HENDERSON, NEV. — DIV Industrial, a newly formed institutional investor and developer of industrial real estate, has acquired 94 acres of land in Henderson’s El Dorado Valley submarket for the development of El Dorado Valley Logistics Center. Terms of the acquisition were not released. Construction is scheduled to begin this summer. The 1.7 million-square-foot El Dorado Valley Logistics Center will feature two buildings, ranging in size from 600,000 square feet to 1 million square feet, with 42-foot clear heights, flat floors and an ESFR sprinkler system. The development site is located at the intersection of Highway 95 and Roger Ray Road, providing access to the entire Las Vegas Valley. The City of Henderson recently annexed the site. DIV’s development partners include HPA Architecture and Kimley-Horn. Cushman & Wakefield’s Alderson Tassi team, led by Donna Alderson and Greg Tassi, represented DIV, while Amy Ogden SIOR of LOGIC Commercial Real Estate represented the seller, IndiCap, in the sale and assignment of the complex land transaction. DIV acquired the land in an unimproved condition with entitlements in process. El Dorado Valley Logistics Center is the first significant development project for DIV Industrial, which was established in late summer 2022 by real estate veterans …

Western

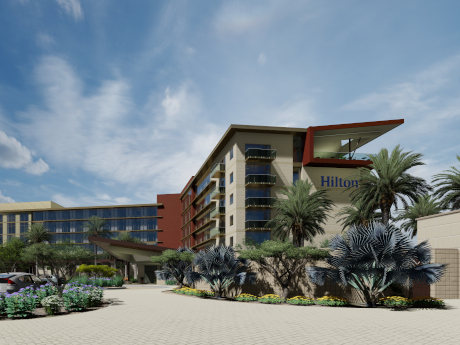

Nationwide Realty Investors Opens 237-Room Hilton at Cavasson Hotel in Scottsdale, Arizona

by Amy Works

SCOTTSDALE, ARIZ. — Nationwide Realty Investors has opened Hilton at Cavasson, a hotel and event center in the master-planned Cavasson development in Scottsdale. Nationwide Realty Investors owns the hotel, which Columbus Hospitality Management operates. The six-story hotel features 237 guest rooms, resort-style amenities and a 15,000-square-foot event space. The full-service property also offers a top-floor event space and terrace, a coffee shop, fitness center, swimming pool and Desert Pony Tavern, a bar and restaurant.

Toibb Enterprises Sells Grocery-Anchored Shopping Center in Simi Valley, California for $19.5M

by Amy Works

SIMI VALLEY, CALIF. — Woodland Hills, Calif.-based Toibb Enterprises has completed the disposition of Simi Valley Promenade, a retail center located at 5105-5197 E. Los Angeles Ave. in Simi Valley. A Chino Hills-based private investor acquired the asset for $19.5 million. Smart & Final, Goodwill, Del Taco, Denny’s, Baskin Robbins, Chi Chi’s Pizza and H&R Block are tenants at the 82,366-square-foot Simi Valley Promenade, which was built in 1981 and most recently renovated in 2002. At the time of sale, the property was 92 percent occupied. Bill Ashe, Jeff Lefko and Ed Hanley of Hanley Investment Group represented the buyer, while Avi Narang of Beverly Hills-based BRC Advisors represented the seller in the deal.

Marcus & Millichap Brokers Sale of 22,424 SF Concorde Place Office Building in Centennial, Colorado

by Amy Works

CENTENNIAL, COLO. — Marcus & Millichap has arranged the sale of Concorde Place, a Class B office property in Centennial. A limited liability company sold the asset to an undisclosed buyer for $2.4 million. Situated on a 1.38-acre site at 7208 S. Tucson Way, Concorde Place features 22,424 square feet of office space. Brandon Kramer and Chadd Nelson of Marcus & Millichap’s Denver office represented the seller in the deal.

COLORADO SPRINGS, COLO. — Flywheel Capital has completed the disposition of a mission critical Class A office/flex and industrial manufacturing/distribution portfolio in Colorado Springs. A private partnership acquired the asset for $54.3 million. Totaling 289,018 square feet, the portfolio includes two two-story buildings located at 10125 and 10205 Federal Drive within Interquest Business Park. Building A (10125 Federal) is a fully leased, 191,924-square-foot, multi-tenant office building. Building B (10205 Federal) is a fully leased, 97,094-square-foot, industrial manufacturing and distribution facility occupied by a single tenant. Aaron Johnson and Jon Hendrickson of Cushman & Wakefield represented the seller in the transaction.

KeyBank Provides $42M Construction Financing for Affordable Housing Property in La Mesa, California

by Amy Works

LA MESA, CALIF. — KeyBank Community Development Lending and Investment (CDLI) has provided a $31.9 million construction loan and a $10.9 million bridge loan to USA Properties Fund for the construction of an affordable housing community in La Mesa. Jeremiah Drake and Keven Ruf of KeyBank structured the financing. The property, 8181 Allison Apartments, will feature 147 one- and two-bedroom residences that meet income restriction requirements of 30 percent, 50 percent and 70 percent or less of the area median income. Onsite amenities will include social services to assist in income, employment and stabilization. The property will also include a two-bedroom, non-revenue manager unit. Additional funding included a $25.3 million federal low-income housing tax credit provided by WNC and $7 million in subsidy financing and $20.7 million in permanent financing from the California Housing Financing Agency Mixed Income Program. The City of San Diego provided a cost-free lease of the land for 65 years, valued at $6.6 million.

GILBERT, ARIZ. — Sethi Management has completed the disposition of Hyatt Place Gilbert, a six-story hotel located at 3275 S. Market St. in Gilbert. HWC Hospitality acquired the asset for $19.5 million. Bill Murney and Jesse Heydorff of Cushman & Wakefield represented the seller in the deal. The hotel features 127 guest rooms, 1,100 square feet of event space, a 24-hour business center, express check-in/check-out and free onsite self-parking.

Beta Agency Arranges $14M Sale of Smart & Final-Anchored Retail Center in Lawndale, California

by Amy Works

LAWNDALE, CALIF. — Beta Agency has arranged the sale of Lawndale Plaza, a shopping center in Lawndale. A San Pedro-based private shopping center owner sold the asset to a Los Angeles-based entity for $14 million. Lawndale Plaza features a Smart & Final store and a multi-tenant retail building, occupied by Subway, Wingstop, Panda Express, Daily Nails & Spa and Wells Fargo. At the time of sale, the property was 100 percent occupied. Richard Rizika and Vanessa Zhang of Beta Agency represented the seller, while Adam Friedlander of Beta Agency and Moon Lim of JLL represented the buyer in the deal.

CLINTON, UTAH — Senior Living Investment Brokerage (SLIB) has negotiated the sale of Barrington Place, a 66-bed memory care community in Clinton, 30 miles north of Salt Lake City. The facility was built in 2016, totaling approximately 32,862 square feet on 2.9 acres of land. A national owner-operator seeking to sell non-core assets sold the property to a family office based in the West for an undisclosed price. The new owner plans to install Ridgeline Management Co. as the operator. Jason Punzel, Vince Viverito and Brad Goodsell of SLIB handled the transaction. “Barrington Place is a well-constructed, newer, standalone memory care community that fits in well with the new owner’s long-term strategy to expand its seniors housing portfolio,” says Punzel.

By Colin Grayson, Lument If you consider multifamily real estate assets to be a good investment, you are in good company. At mid-year, asset managers and private equity firms alone held an estimated $325 billion of levered dry powder set aside for this purpose, enough cash to finance nearly every acquisition closed in the United States in 2021, the highest investment sales volume on record. Despite nearly unanimous support for the asset class, however, multifamily transaction volume in the third quarter slumped year-over-year for the first time since the peak of the pandemic. The mainspring was a sharp rise in mortgage financing costs triggered by high inflation and the Federal Reserve’s commitment to raising rates to bring it under control. Generic rates for 65 percent loan-to-value (LTV) first mortgage debt stood on 5.71 percent at the end of November, representing an increase of 248 basis points since the beginning of the year. Even as financing costs soared, asset pricing changed very little. Initial net cash flow yields of transactions closed in the third quarter of 2022 averaged only 4.6 percent, according to Real Capital Analytics, an increase of 10 basis points from second-quarter 2022 levels. At the same time, cap …