MOAB, UTAH — Sonneblick-Eichner Co. has secured $50 million in construction financing for Phase I of Lionsback Resort, a 175-acre development in Moab. Situated adjacent to Canyonlands and Arches national parks, Lionsback’s $350 million, five-year development plans includes 188 single-family residences and a resort hotel. Proceeds from the fixed-rate, non-recourse construction loan will be used to complete the Phase I onsite infrastructure improvements and vertical construction of the initial 34 single-family homes, as well as the horizontal infrastructure of Phase II. Moab is located in the eastern portion of Utah, near the Colorado border, Colorado River and Arches National Park.

Western

Paladin Equity Capital Acquires Land Parcel in San Bernardino for Everhome Suites Hotel Development

by Amy Works

SAN BERNARDINO, CALIF. — Paladin Equity Capital has purchased a 1.7-acre land site at 898 E. Harriman Place in San Bernardino from Los Angeles-based NHOS Enterprises. The buyer plans to develop an Everhome Suites extended-stay hotel on the site. Slated to break ground in summer 2023, the 60,000-square-foot hotel will feature 117 apartment-style guest rooms with fully equipped kitchens and customizable space, including workstations, full-size closets, additional storage and spa-like bathroom. Onsite amenities include public spaces, a fitness center and a 24/7 self-service marketplace with a variety of food and beverage options. Brad Umansky and Paul Galmarini of Progressive Real Estate Partners represented the seller, while Kevin Barry of Irish Commercial Brokerage represented the buyer in the transaction.

SEATTLE — Green Leaf Capital Partners has purchased Broadstone Sky, a mid-rise apartment community at 4745 40th Ave. S.W. in Seattle. David Young, Corey Marx, Chris Ross, Jordan Louie and Michael Lyford of JLL Capital Markets’ investment sales and advisory team represented the undisclosed seller in the deal. Terms of the transaction were not released. Completed in 2016, Broadstone Sky features 151 one- and two-bedroom units with an average size of 706 square feet, stainless steel appliances, quartz countertops, full-size washers and dryers, oversized windows and vinyl plank flooring. Community amenities include a 24-hour athletic center, rooftop deck, entertaining kitchen, resident lounge, two outdoor barbecue areas and an on-site coffee and wine shop.

PUEBLO, COLO. — Capstone has arranged the sale of a multifamily complex located at 1411-1434 Anita St. in Pueblo. The assets traded for $3.2 million. The names of the seller and buyer were not released. The 24-unit portfolio consists of six duplexes and three quadraplexes. The duplexes were built in 1994 and feature two-bedroom/one-bath units, while the quadraplexes were built in 1993 and feature 1,050-square-foot three-bedroom/two-bath units. Lee Wagner of Capstone represented the seller and buyer in the deal. Ari Schriger of WCW Commercial arranged financing for the value-add acquisition.

SAN DIEGO — A joint venture between San Diego-based Elevation Land Co. and a real estate fund advised by Crow Holdings Capital has unveiled plans to develop Otay Business Park, a 1.8 million-square-foot industrial, distribution and warehouse property in the Otay Mesa submarket of San Diego. Current construction plans for Otay Business Park include the development of eight speculative or build-to-suit buildings that can accommodate users ranging from 45,000 square feet to 500,000 square feet. The buildings will feature 32-foot to 36-foot clear heights, 325 dock-high loading positions, 175 trailer stalls and 16 grade-level loading doors. Slated for completion in the second half of 2024, Phase I will consist of 1 million square feet of space spread across five buildings. Phase II will consist of 770,000 square feet across the buildings, with completion scheduled for 12 months after Phase I is delivered. All buildings are planned for speculative development but can be delivered on a build-to-suit basis for occupants. The developers acquired a total of 263 acres of land where the project is being developed during the second quarter of 2022 for $165 million. The land purchased included the 119 acres that Otay Business Park will occupy, along with several …

LOS ANGELES — Sony Pictures Entertainment has signed a long-term, multi-floor lease to occupy 225,239 square feet of office space at Wilshire Courtyard, a two-building, Class A office campus on Los Angeles’ Miracle Mile. The company is relocating select divisions from Culver City to the new offices at 5750 Wilshire Blvd. Josh Bernstein, Peter Collins, Scott Menkus and Alexa Delahooke of Cushman & Wakefield represented the landlord, Onni Group, while Josh Gorin and Mike Catalano of Savills represented Sony in the lease negotiations. Neal Linthicum of Onni managed the transaction on the company’s behalf. Wilshire Courtyard comprises two six-story office buildings, located at 5700 and 5750 Wilshire Blvd., totaling 1 million square feet. The buildings were originally developed in the late 1980s and underwent significant interior and exterior renovations in 2015. The asset features 125 tiered outdoor balconies for indoor/outdoor work, an onsite Equinox Fitness, renovated common areas and plazas, and a park with jogging trails. Additionally, Onni is adding an amenity center to the property with a golf simulator, multi-screen entertainment center, tenant lounge and conference facility.

Progressive Real Estate Partners Brokers $11.9M Sale of Retail Property in Norco, California

by Amy Works

NORCO, CALIF. — Progressive Real Estate Partners has arranged the sale of a gas station, car wash and multi-tenant retail space at 996 Mountain Ave. in Norco. A Los Angeles private investor sold the asset to a Los Angeles-based private investor that operates gas station properties for $11.9 million in an all-cash transaction. Built in 2000 and fully remodeled in 2020, the property features 18 Chevron fueling positions, a self-service express car wash with a 150-foot tunnel, a 22,000-square-foot ExtraMile convenience store and two retail spaces that Valvoline and a window tinting company occupy. Victor Buendia of Progressive Real Estate represented the seller, while Grace Sue of Meiguo Realty represented the buyer in the deal.

SPOKANE, WASH. — Colorado-based Brinkman Real Estate has acquired two multifamily properties in Spokane: The Flats on Liberty and The Flats on Foothills. 4Degrees sold the assets for an undisclosed price. Brinkman’s capital markets team, in partnership with Jason Bond of Berkadia, led the financing for the portfolio. Coastal Community Bank provided the capital. Situated three miles apart, the two communities offer a total of 120 units. The Flats on Liberty was completed in 2022, and The Flats on Foothills was completed in 2023. The company’s business plan for the properties focuses on tenant-centric improvements, including a more active property management platform for residents’ convenience and minor interior upgrades such as smart-home packages and enhanced lighting.

SAN DIEGO — CBRE has arranged the sale of an office building located at 10200 Willow Creek in San Diego’s Scripps Ranch submarket. Espten Grinnell & Howell APC sold the asset to a private buyer, completing a 1031 exchange, for $6 million. Matt Pourcho, Jeb Bakke, Anthony DeLorenzo, Matt Harris and Nick Williams of CBRE Private Capital Partners represented the seller, while the buyer was self-represented in the transaction. Built in 1980 on 2.2 acres, the one-story property features 23,524 square feet of office space and 92 parking spaces. At the time of sale, the building was fully leased.

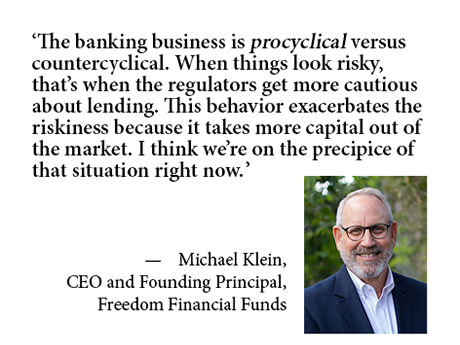

Prospective investors can finance acquisitions even when equity is scarce, explains Michael Klein, CEO and founding principal of Freedom Financial Funds. “The scarcity of equity is an old phenomenon; it’s a relatively new phenomenon that made equity plentiful. For most of history, it was hard work to find equity. However, even in a tight market, if there’s a compelling case for a project to result in success and there are multiple ways of protecting the equity and the debt, that deal will get done.” This is the outlook Klein brings to the 2023 MBA Commercial/Multifamily Finance Convention & Expo. Klein’s company, Freedom Financial Funds, LLC is a private REIT based in Los Angeles and operating in the western United States. The REIT specializes in providing capital to real estate professionals adding value to projects. Debt, Equity and Protecting Value Klein explains that with any type of financing, whether it be debt or equity, it is key to have a compelling story and facts to indicate that the borrower is going to provide a fair amount of value. “Protecting the investor from potential downside risks is an essential part of financing,” explains Klein. This sort of forethought requires thorough due diligence …