Internet connectivity is the digital equivalent of a foundation for any multifamily property. Residents want access for communications, entertainment, business and personal needs. Property operators need connections for management and reporting software resources. Good and reliable connections to the Internet, and a dependable Wi-Fi network as a way of distributing that access, are essential. Looking three to five years into the future, these connectivity needs become even more demanding and complex. The Internet of Things (IoT) creates a layer of interesting application and use cases for property owners. IoT defines the collective network of connected technology that enables communication between devices (“things”) and the cloud and/or among the devices themselves. IoT devices are the technology that creates smart home and buildings. IoT devices also support and simplify functions such as rental property management, energy usage reduction, maintenance cost reduction and more. “Looking into the future, IoT applications can make the property more efficient in surprising ways,” says Eran Dor, vice president of technology products at Pavlov Media. Leak detectors can provide early warning of flooding and appropriately shut off water before any significant damage occurs. Trash cans can be equipped with sensors that indicate when to collect, rather than requiring …

Western

Stockdale Capital Partners Plans 145,000 SF Medical Office, Life Sciences Project in West Los Angeles

by Amy Works

LOS ANGELES — Stockdale Capital Partners has announced plans for 656 S. Vincente Boulevard, a medical office and life sciences property in Los Angeles’ Golden Triangle area. The project will be the first new medical office and life sciences building constructed in the area in more than 20 years. The 12-story property will feature 145,000 square feet of Class A medical office and life sciences space that combines both environmental sustainability and best-in-class amenities. The building will feature electric vehicle charging stations, ample bicycle parking, direct access to a major transit thoroughfare and 418 parking spaces with full valet service for tenants and patients. The project team includes Atelier R and HMC for architectural and design services. Jones Lang LaSalle’s construction management team will support pre-construction and consulting services through the design and construction phases. The building will include an integrated solar framework capable of offsetting building energy usage; recycled building materials designed to maximize energy efficiency; high-efficiency heating and cooling systems; low-water usage plumbing and mechanical systems; drop irrigation; extensive green space; and interior and exterior gardens to help optimize air quality throughout the building. Core-and-shell completion is slated for October 2026. Angie Weber and Dana Nialsi of CBRE will …

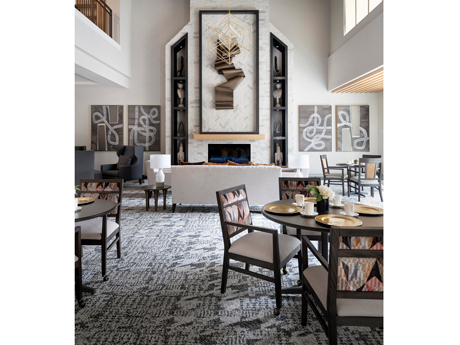

SCOTTSDALE, ARIZ. — Cogir Senior Living and Ryan Cos. US Inc. have opened ACOYA Shea, an independent living, assisted living and memory care community in the Phoenix suburb of Scottsdale. The community features 147 units in a four-story building. “ACOYA Shea is located right in the heart of Scottsdale, and residents will be able to enjoy the walkability of the community and the proximity to all that the area has to offer,” says Dave Eskenazy, chief executive officer of Cogir Management USA. Cogir Senior Living develops, owns and/or operates 60 communities throughout the United States.

DES MOINES, WASH. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of two apartment communities in Des Moines. Spinnaker Landing and Regatta sold for a combined $34.3 million, or $225,987 per unit. Philip Assouad, Giovanni Napoli, Nicholas Ruggiergo, Ryan Harmon and Anthony Palladino of IPA represented the sellers, Spinnaker Landing Apartments LLC and Regatta Apartments LLC, and procured the buyer, a private Los Angeles-based owner, in the transaction. Centrally located between Seattle and Tacoma, Wash., the two garden-style properties are surrounded by office and flex industrial space, including the headquarters of the Federal Aviation Administration and Alaska Airlines. Built in 1987, Spinnaker Landing features 66 units, and Regatta, which was built in 1983, features 86 units.

Seven Hills Realty Trust Arranges $17.3M Recapitalization for Home2 Suites Hotel in Scottsdale, Arizona

by Amy Works

SCOTTSDALE, ARIZ. — Seven Hills Realty Trust (NASDAQ: SEVN) has arranged a $17.3 million first mortgage floating-rate bridge loan for the recapitalization of Home2 Suites by Hilton in Scottsdale. The borrower is a joint venture between Highgate and Rockpoint. Located at 20001 N. Scottsdale Road, the recently constructed hotel features 130 guest rooms. CBRE introduced SEVN’s manager, Tremont Realty Capital, to the transaction. Tremont Realty Capital is an affiliate of The RMR Group (Nasdaq: RMR).

TIGARD, ORE. — Trion Properties has completed the disposition of York Apartments, a multifamily building in Tigard. An undisclosed buyer acquired the asset for $10.8 million, or $209,000 per unit. Located at 7582 SW Hunziker St., York Apartments features 52 units in a mix of three studio units, 48 two-bedroom/one-bath units and one four-bedroom/two-bathroom unit. Rob Marton of HFO Investment Real Estate represented the seller, while Greg Frick of HFO represented the buyer in the deal.

— By Dina Gouveia and Louis Thibault — The San Francisco market ended the second quarter of 2023 with a 27.2 percent vacancy rate for the office sector, according to Avison Young’s market report. As companies scaled back operations and experienced slower growth, vacancy rates continued to increase. As of late, we are seeing many tenants in a wait-and-see mode when it comes to leasing decisions. This is despite a majority of companies desiring to have employees back in the office. Below are a few key trends and observations when it comes to the office market, as well as some green shoots where we see opportunities for an accelerated recovery. Return to the Office The slow return to office (RTO) largely comes down to overall economic conditions and who has the upper hand in the job market. The trend that we’ve seen in the San Francisco region is that larger tech companies like Apple and Google have led the RTO efforts with CEOs like OpenAI’s Sam Altman opining that remote work is essentially detrimental to collaboration and creativity. It appears there is a widespread appetite to bring employees back into the office full-time. As the job market continues to soften, …

Standard Communities Buys Six Affordable Housing Communities in Metro Los Angeles for $122M

by Amy Works

LOS ANGELES — Standard Communities has led a public-private partnership that acquired six Section 8 communities in Los Angeles County with a total of 407 units. Five of the communities are affordable seniors housing. Standard will extend the communities’ affordability by 20 years under new HUD Housing Assistance Payments contracts. The transaction has a total capitalization of approximately $122 million, including planned renovation costs of over $8 million. The six communities were built between 1969 and 1980. “Extending the affordability of all 407 apartment units isn’t just a matter of housing; it’s a commitment to sustaining the heart of our community. We are not only ensuring that seniors and families have an affordable place to call home, we’re also nurturing the vibrant social and economic fabric of Los Angeles County,” says Jeffrey Jaeger, co-founder and principal of Standard Communities. “This investment brings our portfolio in Los Angeles County to over 1,700 units.” The assets include: • Oxford Park, a 109-unit senior community • Rayen Park, an 84-unit senior community • Sherman Arms, a 74-unit senior community • Villa Marisol, a 48-unit senior community • Columbus Terrace, a 42-unit senior community • Villa San Dimas, a 50-unit family community Standard Communities partnered in this transaction with the …

SCOTTSDALE, ARIZ. — Miller Global Properties has completed the disposition of Canopy by Hilton Scottsdale Old Town, located at 7142 E. 1st St. in Scottsdale. Dynamic City Capital acquired the hotel for $102 million, according to local business journals. Built in 2020, Canopy by Hilton Scottsdale Old Town features 177 guest rooms and two restaurants — Outrider Rooftop and Cobre Kitchen. Additionally, the property is within walking distance to more than 100 restaurants, venues and art galleries. Rick Rush and Carter Gradwell of CBRE Hotels represented the seller in the transaction.

PHOENIX — Brinkmann Constructors, as general contractor, and Denver-based The X Co., as developer, have broken ground on X Roosevelt, a 19-story multifamily building in downtown Phoenix. Located in the Roosevelt Row Arts District, the 350,000-square-foot X Roosevelt will feature 370 apartments in a live, work and play environment. The community will also feature coworking space; a gym and fitness studio designed around classes; and 3,500 square feet of first-floor retail space. Chicago-based Lamar Johnson Collaborative is serving as architect for the project, which is slated for completion in fall 2025.