PHOENIX — A joint venture between Toll Brothers Apartment Living and The Davis Cos. has opened Callia, a 403-unit community in Phoenix’s midtown neighborhood. The developers broke ground on the project in 2021, with resident occupancy beginning in October 2022. Pinnacle Financial Partners and Trustmark provided a construction loan facility for the development. Callia is situated on an 8.2-acre site. Phoenix-based architect Biltform and interior designer Streetsense designed the property. Callia offers studio, one-, two- and three-bedroom apartments, as well as nine live-work units. Community features include surface parking, tuck-under garages, EV charging stations, multiple lounges, a package room with cold storage, a fitness center, coworking spaces, property-wide Wi-Fi, a dog park with a pet wash station, bike storage and a bike service station. The property also offers 1,100 square feet of ground-floor retail space.

Western

Wonderful Real Estate Breaks Ground on 1.1 MSF Spec Industrial Development in Shafter, California

by Jeff Shaw

SHAFTER, CALIF. — Wonderful Real Estate has broken ground on a 1.1 million-square-foot speculative development at the Wonderful Industrial Park (WIP) in Shafter. The facility will be located at 5401 Express Ave. It will be the fifth speculative development delivered by WRE over the past five years. WRE has developed and leased more than 1.3 million square feet at Wonderful Industrial Park in 2022. This includes a 1 million-square-foot spec project that was leased by a Fortune 500 food manufacturer and a 309,000-square-foot building leased by existing tenant GAF, the nation’s largest manufacturer of roofing and waterproofing products. WRE is also in the final stages of design on a 415,000-square-foot speculative building in the park that is scheduled for delivery in the first half of 2024.

Dwight Mortgage Trust Provides $36.3M Refinancing for Villa Annette Apartments in Moreno Valley, California

by Jeff Shaw

MORENO VALLEY, CALIF. — Dwight Mortgage Trust has provided a $36.3 million bridge loan to refinance Villa Annette Apartments in Moreno Valley, a city in the Inland Empire region of California, about 64 miles east of Los Angeles. Latco Enterprises owns the 220-unit property, which is newly built and currently in lease-up. Proceeds from the bridge loan will be used to pay off existing construction debt. Villa Annette sits on 11 acres and comprises 14 two- and three-story buildings that offer a mix of one-, two- and three-bedroom floor plans. Amenities include a clubhouse, pool, spa, business center, fitness center and a picnic and grilling area. The owner plans to obtain a HUD 223(f) loan for permanent financing once the asset is stabilized. Ari Mandelbaum originated the transaction for Dwight.

EL CENTRO, CALIF. — Hanley Investment Group Real Estate Advisors has arranged the $2.4 million sale of a single-tenant retail property located in El Centro, approximately midway between San Diego and Phoenix. 7-Eleven occupies the 2,940-square-foot building on a 15-year, triple-net ground lease. Bill Asher and Jeff Lefko of Hanley represented the seller, Imperial Retail Investments LLC, in the transaction. A self-represented, California-based private investor purchased the property.

COLORADO SPRINGS, COLO. — Warby Parker has opened a 2,298-square-foot store at The Promenade Shops at Briargate, a 236,539-square-foot retail center located in Colorado Springs. The store is situated next to Ted’s Montana Grill. The eyewear brand currently operates more than 200 stores throughout the country.

Life sciences-anchored innovation districts are becoming increasingly popular as hubs for research and development in the biotech and pharmaceutical industries. These districts, also known as “innovation districts,” are characterized by clusters of companies, research institutions, supporting organizations, living areas, amenities and offices all located in close proximity. This grouping requires detailed planning and design strategies to maximize their potential for scientific exploration and success on an enormous, ambitious scale. Master planning and engaging site civil engineering partners early on in the process can save time and money once a project reaches the design stage. This article is the first installment in a two-part series on life sciences innovation districts to discuss, first, the planning, and, then, the design elements required by these districts. Read about design in Part 2, here. Fostering innovation, collaboration and productivity is at the heart of planning for life sciences innovation districts. The successes of famous examples such as North Carolina’s Research Triangle Park, Kendall Square in Cambridge, Mass. and Mission Bay in San Francisco indicate how beneficial a melting-pot mix of residential, commercial and research spaces can be when they concentrate talent from research institutions, life sciences innovators, universities and the surrounding community. “Many life …

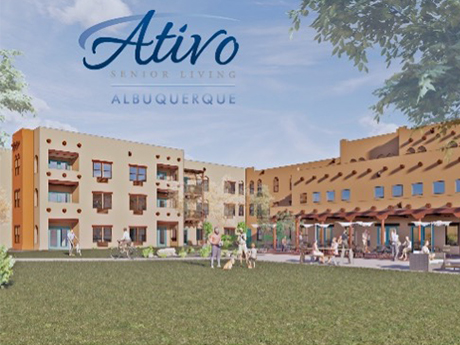

Insight Senior Living Breaks Ground on 144-Unit Ativo of Albuquerque Seniors Housing Community

by Jeff Shaw

ALBUQUERQUE, N.M. — Insight Senior Living has broken ground on Ativo of Albuquerque, a three-story independent living, assisted living and memory care community in Albuquerque. Situated on 6.5 acres, Insight Senior Living will be the operator and Link Senior Development arranged financing. Ativo of Albuquerque will offer 144 apartments. The community is scheduled to open in winter 2024.

TEMPE, ARIZ. — Institutional Property Advisors (IPA) has arranged the sale of and financing for The Gallery, an 88-unit apartment community in Tempe. Living Well Homes sold the property to RSN Property Group for $20.3 million. The Gallery is a two-story, 13-building property built in 1972 on approximately four acres. Amenities include a pool, fitness center and laundry facility. Apartment features include private patios or balconies. The two- and three-bedroom floor plans average 1,013 square feet in size. Cliff David and Steve Gebing, both executive managing directors with IPA, along with Marcus & Millichap’s Paul Bay and Darrell Moffitt, represented the seller and procured the buyer. Brian Eisendrath, Cameron Chalfant, Jake Vitta and Tyler Johnson led the IPA capital markets team.

FLAGSTAFF, ARIZ. — Faris Lee Investments has arranged the $23.5 million sale of The Marketplace, a 268,000-square-foot shopping center in Flagstaff. Tenants at the property include Petco, Best Buy, World Market, Marshall’s, Old Navy and Bealls Outlet. Don MacLellan, Jeff Conover and Scott DeYoung of Faris Lee represented the seller, Macerich, in the all-cash transaction. A California-based 1031 investor purchased the property.

Clarion Partners Provides Financing for 600,000 SF Industrial Property in Riverside, California

by Jeff Shaw

RIVERSIDE, CALIF. — Clarion Partners has provided a has provided a mezzanine loan that’s part of the acquisition financing package collateralized by an industrial building in Riverside. An affiliate of Societe Generale arranged the $10 million mezzanine loan subordinate to a $70 million senior loan. The Class A, 600,000-square-foot facility is fully leased and serves as the headquarters for a third-party logistics provider.