IMPERIAL, CALIF. — Hanley Investment Group Real Estate Advisors has brokered the sale of two single-tenant retail properties in Imperial for a total $5.8 million. A Starbucks Coffee drive-thru occupies the first building, which comprises 2,089 square feet, on a 10-year lease. A private investor purchased the property for $2.9 million. The United States Postal Service leases the second building, which totals 5,430 square feet. An Indiana-based private partnership acquired the property for $2.9 million. Bill Asher and Jeff Lefko of Hanley represented the seller and developer, 5th Street Development LLC, in both transactions. Details on the buyer were not disclosed.

Western

CARLSBAD, CALIF. — Three new tenants have signed leases at Carlsbad Arcade in the Village, a retail center comprising 13,000 square feet in Carlsbad, roughly 35 miles north of San Diego. Village Florist Co., Carlsbad Golf Carts and Joey Snow Design Co. will occupy 1,180; 1,250; and 1,060 square feet, respectively. Serena Patterson and Luke Holler of Urban Property Group represented both the tenants and the landlord, Carlsbad One LLC, in the leasing transactions.

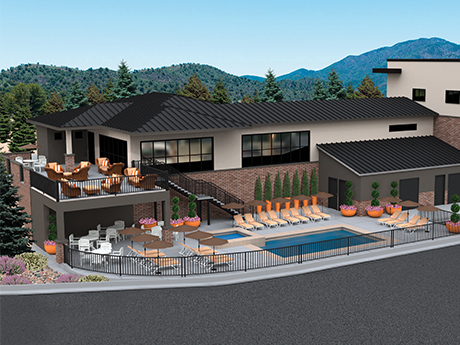

PRESCOTT, ARIZ. — Montezuma Heights Investors has unveiled plans for Montezuma Heights, a $41 million luxury multifamily development in Prescott. The groundbreaking ceremony will be held July 13. The development, located at 609 Bagby Drive, will feature 144 apartment units with one- to three-bedroom floor plans. Amenities will include a state-of-the-art gym, lounge, outdoor grotto with grilling area, dog parks, multiple fire pits and electric car charging stations. The community will also have a trail connection to Granite Creek Park and the Depot shopping center. The developer expects the construction process to take 20 months. MEB Management will serve as the community’s manager and leasing agent.

Ryan Cos. Begins Construction of 101,136 SF Medical Office Building in Scottsdale, Arizona

by Jeff Shaw

SCOTTSDALE, ARIZ. — Ryan Cos. has begun construction on a multi-tenant medical office building in Scottsdale. The two-story, 101,136-rentable-square-foot building is called One Scottsdale Medical. It is 80 percent preleased, with the City of Hope and Exalt Health serving as anchor tenants. They will occupy about 30,000 and 50,000 square feet, respectively. The building will provide additional space for lease to medical tenants. One Scottsdale Medical is scheduled for completion by third-quarter 2024. Mari Lederman and Katie McIntyre from JLL’s Phoenix office are the project’s exclusive leasing brokers.

PHOENIX — Topp Corp. has purchased The Marlowe, a 53-unit apartment complex in Phoenix, for $8.4 million. Built in 1968, the majority of the apartment interiors have been renovated with new cabinets, countertops, appliances, flooring and lighting. The average unit size is 552 square feet. The Marlowe offers new ownership an opportunity to implement a comprehensive value-add strategy by renovating the remaining 20 percent of apartment interiors and adding custom touches to enhance the community. The community enjoys a central location near Tempe, Scottsdale and Phoenix Sky Harbor International Airport. It features a central garden courtyard, swimming pool, laundry facility and assigned parking. Paul Bay and Darrell Moffitt of Marcus & Millichap, in conjunction with Cliff David and Steve Gebing of IPA, represented the seller, Living Well Homes, and procured the buyer.

Saunders, NavPoint Complete Construction of Two Industrial Buildings in Castle Rock, Colorado

by Jeff Shaw

CASTLE ROCK, COLO. — Saunders Development and NavPoint Real Estate Group have completed construction on two 80,000 square-foot industrial buildings in Castle Rock. The buildings, designed for distribution tenants, feature a ceiling height of 24 feet. Lakewood Electric and Colorado Powerline are the first tenants to operate from one of the buildings. Jeff Brandon and Charlie Davis of NavPoint Real Estate Group are handling the leasing of these two buildings.

TACOMA, WASH. — Colliers has brokered the sale of a self-storage property located at 8233 S. Hosmer in Tacoma. Hosmer Self Storage LLC sold the property, spanning 46,265 square feet and consisting of 454 storage units, to Merit Hill Capital. The price was not disclosed. The facility offers a range of storage unit sizes, including drive-up units and options for indoor vehicle storage. The Colliers de Jong | Becher Self Storage Team represented the seller in the negotiation process.

— By James Hall, ABI Multifamily — It’s been a tumultuous year for global capital markets and asset prices, which have had to contend with a broad array of geopolitical and economic headwinds. The Las Vegas multifamily market — while it remains demographically sound — is dealing with inflationary-based pricing concerns and fundamental characteristics dampening investor appetite.Amongst all the noise and negatively skewed fundamentals, Las Vegas’ economy continues to grow, with tourism surpassing pre-pandemic levels this quarter. Harry Reid Airport reported the highest recorded number of passengers in February, indicating that the market continues to benefit from a surge in post-pandemic domestic tourism.A report released by the Federal Funds Information for States ranked Nevada as first in the nation for economic growth and momentum last year. The measurement considers a wide array of key economic and demographic indicators, including population, personal income and employment growth.While California continues to reel from a declining population, both Nevada and Arizona are benefiting from a surge in net-migration. The population of Las Vegas is expected to double by 2060, which would add an additional 2 million residents to the MSA, per Woods and Poole Economics..Las Vegas residents have a much higher propensity to rent …

SIHI, Graycor Construction Break Ground on 516,320 SF Camelback 303 Industrial Park in Goodyear, Arizona

by Jeff Shaw

GOODYEAR, ARIZ. — Sunbelt Investment Holdings and Graycor Construction Company have begun construction on Phase I of Camelback 303, a Class A industrial park in Goodyear. The first phase consists of a 516,320-square-foot building within the Loop 303 Corridor. It is designed for use by a single tenant, or it can be divisible to three tenants. The Camelback 303 project aims to provide warehouse, distribution and manufacturing space. At completion, Camelback 303 is slated for up to 16 buildings ranging from 32,400 square feet to 1.2 million square feet. The development is part of the even larger PV|303 master-planned business park, which totals 1,600 acres and offers 20 million square feet of industrial, office and retail space. Construction on Camelback 303 Phase I is underway now, with completion scheduled for first-quarter 2024. The architect for Camelback 303 is Butler Design Group. Graycor Construction serves as the general contractor. Andy Markham, Mike Haenel and Phil Haenel of Cushman and Wakefield are the project’s exclusive leasing brokers.

Lee & Associates-Ontario Negotiates $19.5M Sale of Riverside Business Park in Jurupa Valley, California

by Jeff Shaw

JURUPA VALLEY, CALIF. — Lee & Associates-Ontario has facilitated the sale of Riverside Business Park, a fully occupied, multi-tenant business park in Jurupa Valley. Intersection Equities LLC acquired the asset, consisting of 37 units across 22 buildings, for $19.5 million. The park features ground-level and dock-high door loading, private yards, and clear heights of up to 16 feet. The sellers were Bravo Whiskey Properties LLC and Transition Properties LLC. The selling agent, Barret Woods of Lee & Associates-Ontario, represented himself as a principal in the transaction. Brad Yates and Stefan Pastor of Stream Realty represented the buyer.