PHOENIX — Hamilton Zanze has purchased the 296-unit Springs at Deer Valley apartment community in Phoenix for an undisclosed sum. This purchase marks the firm’s seventh Arizona property within its current portfolio. The community will be rebranded as Ironwood at Happy Valley apartments. Built in 2021, Ironwood at Happy Valley is located at 24025 N. 23rd Ave., about 20 minutes from downtown Phoenix. The property is also close to the $12 billion Taiwan Semiconductor Manufacturing Co. manufacturing campus. Hamilton Zanze will execute a capital improvements campaign that includes building, amenity and green improvements. Management of the property has been transitioned to HZ affiliate Mission Rock Residential. Dan Woodward, David Potarf, Matt Barnett and Jake Young led the Walker & Dunlop investment sales team that marketed the property.

Western

Greystone Provides $20.3M in Fannie Mae Financing for Patriot Pointe Apartments in North Ogden, Utah

by Jeff Shaw

NORTH OGDEN, UTAH — Greystone has provided $20.3 million Fannie Mae Delegated Underwriting & Servicing (DUS) Green Rewards loan to refinance Patriot Pointe Apartments, an 87-unit multifamily property in North Ogden. Patriot Pointe Apartments was built in 2020 and features one- to three-bedroom units. The nonrecourse, fixed-rate financing carries a 10-year term and 30-year amortization, with full-term interest-only payments. The property achieved a Fannie Mae Green Globes certification for its energy upgrades. Loan proceeds enabled the borrower to monetize a portion of the equity in the property.

LOS ANGELES — Landmark Properties has announced plans to develop a student housing community near the University of Southern California (USC) campus in Los Angeles. Located at the corner of West 39th and South Figueroa streets, the property will offer 435 units in studio through five-bedroom configurations. The development will also include 87 affordably priced units, which will be reserved for students at the low-income level or below. Landmark is still in the planning phase for the project, which is expected to feature more than 1,500 beds. Shared amenities will include a clubhouse; rooftop resort-style swimming pool and grilling area; computer lab; fitness center; on-site parking; and 20,000 square feet of ground-floor retail. Construction is set to begin by the end of 2023, with completion scheduled for fall 2026. Landmark Urban Construction will serve as general contractor for this project. Kevin Shannon, Ken White, Greg Galusha, Bryan Norcott, Ryan Lang, Jack Brett, Chris Benton and Anthony Muhlstein of Newmark, in collaboration with Eric Bergstrom at Bergstrom Capital Advisors, brokered the acquisition of the development site from Ventus Group for an undisclosed price.

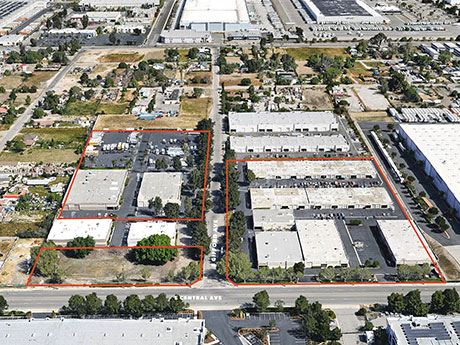

Kidder Mathews Negotiates $26M Sale of Gifford Business Park in San Bernardino, California

by Jeff Shaw

SAN BERNARDINO, CALIF. — Kidder Mathews has arranged the sale of the seven-building Gifford Business Park in San Bernardino for $26 million. The multi-tenant industrial property is located at 750-760 East Central Ave. and 765-791 South Gifford Ave., 2.5 miles from San Bernardino International Airport. It was built in 1989. The seller, Positive Investments, undertook capital expenditures, including roof replacement on five of the seven buildings, exterior paint on the entire property and parking lot re-slurry. The business park is currently 93 percent leased with more than 50 tenants. In-place rents are nearly 20 percent below market rates. Alan Pekarcik of Kidder Mathews represented the seller, while Christopher Smith of Colliers represented the buyer, MIG RE Investors I LLC, in the transaction.

WESTLAKE VILLAGE, Calif. — LTC Properties Inc. (NYSE: LTC), a Westlake Village-based REIT, has sold two skilled nursing centers in New Mexico. The two centers, totaling 235 beds, were sold for $21.3 million, generating proceeds of $20.8 million. The proceeds will be used to pay down the company’s unsecured revolving line of credit. LTC anticipates recording a gain on sale of approximately $15 million in first-quarter 2023. As a result of the sale, the two properties were removed from the operator’s master lease, and LTC provided a rent decrease of 7.5 percent of the net proceeds, or approximately $1.5 million of cash rent, to the operator. The centers were built in 1975 and 1985. “As part of our active asset management program, we identify opportunities to reduce the age of our portfolio and provide us with capital that can be better deployed through new investments or deleveraging our balance sheet,” says Wendy Simpson, LTC’s chairman and CEO. “This sale was in the best interest of LTC and the operator, and we look forward to continue working with them through the four skilled nursing centers and one behavioral hospital they continue to operate under the master lease.”

ALISO VIEJO, CALIF. — MetroGroup Realty Finance has arranged a $10.6 million bridge loan for a retail center in Aliso Viejo. Trader Joe’s anchors the 30,500-square-foot property. Other tenants include the restaurants Eureka! and Lupe’s. The interest-only loan carries a term of 36 months and replaces a maturing commercial mortgage-backed security loan.

RENO, NEV. — Alston Construction has broken ground on TRIC 688 West Building 3, an 815,360-square-foot speculative tilt warehouse/distribution facility in Reno. The project is the first building for Locus Development Group’s planned 200-acre campus. The project will allow for increased economic activity in an underdeveloped area with unused land. Valued at $47 million, construction on Building 3 is scheduled for completion in January 2024.

Alere Property Group Buys Industrial Development Site in Fontana, California for $38.9M

by Jeff Shaw

FONTANA, CALIF. — Alere Property Group has purchased a 17.4-acre site in Fontana for $38.9 million. Located at 13592 Slover Ave., just off Interstate 10 between North Etiwanda and Cherry avenues, the site is entitled for two Class A warehouse distribution buildings totaling about 350,000 square feet. Alere plans to develop the property in 2024 and offer the buildings for lease. Richard Lee, Nicholas Chang, Justin Kuehn and Sione Fua of the Lee Chang Kuehn Fua Group of NAI Capital Commercial’s Ontario office represented both Alere and the seller, CP Fontana, in the transaction.

PLEASANTON, CALIF. — A joint venture comprising Shopoff Realty Investments, Praelium Commercial Real Estate and an affiliate of Singerman Real Estate LLC has purchased an 8.4-acre property in Pleasanton that was formerly home to a Nordstrom department store. Located at Stoneridge Mall, the property marks the fourth mall purchase for Shopoff in recent years, according to the company’s president and CEO. Shopoff is currently exploring potential uses — including residential, mixed-use and office — for the space. Stoneridge Mall is one of the sites identified for redevelopment by the City of Pleasanton’s 2023-31 Housing Element Plan.

POWAY, CALIF. — SENTRE has acquired Parkway Commerce Center, a 147,907-square-foot, multi-tenant industrial park in Poway, for $21.4 million. The facility comprises two warehouse/distribution buildings and two industrial/flex buildings, which are leased to a diverse roster of tenants. The property features 19- to 25-foot clear heights and a total of 21 dock-high doors, 36 drive-in doors and 316 parking spaces. JLL’s Bob Prendergast, Lynn LaChapelle, Ryan Spradling and Zach Saloff represented the seller, an institutional investor.