COMMERCE, CALIF. — 99 Cents Only Stores LLC has announced plans to close all 371 of its stores and wind down business operations. The company has entered into an agreement with Hilco Global to liquidate all merchandise and dispose of fixtures, furnishings and equipment at the stores. Sales under this agreement are expected to begin today. 99 Cents Only was founded in 1982 as a deep-discount retailer where every item cost less than a dollar. The company is headquartered in the southeast Los Angeles suburb of Commerce, and currently operates stores in California, Texas, Arizona and Nevada. The company consulted its financial and legal advisors to find a way to continue operating, but ultimately decided the wind-down was necessary and the best way to maximize the value of its assets. Hilco Real Estate will manage the sale of the company’s owned and leased real estate assets. The company has appointed Chris Wells, managing director at Alvarez & Marsal, as chief restructuring officer. Additionally, Mike Simoncic, interim CEO of 99 Cents Only and managing director at Alvarez & Marsal, will step down. “This was an extremely difficult decision and is not the outcome we expected or hoped to achieve,” said Simoncic. “Unfortunately, the …

Western

— By Pat Swanson, executive vice president, Colliers International — As Orange County enters 2024, its multifamily market stands at the brink of transformation, confronting challenges like softened rents, affordability dynamics and the resilience required in the face of tenant-related complexities. In the midst of a robust economy, the region grapples with obstacles and opportunities that will significantly shape the future of its real estate sector. Orange County’s economic vitality is evident, with a 5.2 percent growth in U.S. GDP and a thriving job market. However, the looming shadow of interest rate fluctuations and inflation above 3 percent has briefly slowed down real estate transactions. While rates are predicted to stabilize, the potential for modest reductions later in the year signals a period of nuanced economic growth and sustained higher rates. In 2024, Orange County’s multifamily housing market is set for change, departing from previous trends of rent increases. The region anticipates modest growth that will be influenced by factors like slower job growth, an influx of 510,000 new units and the mounting challenge of finding qualified tenants. Affordability takes center stage, with rent-to-income ratios reaching 29.8 percent. The widening affordability gap between owning a home and renting is further …

Stevens-Leinweber Begins Construction of Camelback 303 Logistics Center in Goodyear, Arizona

by Amy Works

GOODYEAR, ARIZ. — Phoenix-based Stevens-Leinweber Construction (SLC), on behalf of Brookfield Properties, has started construction of Camelback 303 Logistics Center in the Phoenix suburb of Goodyear. The two-building industrial development will offer 616,100 square feet of Class A industrial space, Class A amenities, and trailer and outdoor storage. Situated at 16395 and 16565 W. Camelback Road, Camelback 303 Logistics will include a 303,500-square-foot Building A and 312,000-square-foot Building B. Each building will feature 36-foot clear heights, LED lighting, 79 dock-high and four drive-in doors and 3,000 amps of power. Additionally, Buildings A and B will also offer 185-foot to 370-foot secured concrete truck courts, parking for 309 to 329 cars and 212 to 214 trailers, and electric vehicle charging stations. Completion is slated for fourth-quarter 2024. The property is located within PV303, a 1,600-acre, master-planned industrial park by Merit Partners. SLC is serving as general contractor and Butler Design Group is serving as project architect. Pat Feeney, Danny Calihan and Tyler Vowels of CBRE are handling leasing for the project.

LOS ANGELES — Colliers has arranged the sale of an affordable apartment community located at 349 S. La Fayette Place in the La Fayette Park neighborhood of Los Angeles. The asset traded for $43.4 million, or $362,000 per unit. Kitty Wallace and Kalli Knight of Colliers represented the buyer and seller in the transaction. Situated on a 43,000-square-foot lot, the three-story property features 120 affordable apartments. The buyer paid cash to preserve the right to create and maintain affordable housing, and purchased the property with the intent of promoting and advancing workforce and affordable housing initiatives. Built in 1971 and extensively remodeled in 2017, the property features 120 subterranean parking spots with third-party billing for electric vehicle charging stations. Currently, 85 percent of the units are fully renovated. The units feature stainless steel appliances, in-suite washers/dryers, hardwood floors with carpeting in the bedrooms and mini-split air conditioners and heaters. Community amenities include a new roof, updated plumbing and boiler, a resurfaced and modernized pool, built-in barbecue area, redesigned fitness center, electric vehicle charging stations and elevator modernizations. All units also include 100-amp electrical panels and new plumbing to accommodate the installation of in-unit washers and dryers.

Indicap, AECOM-Canyon Partners Complete 1 MSF Phase I of Eastmark Center of Industry in Mesa, Arizona

by Amy Works

MESA, ARIZ. — Indicap, in partnership with AECOM-Canyon Partners, has completed Phase I of the Eastmark Center of Industry in Mesa. The newly opened buildings offer 978,837 rentable square feet of Class A industrial space within a 65-acre industrial park in Mesa’s Gateway Airport submarket. The first phase includes five mid-bay and cross-dock buildings, ranging from 83,347 square feet to 426,569 square feet, with 30-foot to 36-foot clear heights and a parking ratio of 1.28 per 1,000 rentable square feet. Indicap acquired the project site in April 2022 for $48 million, marking the company’s entry into the Phoenix metro. The land purchase included 53 acres for a second phase of development. The project team includes Layton Construction, Kimley-Horn, Deustch Architecture and JLL.

WESTMINSTER, CALIF. — A real estate fund managed by Ares Management has acquired a freestanding industrial distribution building in the Orange County city of Westminster from an undisclosed seller. Terms of the transaction were not released. Situated on 11.8 acres at 7400 Hazard Ave., the 258,506-square-foot building features 22- to 24-foot clear heights, ample dock-high and grade-level loading, abundant auto parking and 40 off-dock trailer parking stalls. At the time of sale, the property was 72.6 percent leased. Jeff Chiate, Jeffrey Cole, Rick Ellison and Matt Leupold of Cushman & Wakefield’s National Industrial Advisory Group – West represented the seller in the deal. Randy Ellison and Kyle McGillen of Cushman & Wakefield provided leasing advisory and were retained by the buyer to continue leading project leasing for the asset. Additionally, Rob Rubano, Brian Share, Max Schafer and Becca Tse of Cushman & Wakefield Equity, Debt & Structured Finance secured acquisition financing for the buyer.

AlpHubbard Acquires Burger King-Occupied Restaurant Building in Coos Bay, Oregon for $1.9M

by Amy Works

COOS BAY, ORE. — AlpHubbard LLC has purchased a restaurant property, located at 2021 Newmark Ave. in Coos Bay, from Ternik LLC for $1.9 million. Burger King occupies the 2,824-square-foot freestanding drive-thru building, which was constructed in 1992. Todd VanDomelen and Mike Brown of Portland, Ore.-based Norris & Steven Inc. represented the buyer, while Clayton Brown of Marcus & Millichap represented the seller in the deal. Coos Bay is a coastal city approximately 100 miles southwest of Eugene.

CareTrust REIT Acquires Three Seniors Housing Communities in Southern California for $60M

by Jeff Shaw

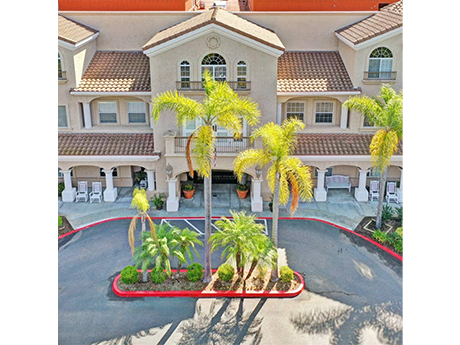

SAN CLEMENTE, Calif. — CareTrust REIT Inc. (NYSE:CTRE), a San Clemente-based seniors housing investor, has acquired three continuing care retirement communities (CCRCs) located in Los Angeles, Orange, and San Diego counties. The portfolio totals 475 assisted living, skilled nursing and memory care beds/units. Bayshire Senior Communities, an existing CareTrust tenant based in Southern California, has taken over management of all three properties. The highest profile property of the three is Torrey Pines Senior Living in San Diego. CareTrust paid $32.3 million for the asset, including transaction costs. Annual cash rent for the first year is approximately $2.6 million, increasing to approximately $3 million in the second year with CPI-based annual escalators thereafter. CareTrust completed the acquisition of the other two CCRCs through a joint-venture arrangement with a third-party regional healthcare investor. Pursuant to the arrangement, CareTrust is the managing member of the joint-venture entity. CareTrust provided a combined common equity and preferred equity investment amount totaling approximately $28 million. The joint-venture landlord has leased these facilities to Bayshire pursuant to a new, triple-net master lease agreement with an initial term of 15 years with two five-year extension options. CareTrust’s initial contractual yield on its combined preferred and common equity investments …

LOS ANGELES — JLL Capital Markets has arranged $65 million in financing for Wateridge, a six-building office and retail campus in West Los Angeles. LPC Realty Advisors I LLC, an investment advisory affiliate of Lincoln Property Co., is the borrower. Todd Sugimoto, Mark Wintner and Chad Morgan of JLL Capital Markets secured the five-year, fixed-rate financing with Deutsche Bank. Built between 1989 and 2005 on 21 acres, Wateridge features three multi-tenant office buildings, a single-tenant medical office building, a standalone 24-hour fitness facility and a multi-tenant retail strip center. At the time of financing, the 583,580-square-foot campus was 80 percent occupied and leased by credit tenants, including Kaiser Health Foundation, County of Los Angeles and Providence Health.

DENVER — Graham Street Realty (GSR), an affiliate of Hamilton Zanze, has completed the disposition of Commerce Square, a light industrial facility located in the Interstate 70 East submarket in Denver. Terms of the transaction were not released. GSR originally purchased Commerce Square in December 2020. The asset comprises 144,464 rentable square feet of shallow-bay light space across two Class B buildings. Commerce Square offers above-standard loading capabilities, front park/rear load orientation, 18-foot clear heights, dock and drive-in loading capabilities and 265 parking spaces. At the time of sale, the property was 96.4 percent leased. Paramount Property Co., an Oakland, Calif.-based GSR affiliate, managed Commerce Square during GSR’s ownership of the asset.