LOS GATOS, CALIF. — Marcus & Millichap has brokered the sale of a retail property, located at 52 N. Santa Cruz Ave. in Los Gatos, just south of San Jose. The asset traded for $4.5 million. Built in 1985, the 4,401-square-foot property is fully occupied and offers six commercial spaces. Yuri Sergunin and J.J. Taughinbaugh of Marcus & Millichap’s Palo Alto office represented the undisclosed seller and procured the undisclosed buyer in the deal.

Western

TUCSON, ARIZ. — Subto Fund LLC has purchased Coronado Vistas, a multifamily property in Tucson, from Bellevue 21 LLC for $1.8 million. Located at 4424 E. Bellevue St., the community features 21 apartments. Allan Mendelsberg and Joey Martinez of Cushman & Wakefield | PICOR represented the buyer and seller in the transaction.

ANAHEIM, CALIF. — CBRE has arranged the purchase of a seven-unit apartment building in Anaheim. A private investor acquired the asset for $2.5 million, or $360,714 per unit. Dan Blackwell and Amanda Fielder of CBRE represented the Orange County-based buyer in the deal. The seller was from Alameda County. Built in 1985, the 6,500-square-foot building is located at 406 E. South St. on a 9,148-square-foot lot. The community features individual patios, garage parking and a newly installed fire sprinkler system.

SAN DIEGO — Impact Real Estate LLC has sold a development site in San Diego to Gabriel Mauser for $1.3 million. The buyer plans to develop 11 accessory dwelling units (ADU) on the 30,493-square-foot property, which is located at 6353 Broadway. Aaron Bove of Marcus & Millichap represented the seller, while Simon Oliveri procured the buyer in the deal.

NEW YORK CITY AND DENVER — Private equity behemoth Blackstone (NYSE: BX) has agreed to acquire AIR Communities (NYSE: AIRC) for $10 billion in an all-cash deal that would take the Denver-based multifamily REIT private. The deal is expected to close during the third quarter. AIR Communities, which is formally named Apartment Income REIT Corp., owns 76 multifamily properties totaling roughly 27,000 units across 10 states and Washington D.C. The properties are primarily concentrated in coastal markets such as Los Angeles, Miami and Boston. Under the terms of the deal, Blackstone will also assume all of AIR Communities’ outstanding debt. Blackstone also plans to invest more than $400 million to maintain and improve the existing communities in the portfolio. The purchase price of $39.12 per share represents a premium of 25 percent to AIR Communities’ closing share price on April 5, 2024, the last full day of trading prior to the announcement. The price also represents a 25 percent premium to AIR Communities’ weighted average share price over the previous 30 days. “AIR Communities represents the highest quality, large-scale apartment portfolio we have ever acquired and is located in markets where multifamily fundamentals are strong,” says Nadeem Meghji, global co-head …

TUCSON, ARIZ. — Inland Real Estate Acquisitions has purchased The Parker, a student housing community in Tucson. Mark Cosenza of Inland Acquisition, with assistance from Brett Smith of The Inland Real Estate Group law department, completed the transaction on behalf of an Inland affiliate. The seller and price were not disclosed. Developed in 2021, The Parker features 131 units in a mix of 13 studio, 52 two-bedroom, seven three-bedroom, 46 four-bedroom, 20 five-bedroom and 19 six-bedroom units. Each unit is fully furnished with wood-style flooring, modern furniture, memory foam mattresses, TVs, private locks on bedroom doors, granite countertops, a full-size washer/dryer, valet trash service and electronic key card access. Community amenities include private and group study rooms; a fitness center with a yoga studio; gated resident parking garage; modern clubhouse; an on-site Chase bank; a rooftop deck with pool, hot tub and poolside cabanas; an outdoor fitness center; fully equipped outdoor kitchen; and a courtyard with a fire pit, lounge seating and games. The property is currently 99.5 percent occupied and is 78 percent pre-leased for the 2024/2025 school year. Core Spaces will manage the property. The Parker is immediately adjacent to the west side of the University of Arizona.

PGIM Real Estate Provides $53.5M Refinancing for Theory U District Student Housing Complex in Seattle

by Amy Works

SEATTLE — PGIM Real Estate has provided a $53.5 million floating-rate loan to Blue Vista Capital Management for the refinancing of Theory U District, a student housing community in Seattle. Serving the students at University of Washington, the seven-story property features 171 units totaling 441 beds. Loan proceeds will be used to refinance the construction loan, covering closing costs and repatriating sponsor equity. Craig Foreman of PGIM Real Estate closed the financing.

PHOENIX — Wespac Construction has completed work on three mixed-use buildings at Culdesac Tempe, a car-free, mixed-use development at 2025 E. Apache Blvd. in Tempe, just east of Phoenix. Situated on 17 acres, Culdesac Tempe will feature 44 apartments and 24,000 square feet of retail space. The site underwent extensive clearing, grading and utility installation. Additionally, a 2,500-square-foot restaurant shell and tenant improvement were constructed for Cocina Chiwas, a full-service restaurant. Key features include a 6,700-square-foot fitness facility and the 4,700-square-foot Market Building that spans three levels and features 16 apartments. DAVIS and Opticos designed the project, which Culdesac owns and developed.

Marcus & Millichap Arranges $11.2M Refinancing for Joann-Occupied Building in Glendale, California

by Amy Works

GLENDALE, CALIF. — Marcus & Millichap Capital Corp. (MMCC) has secured $11.2 million in refinancing for a single-tenant retail building, located at 1000 S. Central Ave. in the Los Angeles suburb of Glendale. Joann, a fabric and crafts retail chain that recently declared bankruptcy, occupies the property. Ron Bayls of Marcus & Millichap Capital Corp. arranged the 10-year loan, which includes a 5.97 percent interest rate with a 30-year amortization and 50 percent loan-to-value ratio.

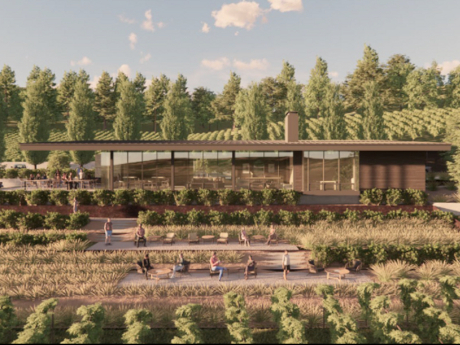

Gantry Secures $7.1M in Financing for Auteur Wines Facilities in Healdsburg, California

by Amy Works

HEALDSBURG, CALIF. — Gantry has arranged a $7.1 million construction-to-permanent loan for the build-to-suit development of dedicated facilities for Auteur Wines, a vintner-founded winery specializing in Pinot Noir and Chardonnay. Located at 10520 Wohler Road in the Sonoma County city of Healdsburg, the project will include a production winery, tasting room and vineyard on 8.2 acres. Jeff Wilcox and Andrew Ferguson of Gantry’s San Francisco production office represented the borrower, a private real estate investor. The 20-year, construction-to-permanent, fixed-rate loan was provided through one of Gantry’s banking relationships and features an initial interest-only period transitioning to an 18-year amortization.