WEST VALLEY, CALIF. — Red Mountain Group has completed the disposition of a four-tenant retail property located in West Valley. An undisclosed buyer acquired the asset for $2.1 million. At the time of sale, the 6,764-square-foot property was fully leased to Tellica Imaging, Allstate Insurance, Metro by T Mobile and a nail salon. Dave Lucas of CP Partners Commercial Real Estate represented the seller in the deal.

Western

For a little more than a year now, Americans have gone on a collective road trip, making up for time stolen during the lockdowns. In turn, that has fueled a rebound in the hotel industry, which was decimated in 2020 and much of 2021. Revenue per available room (RevPAR), a key measure of hotel profitability, is expected to end 2022 at an average of $93, up nearly 8 percent versus 2019, according to a hotel forecast update in late November by STR, a hospitality research organization based in Hendersonville, Kentucky. Meanwhile, the projected average occupancy of 62.7 percent will mark an increase of 5.1 percentage points over 2021, and the estimated average daily rate (ADR) of $148 will best last year’s number by $23, STR reports. Select service lodging properties in particular are helping to lead the recovery, says Steven J. Martens, chairman of NAI Martens, a Wichita-based commercial real estate brokerage that is one of five brands under the Martens Companies umbrella. “The majority of the midscale and upper midscale assets are very dependent upon leisure travel, and they are seeing a rebound throughout the country,” he adds. “Most good operators with strong hotel brands have seen very healthy …

Low Tide Properties, Continental Properties Receive $110M Refinancing for Met Tower Apartments in Downtown Seattle

by Amy Works

SEATTLE — Affiliates of Low Tide Properties and Continental Properties have obtained $110 million in financing for Met Tower, a multifamily property located at 1942 Westlake Ave. in Seattle. Citibank provided the loan, which Dave Karson, Alex Hernandez, Chris Moyer, Alex Lapidus and Meredith Donovan of Cushman & Wakefield Equity, Debt & Structured team arranged. Built in 2001, Met Tower features 366 apartments in a mix of studio, one- and two-bedroom floor plans along with 10,139 square feet of retail space and an attached, eight-level parking garage.

LAS VEGAS — Northmarq has arranged the sale of Sutton Place, a garden-style community located at 5400 W. Cheyenne Ave. in Las Vegas. West Lake Village, Calif.-based Sunstone Properties Trust acquired the asset from Salt Lake City-based Bridge Investment Group for $37 million, or $162,281 per unit. Built in 1986, Sutton Place features 228 apartments in a mix of one- and two-bedroom units ranging from 650 square feet to 927 square feet, a remodeled leasing office, fitness center, playground, soccer field, barbecue and picnic areas, and a laundry facility. At the time of sale, the property was 93 percent leased. The seller invested $2.8 million in capital improvements including deferred maintenance, exterior upgrades, paint and wood repair, asphalt, lighting, HVAC, landscaping, pool/deck furniture and new balcony railings throughout the property. Thomas Olivetti, Trevor Koskovich, Jesse Hudson and Ryan Boyle of Northmarq’s Las Vegas and Phoenix Investment Sales team handled the transaction.

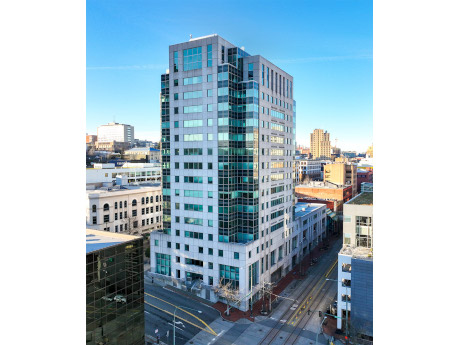

TACOMA, WASH. — Kirkland-based MJR Development has released plans to renovate the office building at 1145 Broadway in downtown Tacoma. Renamed as Tacoma Centre, the 15-story, 200,000-square-foot office building will include a café, bar, lounge areas, conference rooms and a fitness center with locker rooms. With the renovations, the tower will offer office space optimized for a culture of work/life balance and creative collaboration. Once complete, Tacoma Centre will offer a high-end lounge to accommodate casual team meetings, happy hours and corporate events and soirees. The remodeling will focus on common areas, and the building will remain open to tenants during construction. Interior designs will use natural materials, tall windows and expansive views. The renovation is slated for completion in summer 2023. MJR acquired the property, previously known as Tacoma Financial Center, in January 2022. Will Frame, Drew Frame and Ben Norbe of Kidder Mathews represented MJR in the sale and are now managing the leasing.

Sonnenblick-Eichner Negotiates Sale of Hotel Development Site in Dana Point, California

by Amy Works

DANA POINT, CALIF. — Sonnenblick-Eichner Co. has arranged the sale of the fee simple interest in the Cannon’s Hotel development site in Dana Point. The former home of Cannon’s Restaurant, the site is fully entitled and has received California Coastal Commission approval for a 100-room hotel. A private investor acquired the asset for an undisclosed price. Located on a bluff-top overlooking the Dana Point Harbor and Marina, the site is one block south of Pacific Coast Highway and approximately 2.5 miles west of Interstate 5. The Dana Point Harbor and Marina features more than 2,400 boat slips, several restaurants and various marine-oriented activities. The harbor and marina are undergoing a $338 million revitalization, including the addition of approximately 110,000 square feet of destination retail, restaurant, hotel and office space. Todd Bedingfield and David Sonnenblick handled the transaction.

SAN FRANCISCO — Newmark has brokered the sale of 3175 17th Street, a flex building in San Francisco’s Mission District. ODC, a nonprofit dance company, acquired the asset from Seven Tepees, a nonprofit youth development program, for $6.7 million. Mark Geisreiter, Seth McKinnon and Aaron Gillespie of Newmark represented the seller in the deal. The building offers 14,000 square feet of flex space.

Gantry Secures $14.3M Construction Loan for Office-to-Multifamily Conversion in Monterey, California

by Amy Works

MONTEREY, CALIF. — Gantry has secured $14.3 million of construction financing for the adaptive reuse of an office property into workforce multifamily housing. The borrower is an undisclosed local developer. Located at 2300 Garden Road, the property will feature 64 one- and two-bedroom market-rate apartments on a 7.23-acre site. Robert Slatt, Jeff Wilcox and Andrew Ferguson arranged the financing for the borrower. Gantry’s secured the three-year construction loan through one of its correspondent life company lenders.

Dwight Capital Provides $21.4M HUD Loan for Paxton 365 Apartment Complex in Salt Lake City

by Amy Works

SALT LAKE CITY — Dwight Capital has provided a $21.4 million HUD 223(f) loan for Paxton 365, a mixed-use multifamily property in Salt Lake City. The refinancing benefitted from a Green Mortgage Insurance Premium Reduction, as Paxton 365 is Energy Star certified. The asset features a five-story building with 121 residential units and three commercial spaces, including Paxton Pub. Community amenities include a dog park, courtyard with fire pit, fitness center, roof terrace, community lounge, grill areas and electric vehicle charging stations.

Stepp Commercial Negotiates $9.3M Sale of Multifamily Building in Signal Hill, California

by Amy Works

SIGNAL HILL, CALIF. — Stepp Commercial has arranged the sale of a residential property located at 1867 Temple Ave. in Signal Hill, near Long Beach. Los Angeles-based VMG Properties sold the asset to a Long Beach-based family office for $9.3 million, or $338,543 per unit. Built in 1964, the two-story hilltop property overlooks Long Beach and sits on a 13,849-square-foot lot. The community offers 13 one-bedroom units and 11 two-bedroom units, as well as 24 subterranean parking spaces. Community amenities include a pool, elevator and close proximity to Hillbrook Park. Robert Stepp and Michael Toveg of Stepp Commercial represented the seller, while Robert Stepp also represented the buyer in the deal.