formation Park Industrial Project in Goodyear, Arizona

by Amy Works

GOODYEAR, ARIZ. — Dallas-based Formation Interests and Crescent Real Estate has broken ground on the first phase of Formation Park 10, an industrial development at the corner of Bullard Avenue and Celebrate Life Way in Goodyear, a suburb west of Phoenix. Willmeng Construction is serving as general contractor for the project. The first phase of Formation Park 10 will consist of 427,000 square feet spread across two buildings and includes a large, first-of-its-kind park to serve as an amenity for future tenants and the surrounding community.

Davis Property & Investment Buys Central Commerce Center Industrial Campus in Kent, Washington

by Amy Works

KENT, WASH. — Davis Property & Investment has acquired Central Commerce Center, an industrial campus located at the intersection of Central Avenue South and 259th Street in Kent, a suburb south of Seattle. Constructed between 2000 and 2001, Central Commerce Center comprises four fully leased industrial buildings with freeway access, ample parking and proximity to numerous walkable amenities. The buildings offer 12- to 16-foot clear heights, on-grade loading facilities and an infrastructure that includes a total of 1400 amps 3-phase 480v power. Brian Bruininks and Shane Mahvi of Andover Co. represented the undisclosed seller in the deal. The price was not disclosed.

SRS Negotiates $6.1M Ground Lease Sale of Chick-fil-A-Occupied Property in Murrieta, California

by Amy Works

MURRIETA, CALIF. — SRS Real Estate Partners has arranged the $6.1 million ground lease sale of a restaurant property at 27960 Clinton Keith Road in the Inland Empire city of Murrieta. Chick-fil-A occupies the 5,000-square-foot property, which opened for business in March and has a 15-year ground lease in place. Winston Guest, Matthew Mousavi and Patrick Luther of SRS Capital Markets represented the seller and developer, Newport Beach-based Sage Investco, and the buyer, a California-based private family trust, in the all-cash transaction. The Chick-fil-A property sale is part of a break-up strategy valued in excess of $20 million for the Class A pads at The Vineyard Shopping Center, a 26.3-acre retail project anchored by Costco and ALDI.

Progressive Real Estate Partners Brokers $2.4M Sale of Value-Add Retail Strip Center in West Covina, California

by Amy Works

WEST COVINA, CALIF. — Progressive Real Estate Partners has arranged the sale of a multi-tenant retail strip center in West Covina, approximately 20 miles east of Los Angeles. A San Bernardino County-based private investor sold the asset to a West Covina-based investor for $2.4 million in an all-cash transaction. Located at 532-540 N. Azusa Ave., the 7,760-square-foot property was fully occupied at the time of sale by five service-oriented tenants ranging in size from 1,300 square feet to 2,000 square feet. Current tenants include a nail salon, hair salon, martial arts school, massage studio and Friar Tux. Greg Bedell and Roxanne Klein of Progressive Real Estate Partners represented the seller in the deal.

Jordon Perlmutter & Co., Rockefeller Group Open 200,000 SF Paradigm River North Office Building in Denver

by Amy Works

DENVER — Jordon Perlmutter & Co. and Rockefeller Group have opened Paradigm River North, a Class AA office building at 3400 Walnut St. in Denver’s River North Art District. Paradigm River North is the first joint venture between Perlmutter and Rockefeller. Designed by Denver-based Tryba Architects, Paradigm River North offers 188,000 square feet of office space across eight stories and 12,000 square feet of ground-floor retail space. The property features smart-phone access, valet-run parking that offers ease of use for tenants, a high-end bike room for multimodal transit and spacious outdoor terraces on every floor. Law firm Davis Graham & Stubbs LLP has pre-leased 80,000 square feet on the top three floors of Paradigm River North. Jamie Gard and Jeff Castleton of Newmark are handling leasing for the property.

Brinkmann Constructors, Scannell Properties Plan 150,000 SF Manufacturing Facility in Mesa, Arizona

by Amy Works

MESA, ARIZ. — Brinkmann Constructors, in partnership with Scannell Properties, is developing an industrial facility in Mesa for Super Radiator Coils, a company specializing in heat exchanger manufacturing. Constructed of concrete tilt-up panels, the 150,000-square-foot building will include more than 45,000 square feet of Class A office space, 130,000 square feet of fully conditioned manufacturing floor space, gantry crane systems and clean room areas that support advanced manufacturing. The state-of-the-art facility will operate as a western U.S. production hub for Chaska, Minn.-based Super Radiator Coils. The new location will consolidate and expand the company’s manufacturing capabilities to support the growth of the company’s operations in the Western region. Ware Malcomb is serving as architect for the project, which is slated for completion in fall 2024.

BRENTWOOD, CALIF. — Gortikov Capital has arranged $49.5 million in refinancing for Lux Villas, a Class A multifamily building in the East Bay city of Brentwood. Bryan Gortikov of Gortikov Capital led the capital markets team representing the undisclosed borrower. Developed in 2005 and fully renovated in 2023, Luxe Villas features 60 apartments, a fitness center, clubhouse, sunlit central courtyard and a rooftop lounge with expansive city views. Units offer expansive glass windows, high ceilings, top-of-the-line appliances and in-unit washers/dryers.