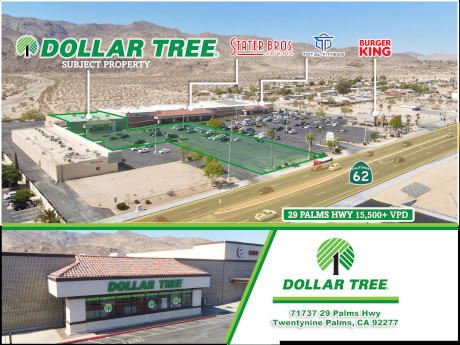

TWENTYNINE PALMS, CALIF. — Marcus & Millichap has arranged the sale of Dollar Tree, a net-leased retail property in Twentynine Palms, just north of Joshua Tree National Park in Southern California. An individual/personal trust sold the asset to an undisclosed buyer for $2.1 million. The 15,506-square-foot Dollar Tree is located at 71737 29 Palms Highway. Dollar Tree has committed to four and a half years on the lease, having recently exercised its five-year option period. There are two additional five-year extension options. The asset occupies a 1.5-acre lot within a 90,000-square-foot retail plaza featuring Stater Bros., Burger King and Total Fitness Gym. Michael Grandstaff and Christopher Hurd of Marcus & Millichap represented the seller, while Karl Markarian of JohnHart Corp. represented the buyer in the deal.

Western

Creation to Break Ground on $120M The Switchyard Mixed-Use Development in Suburban Phoenix

by Katie Sloan

QUEEN CREEK, ARIZ. — Development firm Creation is set to break ground on The Switchyard, a $120 million mixed-use development located at the northeast corner of Ellsworth and Ocotillo roads in the Phoenix suburb of Queen Creek. Plans for the 10-acre project include the development of 54,000 square feet of restaurant, retail, residential and office space. The retail portion of the development will include a 3,800-square-foot Postino wine café and an 11,900-square-food restaurant called The Porch, which will include an expansive outdoor patio. Creation plans to break ground on the multi-phase project later this year. Phase I is scheduled for completion in early 2026. The development team includes Dallas-based architect GFF Design and general contractor LGE Design Build. Creation is a real estate development firm with dual headquarters in Phoenix and Dallas. The company has a $4.5 billion pipeline of ground-up development currently underway across six states. — Katie Sloan

John Ramous, Nevada region partner at Dermody Properties, discusses how the southern part of the state’s various regions have evolved into industrial hubs — and what the firm is doing to capitalize on this. WREB: What is it about Las Vegas and its fundamentals that have made it an ideal place for industrial? Ramous: There are several key fundamentals driving Las Vegas’ — or Southern Nevada’s — growth as a comprehensive industrial and regional logistics hub. It’s strategically located near Southern California and other major West Coast markets, maintains a business and tax-friendly environment, has a supportive infrastructure, a streamlined permitting process, a focus on sustainability and a large, talented workforce with competitive labor costs. All these factors make this region an ideal place for industrial and logistics, as well as a very attractive location to work, live and conduct business. WREB: Can you tell me more about your Apex project? Ramous: Apex Industrial Park is becoming a primary center for larger and scalable logistics facilities, advanced manufacturing, technology and other distribution uses. Located in North Las Vegas off Interstate 15, it is luring major companies to the region, benefiting the entire Southern Nevada market. Trucks are arriving full …

EQT Exeter Buys Four Gayteway Business Park Buildings in Arlington, Washington for $70.6M

by Amy Works

ARLINGTON, WASH. — EQT Exeter has purchased Gayteway Business Park buildings B, C, F and G from Chris Gayte and Brent Nicholson of Gayteway Business Park for $70.6 million. Situated on 22.3 acres in Arlington, approximately 45 miles north of Seattle, the four Class A industrial buildings total 365,000 square feet. Located at 20101 and 19927 67th Ave. Northeast, the buildings offer dock-high and grade-level loading, concrete truck courts, 24- to 30-foot clear heights, abundant parking and ESFR sprinklers. Brett Hartzell and Paige Morgan of CBRE National Partners represented the seller in the deal. Al Hodge of Broderick Group assisted on the transaction.

Colliers Mortgage Arranges $24.4M Construction Financing for Kingsley Apartments Affordable Project in Los Angeles

by Amy Works

LOS ANGELES — The Los Angeles Colliers Mortgage Structured Finance Group has arranged $24.4 million in construction financing for Kingsley Apartments, an affordable housing development in Los Angeles’ Koreatown submarket. Jonathan Lee, Shahin Yazdi, William Hyatt and Tommy Adelson of Colliers arranged the financing, which features a term of 30 months plus optional extensions. Upon completion, the 72,800-square-foot Kingsley Apartments will offer 136 studio and one-bedroom units restricted to residents earning up to 80 percent of the area median income. The undisclosed borrower plans to break ground on the project in June 2024.

NBP Capital Sells Thunderbird Village Multifamily Community in Vancouver, Washington for $26.7M

by Amy Works

VANCOUVER, WASH. — NBP Capital has completed the disposition of Thunderbird Village, a garden-style apartment community in Vancouver, a suburb of Portland, Oregon. An undisclosed buyer paid $26.7 million for the property, which is located at 4601 E. 18th St. Josh McDonald, Joe Nydahl and Phil Oester of CBRE represented the seller in the deal. Built in 1972, Thunderbird Village features 182 one-, two- and three-bedroom floor plans averaging 972 square feet. Of the units, 41 have been renovated to include upgraded vinyl and carpet flooring, new appliances and hardware, quartz countertops and stacked washers/dryers. Newly renovated community amenities include an outdoor swimming pool, sauna, walking trails, fitness center, tennis and basketball courts, and business center.

AURORA AND DENVER, COLO. — Brennan Investment Group has purchased two distribution facilities, totaling 206,000 square feet, in Aurora and Denver. Terms of the transaction were not released. The properties are located at 18245 E. 40th Ave. in Aurora and 4999 Oakland St. in Denver. At the time of sale, the Oakland property is fully leased to a single tenant, and the 40th Avenue property is partially leased.

SHOW LOW, ARIZ. — Marcus & Millichap has arranged the sale of Show Low Small Bay Industrial Park, a two-building industrial asset in Show Low, approximately 175 miles northeast of Phoenix near the New Mexico border. A private investor sold the property to a California-based private investor for $2.2 million. Located at 1241 E. Lumbermans Loop, Show Low Small Bay Industrial Park offers 17,200 square feet of small-bay industrial space on 1.5 acres. At the time of sale, the buildings were fully leased. Cory Gross of Marcus & Millichap represented the seller and procured the buyer in the deal. Ryan Sarbinoff, also of Marcus & Millichap, served as broker of record in Arizona for the transaction.

Content PartnerDevelopmentFeaturesLeasing ActivityMidwestMultifamilyNortheastPavlov MediaSoutheastTexasWestern

How Developers Use Mix of Technology, Amenities to Attract Residents

The multifamily industry faces a major challenge. Final construction costs have grown 33 percent since 2019 interest rates and operational expenses are sky high; and rents may need to increase, where possible, to make deals feasible — an off-putting reality for residents. One developer solution is smaller apartments, which make units cheaper. There is also a push to add more common-space amenities that are both valuable and less costly to include. These features include rooftop spaces, green areas and decks. However, to make these spaces truly usable for today’s multifamily residents, it is important to make them technologically flexible and to offer easy internet connection. “The floor plans of most new-construction multi-dwelling units (MDUs) today are shrinking, and their amenities are expanding,” says Bryan Rader, president of MDU at networking and internet service company Pavlov Media. According to RentCafe, the average size of newly constructed apartment units fell by almost 6 percent in a decade, with half of that change occurring in the last year. Rader likens it to the “resort-style community” approach, where hotel rooms are small, and guests are encouraged to spend time everywhere else on the property. Similarly, multifamily developers create shared amenities such as comprehensive fitness …

AvalonBay Communities Divests of AVA North Hollywood Multifamily Property in Los Angeles for $62.1M

by Amy Works

LOS ANGELES — AvalonBay Communities has sold AVA North Hollywood, a multifamily community in the NoHo Arts District of Los Angeles. Prime Residential acquired the asset for $62.1 million, or $393,077 per unit. Kevin Green, Joseph Grabiec and Gregory Harris of Institutional Property Advisors, a division of Marcus & Millichap, represented the seller and procured the buyer in the deal. Built in 2015, AVA North Hollywood features 156 apartments with full appliance packages, washers/dryers and private patio areas. Most apartments have nine-foot ceilings and loft-style units have 14-foot ceilings. Common-area amenities include a swimming pool and spa, clubroom, sky deck, leasing office, movement studio, cybercafé and business center. The property also offers 11,000 square feet of ground-floor retail space, which is fully occupied by four eateries, a Pilates studio and a massage and spa center.