LAS VEGAS — ABI Multifamily has negotiated the sale of a three-property multifamily portfolio in Las Vegas for a combined $8.9 million, or $121,431 per unit. The undisclosed buyer and seller are both based in Nevada. Jason Dittenber, Josh McDougall, Anthony Marinello and Bradley Gumm of ABI Multifamily represented the seller in the deal. The portfolio includes:

Western

Anchor Point Capital Negotiates $12.2M Sale of Plaza Diamond Bar Office/Retail Campus in Los Angeles County

by Amy Works

DIAMOND BAR, CALIF. — Anchor Point Capital has arranged the sale of Plaza Diamond Bar, a two-building office and retail property in Diamond Bar, approximately 30 miles east of Los Angeles. Two separate buyers, both private investors, acquired the assets for a combined total of $12.2 million. The seller of both assets was a partnership led by Metro Properties LLC. The office building, located at 2040 S. Brea Canyon Road, sold as an all-cash deal, and the retail building, at 2020 S. Brea Canyon Road, sold with a creative seller financing structured by Anchor Point Capital. Built in 2007, the two-story, 25,000-square-foot office building was 40 percent occupied by a variety of medical and related tenants. Built in 1980 and renovated in 1992, the single-story, 8,000-square-foot, multi-tenant retail building was 50 percent leased at the time of sale. Eric Vu of Newport Beach-based Anchor Point Capital handled the transactions.

LOS ANGELES — Kennedy Wilson Brokerage, a division of Kennedy-Wilson Properties, has arranged the sale of two retail properties on the northwest and northeast corners of Melrose and Edinburgh avenues in Los Angeles. Quiet Lion LP sold the two assets, which represent three buildings on two parcels, in two separate transactions totaling $6.8 million. Oh Polly, a fashion brand, acquired a vacant, 3,355-square-foot, single-tenant building at 8001 Melrose Ave. with plans to occupy the asset. A local investor acquired the 2,442-square-foot asset at 7975-7977 Melrose Ave., which also included a 625-square-foot building at 710 N. Edinburgh Ave., with plans to operate the properties as a leased investment. MOSCOT and Vettese Studios, a clothier, occupies the property at 7975-7977 Melrose Ave., and Community Goods, a neighborhood coffee shop, occupies the building at 710 N. Edinburgh Ave. Ed Sachse, Jaysen Chiaramonte and Jack Nathan of Kennedy Wilson Brokerage represented the seller in both transactions.

PALM DESERT, CALIF. — CBRE has brokered the purchase of an apartment property located at 73435 San Gorgonio Way in the Coachella Valley city of Palm Desert. A Los Angeles-based private investor acquired the asset from an undisclosed seller for $2.2 million, or $264 per square foot, in an off-market transaction. Dan Blackwell and Andrew Boukather of CBRE represented the buyer in the deal. Built in 1988, the two-story, 8,360-square-foot building offers 10 two-bedroom apartments with a patios or balconies, a community pool and garage parking.

AcquisitionsContent PartnerFeaturesLoansMidwestMultifamilyNAINortheastOfficeRetailSoutheastTexasWestern

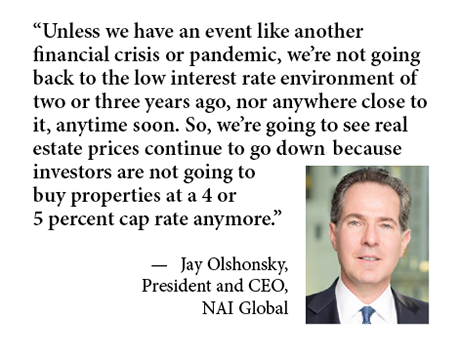

Previous Year’s Challenges Shape 2024 Outlook for Cap Rates, Investment Activity, Distressed Properties

If NAI Global president and CEO Jay Olshonsky had to use one word to sum up the 2023 commercial real estate market, it would be “inactive.” The interest rate-fueled bid-ask spread stifled investment sales of all property types, and in the office sector especially, tenants avoided making any space decisions if they didn’t have to. One month into 2024, not much has changed. From an investment sales perspective, Olshonsky still sees properties offered at capitalization rates between 4 and 5 percent while interest rates are 6 percent or higher, which is prolonging the disconnect between buyers and sellers. Meanwhile, robust job creation well beyond today’s levels is needed to create the leasing demand that will reverse the office sector’s troubles in the new era of hybrid work. But that’s not likely to happen in 2024 as the tech sector, in particular, continues to lay off workers. “I’ve been in the real estate business a long time, and this is a cycle unlike most others,” says Olshonsky. “The biggest problem we have right now is mainly record-high office vacancy just about everywhere — certainly in the large cities — which we’ve never really seen before. On the investment side, lenders cannot …

SAN JOSE, CALIF. — Hines Global Income Trust (HCIT) has purchased Hanover Diridon, a Class A multifamily property in San Jose. The buyer plans to rebrand the asset at Diridon West. Located at 715 W. Julian St., the seven-story property features 249 apartments in a mix of studios, one-bedroom and two-bedroom layouts with luxury finishes. Community amenities include a pool with cabanas, rooftop sky deck with cityscape views, fitness center, dog spa, an indoor/outdoor clubhouse and below-grade parking. Developed in 2021, the property is currently 95 percent leased. Terms of the transaction were not released.

Unilev Capital Sells 151,709 SF Tri-City Retail Center in San Bernardino, California for $24.3M

by Amy Works

SAN BERNARDINO, CALIF. — Unilev Capital has completed the sale of Tri-City Center, a shopping center in San Bernardino, to DPI Retail for $24.3 million. Built in 1987, the 151,709-square-foot property was fully occupied at the time of sale. Current tenants include 24 Hour Fitness, Curacao, Pollo Campero, Poke Bar, Barber, Cantos Jewelers and Pet World. Bryan Ley and Tim Kuruzar of JLL Retail Capital Markets represented the seller in the transaction.

Tejon Ranch Co. Breaks Ground on 700,000 SF Nestlé USA Distribution Center in California

by Amy Works

TEJON RANCH, CALIF. — Tejon Ranch Co. has begun construction on a distribution center for Nestlé USA Inc., the world’s largest food and beverage company. The development is located on 58 acres of Tejon Ranch Commerce Center (TRCC) in Tejon Ranch, approximately 100 miles northwest of Los Angeles. The multi-story, 700,000-square-foot building will be fully automated to serve Nestlé’s portfolio and designed to support future growth and expansion plans. No official opening date has been announced, but Nestlé is targeting 2025 for initial completion of construction and 2026 for commencement of operations. TRCC represents more than 2.5 million square feet of industrial space either under construction or completed. Mac Hewett, Mike McCrary and Brent Weirick of JLL represented Tejon Ranch Co. in the 58-acre land sale transaction.

OREM, UTAH — Marcus & Millichap has negotiated the sale of a two-property Marriott portfolio in Orem, just north of Provo. A limited liability company acquired the asset. The name of the seller and acquisition price were not released. The sale included TownePlace Suites Provo Orem and Fairfield Inn & Suites Orem, two four-story hotels sharing a total of 190 guest rooms. Located at 879 N. 120 West, the TownePlace Suites Provo Orem offers 100 guest rooms, and Fairfield Inn & Suites Provo Orem, located at 901 N. 1200 West, features 90 guest rooms. Adam Lewis of Marcus & Millichap handled the transaction.

COMPTON, CALIF. — Bridge Logistics Properties (BLP) has purchased an infill, last-mile logistics facility in Compton, just south of Los Angeles. Terms of the transaction were not released. Located at 1215 W. Walnut St., the 57,671-square-foot, rear-load warehouse features 25-foot clear heights, eight dock-high positions, a secured truck court and 83 parking spaces. The property is fully leased through June 2025. The asset is located adjacent to the 91 Freeway in Compton, with connectivity to the ports of Los Angeles and Long Beach, Los Angeles International Airport and downtown Los Angeles. Rob Flores and Brian Held of CBRE represented BLP in the deal.