LAHAINA, HAWAII — Pacific Retail Capital Partners (PRCP) has launched an effort to raise funds and awareness for those affected by the recent wildfires in Lahaina on the island of Maui. Dubbed #ExtendAloha, the campaign encourages donations to the DTL Foundation’s dedicated Maui Fire Relief Fund. PRCP manages Queen Ka’ahumanu Center on the island and has agreed to match the first $10,000 raised. Donations can be made at dtlfoundation.org/mauifire.

Western

AcquisitionsBuild-to-RentContent PartnerFeaturesLoansMidwestMultifamilyNortheastSingle-Family RentalSoutheastTexasWalker & DunlopWestern

Multifamily Owners Navigate Challenges, Opportunities Arising from Capital Markets

When Zelman & Associates’ 2023 Virtual Housing Summit opens in September, Alex Virtue will take the stage as a newly appointed managing director who has been charged with expanding the firm’s investment banking coverage of multifamily and other commercial real estate property sectors. Virtue joined the institutional research advisory and investment firm in May with over two decades of experience in mergers and acquisition transactions and capital raising across real estate sectors in both the public and private capital markets. His resume includes senior positions with Merrill Lynch, Eastdil Secured/Wells Fargo Securities, CBRE Capital Advisors and Xebec, an industrial developer and asset manager. Zelman & Associates, founded in 2007, was acquired by Bethesda, Md.-based commercial real estate finance and advisory firm Walker & Dunlop in 2021. “My focus at Zelman and Walker & Dunlop is broadening the firm’s reach on entity-level transactions in multifamily and related housing sectors such as single-family rentals, built-for-rent, student housing, affordable housing and manufactured housing communities, as well as other commercial real estate sectors,” says Virtue “I would characterize my concentration as bringing traditional banking investment expertise, knowledge and services across the Walker & Dunlop platform and working with my colleagues to bring these advisory …

SAN JOSE, CALIF. — Urban Catalyst has launched UC Multifamily Equity I LLC (UCME) to focus on the development of Aquino, a multifamily property within walking distance of downtown San Jose. The project is fully entitled and approved for multifamily construction. The development timeline was not released. Aquino will offer 272 studio, one-, two- and three-bedroom apartments with stainless steel appliances, quartz countertops, electric ranges and air conditioning. On-site amenities will include private coworking offices, a bar and lounge, fitness center with a yoga studio, dog run, and courtyard with an outdoor kitchen. Urban Catalyst has structured UCME as a real estate operating company, which allows it to accept funding from qualified retirement accounts such as IRAs and 401(k) plans.

Birtcher Development Receives $75M Construction Financing for 492,631 SF Logistics Center in Rialto, California

by Amy Works

RIALTO, CALIF. — Birtcher Development LLC has received $75 million in construction financing for the development of Birtcher Logistics Center Rialto, a Class A logistics facility currently under construction in the Inland Empire city of Rialto. Situated on 21 acres, the 492,631-square-foot property will feature 40-foot clear heights, 62 dock-high doors, 5,642 square feet of ground-floor office space and 5,221 square feet of mezzanine space. Additionally, the site will offer 90 trailer parking spaces and 287 auto parking spaces. Greg Brown, Peter Thompson and Spencer Seibring of JLL Capital Markets’ debt advisory team secured the nonrecourse loan from the lender, Principal Global Investors.

ProEquity Asset Management Sells Power Plaza Retail Center in Vacaville, California for $29.2M

by Amy Works

VACAVILLE, CALIF. — ProEquity Asset Management has completed the disposition of Power Plaza, a grocery-anchored neighborhood retail center at 1001-1071 Helen Drive in Vacaville, approximately midway between Sacramento and San Francisco Bay. DPI Retail acquired the asset for $29.2 million. Built in 1993 and 1994, the 112,250-square-foot retail center was 96 percent occupied at the time of sale. Current tenants include Sprouts Farmers Market, Restoration Hardware Outlet, Williams Sonoma Home Outlet, Pacific Dental Services, The Good Feet Store and Banfield Pet Hospital. Eric Kathrein, Tim Kuruzar, Warren McClean and Andy Spangenberg of JLL Retail Capital Markets represented the seller in the deal.

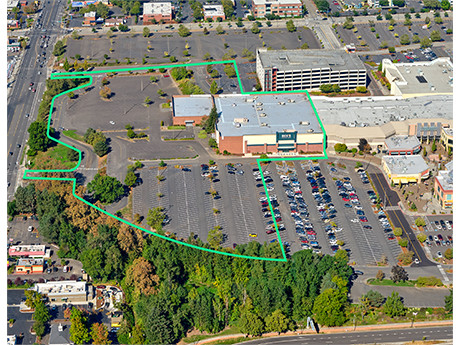

HAPPY VALLEY, ORE. — CBRE has arranged the sale of a 146,888-square-foot property located in Happy Valley, a suburb of Portland. Sears formerly occupied the building, which is physically attached to the adjacent Clackamas Town Center mall, which totals 1.4 million square feet. Dick’s Sporting Goods partially backfilled the property in 2019 and opened in 2020 following the departure of Sears in 2018. The remainder of the building, including two 15,000-square-foot, ground-level spaces and a 64,000-square-foot upper-level space, remains vacant. Dino Christophilis and Daniel TIbeau of CBRE represented the undisclosed seller in the transaction. A Texas-based private investment group acquired the property for an undisclosed price.

ENGLEWOOD, COLO. — Malman Commercial Real Estate has arranged the acquisition of an 8,050-square-foot industrial building located at 2703 S. Shoshone St. in Englewood, just south of Denver. AMAC Holdings Ltd. purchased the asset from LTW Properties LLC for $1.6 million. Jake Malman of Malman Commercial represented the buyer, while Tim Shay and TJ Smith of Colliers represented the seller in the transaction.

Panattoni Begins Construction of 182,184 SF Simmons Airpark Industrial Building in North Las Vegas

by Amy Works

NORTH LAS VEGAS, NEV. — Panattoni Development has started construction on Simmons Airpark, a Class A industrial facility at 2880 Simmons St. in North Las Vegas. The asset is valued at $18 million. Completion is slated for April 2024. The 182,184-square-foot building will feature 36-foot clear heights, a full concrete truck court and drive aisles, potential for evaporative cooling or full HVAC and the potential for a fully secured truck court. Panattoni Development will own the property.

CORONA, CALIF. — Berkadia Institutional Solutions has brokered the sale of Hills of Corona, a garden-style multifamily community in Corona. A private Los Angeles-based investor acquired the asset for an undisclosed price. Located at 2365 S. Promenade Ave., Hills of Corona features 248 one- and two-bedroom floor plans with walk-in closets, dishwashers, private balconies or patios and in-unit washers/dryers. Community amenities include a clubhouse, fitness center, two swimming pools, a business center and spa. Derrk Ostrzyzek, Rachel Parsons and Tom Moran Jr. of the Southern California Berkadia Institutional Solutions team handled the transaction. The name of the seller was not released.

Newmark Brokers Sale of 24,867 SF Midtown Plaza Retail Center in Walnut Creek, California

by Amy Works

WALNUT CREEK, CALIF. — Newmark has completed the sale of Midtown Plaza, an urban retail center in the Bay Area city of Walnut Creek. The asset traded for an undisclosed amount. Nicholas Bicardo, Rick Steffens and Cheyne Bloch of Newmark represented the undisclosed seller, while L&B Realty Advisors represented the buyer, an institutional client. The 24,867-square-foot property is located at 1410-1444 N. California Blvd. and 1620-1630 Cypress St. and includes a surface parking lot. At the time of sale, the shopping center was 100 percent leased to a variety of food, home improvement and service retail tenants, including Galpao Gaucho Brazilian Steakhouse and Premier Bath & Kitchen.