Badiee Development has logistics and industrial projects throughout the Western U.S., but its current focus is the region’s three S’s: San Diego, Sacramento, Calif., and Salt Lake City. “Badiee Development is prioritizing leasing at our existing projects in San Diego and Sacramento, and entitling future projects in San Diego, Sacramento and Salt Lake City,” says Ben Badiee, the firm’s founder and CEO. “Our company holds a ‘land bank’ with plans to develop more than 2 million square feet across four distinct projects in three markets.” San Diego Badiee’s headquarters is ripe with industrial ventures for the firm. These include the two-building, 242,969-square-foot Sanyo Logistics Center and the 38-acre Britannia Airway Logistics Center, both of which are being built near the Mexican border in Otay Mesa. Britannia Airway has also been entitled for an interim use of industrial outdoor storage (IOS), allowing the project to accommodate about 1,000 trucks and trailers. “Being in our ‘backyard,’ Otay Mesa has proven to be a highly successful market for the firm,” Badiee says. “It is at the forefront of the onshoring/nearshoring trend for the U.S. and Mexico, and land availabilities are scarce.” Sacramento Land scarcity has also been a driver for Badiee in Sacramento …

Western

BWE Arranges $66.5M Construction Financing for Plaza de Perris Shopping Center Expansion in Perris, California

by Amy Works

PERRIS, CALIF. — BWE has arranged $66.5 million in construction financing for a new phase of development at Plaza de Perris, a retail center located in the Inland Empire city of Perris. Upon completion, the property will span 363,582 square feet and feature a Target location. Wood Investments, the borrower and developer, purchased the center in 2017 and previously completed the addition of 118,000 square feet of retail space at the property in 2019 and 2020. Upon completion of construction, Target will join the center as a tenant. Other tenants at the center, which was 99 percent leased at the time of financing, include Ross Dress for Less, Ulta Beauty, Burlington Coat Factory, Planet Fitness and Five Below. Tom Kenny and Josh Boehling of BWE secured a $55.5 million loan through a life insurance company, as well as an $11 million joint-venture equity investment, on behalf of the borrower.

LAS VEGAS — Northmarq has arranged the sale of Millennium East, a multifamily community located in Las Vegas’ Sunrise Manor area. A Massachusetts-based property manager company seller sold the asset to a California-based real estate investment company for $52.7 million. Built in 2000 and renovated in 2018, Millennium East features 236 one-, two- and three-bedroom apartments ranging from 720 square feet to 1,116 square feet. A majority of the units were renovated and feature upgraded nickel light fixtures, full-size washers and dryers, luxury vinyl flooring and stainless steel appliances. Onsite amenities include a resort-style pool, gym, playground, dog park, package lockers and covered parking. Thomas Olivett of Northmarq’s Las Vegas multifamily investment sales team represented the seller in the deal. Bryan Mummaw, Bryan Liu, Brandon Harrington, Tyler Wood and Chris Gitibin of Northmarq’s debt and equity team secured $33.5 million in acquisition financing for the buyer. The permanent, fixed-rate loan was arranged through Northmarq’s relationship with Freddie Mac.

SAN DIEGO — Driftwood Capital, along with architect AO and general contractor R.D. Olson Construction, has broken ground on Element Hotel by Marriott in the Mission Valley submarket of San Diego. The seven-story, 150-room hotel will be located next to the existing full-service Marriott Hotel Mission Valley. The two hotels will share the pool amenity deck and restaurant space, while each maintaining its own entrance, lobby, lounge and other amenities. Slated for completion in winter 2026, the 98,000-square-foot hotel will feature a 5,300-square-foot conference and ballroom space, a fitness center, meeting rooms and a lobby/lounge, as well as shared exterior main and lounge area. Once completed, the hotel will comply with Title 24 energy and water use criteria, which is similar to LEED’s silver level. Additional project partners include Ficcadenti Waggoner and Castle as structural engineer, Kimley-Horn as civil engineer, RTM Engineering as MEP engineer and Linda Snyder Associates as interior designer.

HUNTINGTON BEACH, CALIF. — CBRE has brokered the sale of Beachwood Apartments, a multifamily property located at 125 16th St. in Huntington Beach, approximately 35 miles southeast of Los Angeles. The asset traded for $8.6 million, or $480,556 per unit. Built in 1971, Beachwood Apartments features 18 one-, two- and three-bedroom apartments totaling 15,809 rentable square feet. Select units have private patios or balconies and some units offer ocean views. Each unit features an individual water heater and individual meters for gas and electricity. Community amenities include a courtyard, sun deck, laundry facilities, 24 garage spaces and an on-site manager. Dan Blackwell and Mike O’Neill of CBRE represented the Huntington Beach-based seller and the Fountain Valley-based buyer in the transaction.

American Gem Packaging Solutions Buys 50,594 SF Industrial Building in Goodyear, Arizona

by Amy Works

GOODYEAR, ARIZ. — American Gem Packaging Solutions has acquired a 50,594-square-foot industrial building located at 2760 S. La Luna in Goodyear, a western suburb of Phoenix. A1 Desert Investments sold the asset for $4.7 million. Jeffrey Garza Walker represented the buyer, while the seller was self-represented in the deal.

NORTHBROOK, ILL. — Pine Tree, in partnership with a state pension fund, has purchased six open-air shopping centers from SITE Centers Corp. (NYSE: SITC) for $495 million. The portfolio comprises 2.5 million square feet and includes properties in metros such as Fort Lauderdale, Florida; Columbus, Ohio; Cincinnati; Phoenix; and Portland, Oregon. The assets included in the portfolio are: The portfolio’s retail anchors include Kroger, New Seasons Market, The Fresh Market, Target, Ulta Beauty, Nordstrom Rack, Dick’s Sporting Goods and 13 stores leased by TJX Cos. Pine Tree is a retail developer and management company based in Northbrook, Illinois. The deal, which was sourced off-market, brings Pine Tree’s assets under management to a total of approximately $2.5 billion and 20 million square feet. SITE Centers is a retail REIT based in Beachwood, Ohio. The SITC stock price opened at $14.56 on Friday, June 14, up slightly from $13.19 one year prior. — Channing Hamilton

BWE Provides $39.4M HUD Construction Loan for Pueblo Springs Multifamily Community in Pueblo, Colorado

by Amy Works

PUEBLO SPRINGS, COLO. — BWE, on behalf of ESH Development, has secured a $39.5 million HUD 221(d)(4) loan to finance the development of Pueblo Springs, a Class A market-rate apartment project in Pueblo, approximately 45 miles south of Colorado Springs. James Swanson of BWE’s Phoenix office originated the financing. The HUD-insured loan provides for a combined construction and permanent financing for market-rate multifamily projects. The non-recourse, fully assumable loan features a 40-year, fully amortizing term that will qualify for HUD’s reduced rates for eco-friendly developments upon final construction and delivery of units. Pueblo Springs will feature 199 units with nine-foot ceilings in select units, walk-in closets, ceiling fans, private balconies or patios, soaking tubs, breakfast bars, pantries, granite or quartz countertops, and stainless steel and Energy Star appliances, including in-unit washers/dryers. Community amenities will include a clubhouse with Wi-Fi, a fitness center, business center/e-lounge, community room with gourmet kitchen, bike storage, heated pool and spa, barbecue and picnic areas, walking paths, extensive landscaping, 24-hour emergency staff and gated entry. Colorado Structures is serving as general contractor for the project, which will be built to a high standard of energy efficiency.

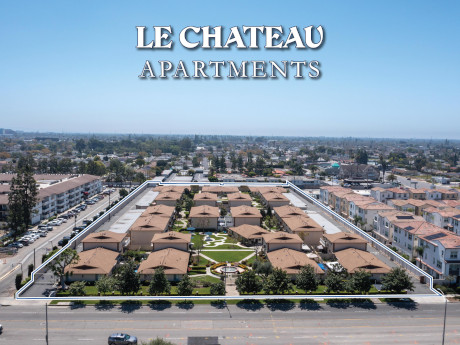

Marcus & Millichap Negotiates $27M Sale of La Chateau Apartments in Anaheim, California

by Amy Works

ANAHEIM, CALIF. — Marcus & Millichap has arranged the sale of La Chateau Apartments, a multifamily community in Anaheim. The asset traded for $27.4 million, or $361,184 per unit. Tyler Leeson, Matt Kipp and Nicholas Kazemi of Marcus & Millichap represented the undisclosed seller, while Drew Holden of Marcus & Millichap represented the undisclosed buyer in the deal. Built in 1964, Le Chateau offers 76 apartments in single-floor and townhome unit styles, all with two bedrooms. Each unit features a private patio and carport with an overhead storage bin. Community amenities include four on-site laundry facilities, a clubhouse and gated garage.

PORTLAND, ORE. — Gantry has arranged a $16.2 million permanent loan for the acquisition of a warehouse facility located at 6447 N. Cutter Circle in Portland. FedEx Ground fully occupies the 212,000-square-foot building, which was redeveloped in 2015. The 126-door, cross-docked facility offers ready access to the Port of Portland, Interstate 5, Union Pacific Railroad and Portland International Airport. Tony Kaufmann and Joe Foley of Gantry’s San Francisco production office represented the borrower, a private real estate investor. The long-term, fixed-rate loan was secured from one of Gantry’s correspondent life company lenders and structured with a term that exceeds the tenant’s firm lease term. The loan features interest-only payments for half the term, followed by a 30-year amortization period.