GOODYEAR, ARIZ. — UrbanStreet Group has purchased a nearly 17-acre land parcel at the Douglas at Goodyear Airport Commons in Goodyear for $14.5 million. The parcel comes with fully approved plans for a 307-unit build-to-rent (BTR) townhome community. ABI Multifamily’s Patrick Burch and John Klocek represented the seller, Blueprint Capital, in this transaction.

Western

ALMQUIST Signs 21 Tenants to River Street Marketplace in San Juan Capistrano, California

by Jeff Shaw

SAN JUAN CAPISTRANO, CALIF. — ALMQUIST has signed 21 tenants to River Street Marketplace, a 60,000-square-foot retail development currently underway in San Juan Capistrano. Concepts that will join the lineup include Bred’s Hot Chicken, Capistrano Brewing, Common Thread, Fermentation Farm, Finca by David Pratt, Free People, Gueros Cevicheria, Hudson’s Cookies, Kozan Teahouse & Boba, La Vaquera, McConnell’s Ice Cream, The Meat Cellar Market and Steakhouse, Mendocino Farms, Nana’s Fish Chippery, Nom, SALT., Seager, Shootz Hawaiian, Toes on the Nose, Ubuntu Café and Wildfire Mercantile.

Heather Sharp Joins Progressive Real Estate Partners as Senior Vice President of Retail Sales, Leasing

by Jeff Shaw

RANCHO CUCAMONGA, CALIF. — Heather Sharp has joined Progressive Real Estate Partners as senior vice president of retail sales and leasing. Sharp, who brings more than 25 years of experience in real estate, will lead the firm’s expansion into the Coachella Valley while continuing brokerage activities, including the sale and leasing of retail properties. Previously, Sharp was a partner at Wilson Meade Commercial Real Estate in Rancho Mirage. “We have been eager to bring our team-oriented, resource-rich brokerage culture to the Coachella Valley for a few years, but were waiting for the right person to lead this expansion,” says Brad Umansky, president of Rancho Cucamonga-based Progressive.

Orange County’s Retail Vacancy is Tight, but Capital Markets Activity Will Be Sluggish this Year

by Jeff Shaw

— By Terrison Quinn, Managing Principal, SRS Real Estate Partners — The Orange County retail property market was very active last year for both leasing and capital markets. At 4 percent, Orange County’s retail vacancy was back down to pre-pandemic levels. There was an annual net positive absorption of 445,000 square feet with 191,000 square feet of new space delivered in 2022, per CoStar. Average rents increased 5 percent from an average market rent of $34.84 per square foot, per year to $36.58 — the highest rate of rent growth in 10 years. We don’t see rents coming down at all this year, especially as there’s only 170,000 square feet of new space currently under construction and we continue to experience favorable consumer demand. From a capital markets perspective, investment activity remains to be seen. In line with national trends, many investors and lenders are putting capital deployment on pause as they analyze economic activity and adjust to a period of higher interest rates, higher inflation and, perhaps surprisingly, strong employment. Despite the angst that comes from uncertainty, there is a lot of positive sentiment toward economic corrections, creating investment opportunities over the coming years. This is certainly the …

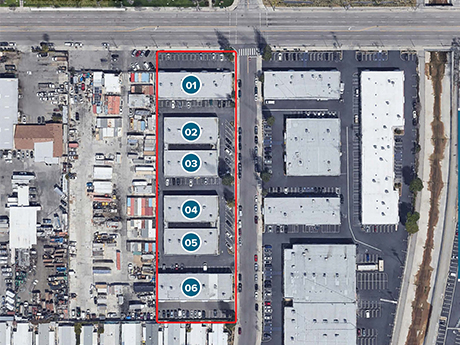

PORTLAND, ORE. — BKM Capital Partners has purchased Airport Business Center in Portland for $37.3 million. The 11-building light industrial portfolio is located at 6756 NE Alderwood Road and 6620-7040 NE 79th Court in Portland’s Columbia industrial corridor. The 228,518-square-foot business park contains 41 units with an average size of 5,600 square feet. The spaces were 92 percent occupied at the time of the sale. BKM acquired the asset through a joint venture partnership with TerraCore Capital.

LOS ANGELES — Selective Eton Nordhoff LLC has acquired a 48,550-square-foot industrial property in the Chatsworth and Canoga Park communities of Los Angeles. Though the purchase price was not disclosed, the asset was listed at nearly $10.5 million and sold for above asking price. The multi-tenant industrial property was built in 1977. It has largely remained the same since that time, save for cosmetic updates over the years. Arthur Pfefferman of Coldwell Commercial Quality Properties represented both the buyer and the seller.

CARLSBAD, CALIF. — PSRS has arranged $5.9 million in financing for the acquisition of a 32,000-square-foot industrial property in Carlsbad. The deal closed in 35 days to meet the borrower’s 1031 exchange deadline. The non-recourse loan features a five-year term with a 5.55 percent interest rate and a 30-year amortization. Ryan Frankman and Ari Zeen of PSRS arranged the financing through an insurance company.

DENVER — McCarthy Building Cos. has leased a 13,000-square-foot space at One Platte in Denver. The newly developed, 250,402-square-foot office building is located at 1701 Platte St. The new space will allow McCarthy to expand and relocate within the Denver market. The company has been an active player in the market since the mid-1970s. JLL’s David Shirazi, Janessa Biller and Scott Wetzel represented McCarthy in the lease. Newmark represented the landlord, Shorenstein.

TUCSON, ARIZ. — Tahl Machine, which provides parts for mechanical and electronic equipment, has renewed its lease for 10,500 square feet of industrial space at Tucson Industrial Center. The space is located at 4151 E. Tennessee St., Suites 239 and 257 in Tucson. Cintya Denisse Angulo Garcia of Cushman & Wakefield | PICOR represented the landlord in this transaction.

University of California Approves Plans for $1.1B Student Center, 2,400-Bed Residence Hall at UC San Diego

by Katie Sloan

SAN DIEGO — The University of California Board of Regents has approved plans to develop a new student center and 2,400-bed residence hall on the University of California San Diego campus. The two projects will cost $1.1 billion, according to reports by The San Diego Union Tribune. Construction on both developments is set to begin this summer. The four-building student center, named Triton Center, is set for completion in 2026. One of the buildings will be home to the university’s student health, mental health and well-being services. This property will include an urgent care space; primary care, pharmacy and wellness services; and a new home for the university’s Counseling and Psychological Services department. Triton Center will also include an alumni and welcome center; a multi-purpose building with a 500-person event space; an art gallery; and a student academic resources building. The residence hall, Ridge Walk North Living and Learning Neighborhood, is scheduled to open in time for fall semester 2025 and will serve undergraduate students. The building will also include updated administrative and teaching space for the university’s Thurgood Marshall College, School of Global Policy and Strategy, and the Department of Economics in the School of Social Sciences. Ridge Walk will …