SACRAMENTO, CALIF. — PMB has opened the UC Davis Rehabilitation Hospital in Sacramento. The 52-bed inpatient rehabilitation facility is located on the UC Davis Sacramento campus and offers comprehensive rehabilitation services for patients with various conditions. The hospital features state-of-the-art facilities, private rooms, therapy gyms and a therapeutic courtyard. The new facility was announced as part of a joint venture agreement between UC Davis Health and Lifepoint Rehabilitation, a business unit of Lifepoint Health. Lifepoint Rehabilitation will manage the day-to-day operations of the inpatient rehabilitation facility. The architect was Taylor Design, while the general contractor was McCarthy Building Cos.

Western

MESA, ARIZ. — Arizona Gynecology Associates (AZGYN) is renovating a former Banner urgent care facility in Mesa. The 4,307-square-foot medical office building will undergo exterior and interior upgrades, including the addition of an X-ray suite and a dedicated women’s urgent care center. The expanded location will triple AZGYN’s footprint in Mesa and provide enhanced healthcare services to the community. Renovations are underway for completion by the end of the year. JLL’s Mari Lederman and Katie McIntyre represented AZGYN in the acquisition. Chad Shipley and Rommie Mojahed of SVN represented the building seller, Summit Properties Group LLC.

CARLSBAD, CALIF. — BKM Capital Partners has completed the acquisition of Commerce Carlsbad, an eight-building industrial park in Carlsbad. The property, now named Pacific Coast Industrial Center, offers 129,928 square feet of space in 62 small-bay units. BKM plans to make significant improvements to the park and reduce the office space to meet market demands. With high demand and limited availability in the area, BKM aims to achieve full occupancy and market rates in the future. Cushman and Wakefield’s Brad Tecca facilitated the transaction as a representative for the seller. BKM represented itself in the deal. The price was not disclosed.

LOVELAND, COLO. — Tepuy Properties has sold a 28,396-square-foot office/industrial space in Loveland for $4.7 million. The building, situated off highway 287, offers versatile spaces suitable for different businesses. The property, originally purchased by Tepuy in 2017, is fully occupied. The buyer was Wing Seven Capital LLC. The sale of this property allows Tepuy to reposition another asset in its portfolio.

Lee & Associates Arranges 10-Year Lease at Airway Office Park in Long Beach, California

by Jeff Shaw

LONG BEACH, CALIF. — Lee & Associates has successfully finalized a 10-year lease for a 10,812-square-foot creative office space at Airway Office Park in Long Beach. The tenant, Swing Set Productions, a creative production studio serving top brands, will relocate from Huntington Beach to this new studio. The Airway Office Park, developed by Urbana Real Estate Development, offers more than 60,000 square feet of office space and amenities. The project is currently under construction and scheduled for completion late this month. Jeff Coburn and Shaun McCullough of Lee & Associates Los Angeles – Long Beach represented the landlord, Airway Office Park LLC. Michael Shuken of Savills represented the tenant. The value of the lease is about $5 million.

Empire Group Obtains $88.5M Construction Financing for Build-to-Rent Residential Community in Phoenix

by John Nelson

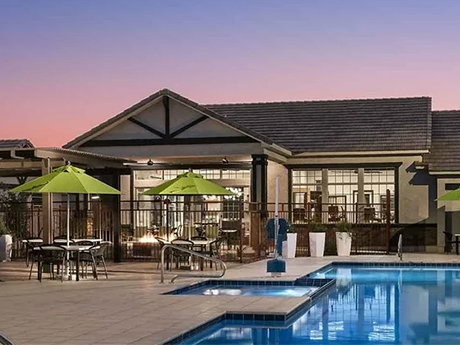

PHOENIX — Empire Group, a multifamily and commercial real estate development firm based in Scottsdale, Ariz., has obtained an $88.5 million construction loan for the development of Village at Bronco Trail. The 354-unit build-to-rent (BTR) community will be situated on a 30-acre site at 29th Avenue and Sonoran Desert Drive on the city’s north side. Empire Group expects to deliver the first swath of single-family homes at Village at Bronco Trail in 2024. Homes will average 920 square feet and amenities will include detached garages, a dog park, grilling area, resort-style pool, clubhouse and common area open spaces. Each home will have a private yard; kitchen with quartz countertops, stainless steel appliances and backsplashes; full-size washers and dryers; and upgraded smart-home features and technology. The property will be situated within two miles of the chip manufacturing plant for Taiwan Semiconductor Manufacturing Co., which is a $40 billion facility and a major economic demand driver for the North Phoenix residential market. Kyle McDonough and George Maravilla of Tower Capital arranged the financing on behalf of Empire Group. The direct lender was not disclosed, but the mortgage brokerage firm was able to secure multiple term sheets from lenders during due diligence. “The BTR …

— By Will Strong, Executive Vice Chair, Industrial Capital Markets, Cushman & Wakefield — Albuquerque has emerged as a vibrant hub for industrial development, showcasing a thriving economy and a favorable business climate. With its strategic location, robust infrastructure and supportive policies, the city has become an attractive destination for ecommerce and logistics companies seeking growth and expansion. Situated in the heart of the Southwest, Albuquerque enjoys a prime location that serves as a gateway to various markets. It is conveniently connected to major transportation networks, including interstates 25 and 40, making it accessible for shipping goods across the region. The city is served by the Albuquerque International Sunport, facilitating efficientair freight and business travel. The market’s availability of reliable utilities, such as water, electricity and high-speed internet, further strengthens the city’s industrial ecosystem. The Albuquerque industrial market grew more than 300,000 square feet in the past year. Demand has been strong enough to continually outpace deliveries, enabling vacancies to tighten below the historical average, according to CoStar. Vacancies have fallen to just 2.4 percent, well below the national average of 4.5 percent. Albuquerque has a diversified base of industries, led by aerospace, high-tech manufacturing, distribution and logistics, technology and …

Joint Venture Receives Financing for $168.1M Halawa View Affordable Housing Community in Honolulu

by Jeff Shaw

HONOLULU — Hunt Capital Partners (HCP), Pacific Development Group (PDG) and Hunt Development Group (HDG) have received $68.9 million in federal Low-Income Housing Tax Credit (LIHTC) equity and $24.4 million in State LIHTC equity financing for Halawa View II, a high-rise development in Honolulu. The building will complement the first phase of Halawa View, which was constructed in 1972 and renovated in 2012. Hunt Capital Partners facilitated the Federal LIHTCs through its proprietary fund with JPMorgan Chase. The Bank of Hawaii, with participation from American Savings Bank and Central Pacific Bank, provided construction financing in the form of an $80.2 million tax-exempt loan and a $12.3 million taxable loan. The Bank of Hawaii will also provide $24.6 million in permanent, tax-exempt financing. Additional financing includes a $42.3 million Rental Housing Revolving Fund loan from Hawaii Housing Finance and Development Corp. and a $5 million loan from Honolulu’s Affordable Housing Fund, which will be lent to the partnership through Hawaii Assisted Housing. Halawa View II will offer 302 studio, one-, two- and four-bedroom apartments. The building will rise 18 stories on a 3.11-acre site. Units will be affordable to households earning at or below 30, 40, 50 and 60 percent of …

LOS ANGELES — BH Properties has started an investment initiation into affordable housing with the goal of building a $1 billion portfolio of assets. The new platform will focus on Low-Income Housing Tax Credit (LIHTC), Section 8 and age-restricted housing throughout the United States. William Stoll, who BH Properties hired as a managing director, will lead the initiative. Prior to joining BH Properties, Stoll worked at Steadfast Cos. for 14 years. He joined the firm in 2009 as the manager of a Southern California portfolio of 10 LIHTC properties and eventually rose to the role of executive vice president of acquisitions. Stoll graduated from San Diego State University.

Gantry Arranges $15.2M Acquisition Financing for Cotton Mill Shopping Center in Washington, Utah

by Jeff Shaw

WASHINGTON, UTAH — Gantry has arranged a $15.2 million loan for the acquisition of Cotton Mill II, a retail center located in Washington, a suburb of St. George. Situated on 18.2 acres, the property comprises a shopping center and two outparcel ground leases totaling 165,000 square feet, with an additional pad that has capacity for a 15,000-square-foot multi-tenant inline building. Tenants at the center include Kohl’s, Natural Grocers, Ross Dress For Less, JOANN Fabrics, Dollar Tree, Red Robin and Cache Valley Bank. Tony Kaufmann and Erinn Cooke of Gantry secured the 30-year financing through a life insurance company on behalf of the undisclosed borrower.