COLORADO SPRINGS, COLO. — Marcus & Millichap has arranged the sale of a medical office building located at 2960 N. Circle Drive in Colorado Springs. A local limited liability company sold the property to local investor for $4.2 million. Colorado Springs Family Practice occupies the 24,806-square-foot building, which was built in 2003 on two acres. Spencer Mason, Brandon Kramer and Erik Enstad of Marcus & Millichap’s Denver office represented the seller in the deal.

Western

BILLINGS, MONT. — Senior Living Investment Brokerage (SLIB) has arranged the sale of a 32-unit assisted living facility in Billings. The community was built in 2015, spanning approximately 16,044 square feet on 1.4 acres of land. The seller was a local owner exiting the senior living market. The buyer is a nonprofit located in Montana. The price was not disclosed. Jason Punzel, Vince Viverito and Brad Goodsell of SLIB handled the transaction.

LOS ANGELES — Alliant Strategic Development (ASD) has broken ground on four transit-oriented multifamily communities, totaling 727 income-restricted rental units, in the Los Angeles neighborhoods of Canoga Park, Van Nuys and North Hollywood. Upon completion, which is slated to occur in the fourth quarter of 2024 and first quarter of 2025, the portfolio will offer units geared to households throughout the affordable spectrum — on average earning up to 90 percent of the area median income (AMI), with 144 of the units designated for households making 50 percent or less of AMI. The four projects include: Sync on Canoga, featuring 220 one-bedroom units at 7019 Canoga Ave. in Canoga Park. Pendant on Topanga, totaling 149 studio, one- and two-bedroom apartments at 7322 Topanga Canyon Blvd. in Canoga Park. Vose, offering 332 studio, one- and two-bedroom apartments at 7050 Van Nuys Blvd. in Van Nuys. Candence at Noho, featuring 26 one- and two-bedroom units at 5633 Farmdale Ave. in North Hollywood. The interiors of the 727 units will include energy-efficient stainless steel kitchen appliances, in-unit washers/dryers and stone countertops. Community amenities across the portfolio include fitness centers, rooftop decks, electric vehicle charging stations, pools, spas, outdoor lounge areas and dog parks …

— Kyle Davis, Sales & Leasing Agent, Commercial Properties Inc., a CORFAC International Firm — A market cooldown is likely in 2023 as interest rates rise and the investor pool becomes more cautious to some degree. I believe many investors recall lessons from the Great Recession and are not as significantly overleveraged, which means the effects of this market correction may not be nearly as drastic. Phoenix’s retail market also has some bright spots. The area’s retail net absorption was positive at more than 1.5 million square feet, with vacancy rates down to 5.1 percent at the end of the fourth quarter of 2022. This is compared to the 1,071,783 square feet of absorption and 6.6 percent vacancy rate a year ago. Many look at factors like unemployment, interest rates, housing starts, etc., to speculate about the coming market. What will impact our industry most directly, however, is how the lending market reacts to these indicators. As with 2008 and 2020, creditors may look at the same data points as investors and lower their risk profiles significantly faster than investors are able to counteract. There will be many commercial property loans set for refinancing in the near or upcoming future, as commercial property …

Belmont Village Senior Living Breaks Ground on 177-Unit Project in San Ramon, California

by Amy Works

SAN RAMON, CALIF. — Belmont Village Senior Living, in partnership with Sunset Development, has broken ground on Belmont Village San Ramon. Located at 6151 Bollinger Canyon Road within the Bishop Ranch neighborhood of San Ramon, the 175,320-square-foot community will feature a heated saltwater pool, putting green, farm-to-table gardening areas, al fresco dining, outdoor yoga lawn and group fitness space, and a dog park. Slated for completion by fall 2024, Belmont Village San Ramon will feature 177 studio, one- and two-bedroom residences for independent living, assisted living and memory care needs. The property will offer residents concierge and transportation services, valet parking, onsite physiotherapy, a fitness center, art studio, screening room, club lounge, full-service salon and spa, personal wine storage and multiple dining venues. Aron Will, Tim Root and Michael Cregan of CBRE National Senior Housing secured the non-recourse construction financing for the project on behalf of a joint venture between Belmont Village Senior Living and Harrison Street Real Estate Capital. The project team includes W.E. O’Neil Construction and HKIT Architecture.

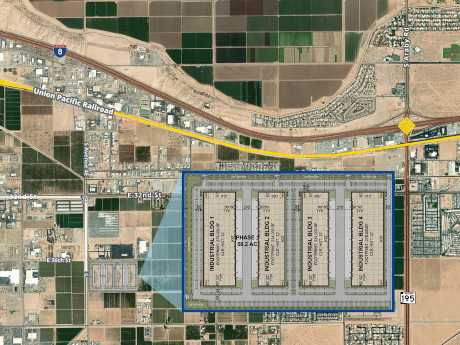

YUMA, ARIZ. — Panattoni Development has unveiled plans to develop a 1 million-square-foot industrial park at 36th Street and South Avenue 4E in Yuma. The initial phase of Panattoni’s Yuma Industrial Park is slated to include four buildings ranging from 234,000 square feet to 279,000 square feet each. The buildings will feature two grade-level doors, 49 rear-load, dock-high doors and 32-foot clear heights.

GOLDEN, COLO. — JLL Capital Markets has arranged a $31.2 million refinancing for Epoque Golden, an apartment property at 1175 Newstar Way in Golden. Eric Tupler and Tony Nargi of JLL Capital Markets secured the five-year, fixed-rate loan through Freddie Mac Multifamily for the borrower team, including Forum Real Estate Group. JLL Real Estate Capital, a Freddie Mac Optigo lender, will service the loan. Constructed in 2019, Epoque Golden features 120 studio, one-, two- and three-bedroom apartments with open-concept floor plans, quartz countertops, full-size washers/dryers, private balconies and walk-in closets. Community amenities include a resort-style swimming pool, fitness center with outdoor yoga terrace, landscaped courtyard with fire pits and grilling area, a speakeasy, private dining room, work-from-home space, electric vehicle charging station and golf and ski storage.

GREEN VALLEY, ARIZ. — Northmarq has arranged the sale of Sahuarita Mission, a multifamily community located at 1091 W. Beta St. in Green Valley. Sahuarita Mission Owner LLC (FSO Capital Partners) sold the asset to Cypress, Calif.-based WNC Apartment Ventures for $8.8 million, or $169,231 per unit. Built in 2000, Sahuarita Mission is an affordable multifamily community with four two- and three-story buildings on 2.9 acres. The fully occupied property features 52 two- and three-bedroom units, ranging in size from 822 square feet to 1,013 square feet, with walk-in closets, balcony or patio, plush carpet and automatic dishwashers. Community amenities include a clubhouse, children’s playground, picnic area with grill, laundry facilities and on-site leasing office. Trevor Koskovich, Jesse Hudson, Ryan Boyle and Logan Baca of Northmarq Phoenix’s investment sales team represented the seller in the deal. Bryan Mummaw, Bryan Liu, Brandon Harrington, Christopher Gitibin, Brad Burns and Tyler Woodard of Northmarq’s debt and equity team secured a $5.9 million loan for the buyer through Northmarq’s relationship with Freddie Mac.

PSRS Arranges $16.3M Refinancing for Eastlake Village Center Retail Space in Chula Vista, California

by Amy Works

CHULA VISTA, CALIF. — PSRS has secured a $16.3 million non-recourse loan for the refinancing of a 43,471-square-foot retail space at Eastlake Village Center in Chula Vista. James Mulvihill and Kevin Mulvihill of PSRS arranged the loan, which a life insurance company provided. PSRS will service the mortgage as part of its $6.6 billion loan serving portfolio.

PHOENIX — Holualoa Cos. and LaPour Partners have completed the disposition of the AC Hotel Phoenix Biltmore by Marriott in Phoenix. Nella Invest bought the asset for $67.8 million, or $423,750 per room. Located at 2811 E. Camelback Road, the five-story hotel features 160 rooms in a mix of traditional rooms and suites. Amenities include AC Kitchen & Lounge, a fitness center, business center, outdoor pool, sundry shop, guest laundry and more than 5,000 square feet of meeting space. The hotel was developed as part of a mixed-use project along with the Camelback Collective Office Building, which sold in July 2022. Co-developers Holualoa and LaPour Partners purchased the site in October 2016. Melvin Chu, John Strauss and Ben Geelan of JLL Hotels & Hospitality represented the seller, with Halo Hospitality and DCA Partners as advisors to the buyer. Azul Hospitality Group operates the hotel.