DENVER — Broe Real Estate Group has unveiled plans for the second phase of its $200 million Cherry Creek North redevelopment project in Denver. 250 Clayton, an eight-story, 175,000-square-foot mixed-use building, will complement 200 Clayton, the company’s eight-story, 76,000-square-foot first phase. Fully preleased, 200 Clayton is on track for delivery in spring 2023. The Beck Group designed 250 Clayton, which will feature retail space and institutional-quality commercial office space with floor plates as large as 27,000 square feet. Construction of the second phase is scheduled to begin in fourth-quarter 2023.

Western

Birtcher Development Receives Approval for 2.25 MSF Birtcher Oak Valley Commerce Center in Calimesa, California

by Amy Works

CALIMESA, CALIF. — Birtcher Development has received full entitlement for Birtcher Oak Valley Commerce Center in Calimesa. Construction is currently underway, with completion slated for third-quarter 2024. Totaling 2.25 million square feet, Birtcher Oak Valley Commerce Center will feature four Class A logistics facilities: Building A, a 705,783-square-foot cross-dock facility with 5,600 square feet of office space and 118 dock-high doors. Completion is scheduled for second-quarter 2024. Building B, a 46,172-square-foot side-loaded property with 5,168 square feet of office space and 69 dock-high doors. Completion is slated for second-quarter 2024. Building C, a 457,257-square-foot cross-dock facility with 5,114 square feet of office space and 78 dock-high doors. Completion is expected in early third-quarter 2024. Building D, a 619,358-square-foot cross-dock building with 5,162 square feet of office space and 109 dock-high doors. Completion is scheduled for third-quarter 2024. All four facilities will feature 40-foot clear heights, flat floors, 10-inch slabs, a minimum of 185-foot truck courts and an ESFR sprinkler system. A nine-acre trailer lot will be constructed adjacent to Buildings A and B, providing 250 trailer stalls. Mike McCrary, Peter McWilliams, Patrick Wood and Scott Coyle of JLL are handling leasing for the project.

Origin Investments, Jackson Dearborn Plan $117.9M Apartment Community in Colorado Springs

by Amy Works

COLORADO SPRINGS, COLO. — Origin Investments and Jackson Dearborn Partners have formed a joint venture to develop Solace at The Ranch, a $117.9 million multifamily community at 7718 E. Woodmen Road in Colorado Springs. Construction is underway for the project, which will feature a three-story, 374-unit, garden-style apartment community and 12 carriage house-style units. The first units are slated for delivery by year-end 2024, with the balance of the units being delivered in phases over a period of several months. The community will consist of 21 residential buildings and a clubhouse. The unit mix will be 52 three-bedroom, 210 two-bedroom and 112 one-bedroom layouts, and the carriage houses will be a mix of two- and three-bedroom floor plans. Additionally, the community will offer 628 parking spaces, including 189 attached and detached garages. The carriage house units will sit atop attached garages. Sub4 Development is serving as general contractor for the project.

Avanti Residential, FCP Acquire 382-Unit Omnia on Thomas Multifamily Property in Phoenix

by Amy Works

PHOENIX — Avanti Residential, in partnership with FCP, has purchased Omnia on Thomas, a multifamily community in Phoenix, for $65 million. The name of the seller was not released. Located at 1645 E. Thomas Road, Omnia on Thomas features 382 apartments in a mix of studio, one- and two-bedroom layouts, four swimming pools, a fitness center and five electric vehicle charging stations. The partnership plans to spend approximately $12,000 per unit on capital improvements.

LONG BEACH, CALIF. — Kidder Mathews has arranged the sale of Union 5 Apartments in Long Beach. The asset traded for $13.7 million. The names of the seller and buyer were not released. Darin Beebower and Mark Ventre of Kidder Mathews handled the transaction. Located at 1821-27 E. 5th St., the 25,056-square-foot property features 34 apartments. Built in 1960, Union 5 was renovated in 2018.

Developer Evolution Projects Receives $109M Construction Financing for 35 Stone Office Building in Seattle

by Amy Works

SEATTLE — Seattle-based Evolution Projects has received $109 million in construction financing for the development of 35 Stone, a pre-leased office building in Seattle’s Fremont neighborhood. Canyon Partners Real Estate provided a mezzanine loan to finance the development, concurrent with the closing of a senior construction loan from The Union Labor Life Insurance Co. Slated for delivery in third-quarter 2024, the five-story building will offer 112,700 square feet of office space and 7,500 square feet of retail space. Onsite amenities will include a roof deck, bike parking, locker and shower suites, a central lobby with retail space and 135 parking stalls. Designed to meet Living Building Pilot Program standards, the property will reduce energy usage by at least 25 percent compared to other office buildings and is anticipated to be one of the most energy efficient and sustainable office buildings in Seattle. Brooks Running will occupy the office space in 35 Stone, which is situated within the master-planned Campus Seattle development. Brian Kelly and Eric Lonergan of Savills represented Brooks Running in the lease transaction. Kaden Eichmeier and Bruce Ganong of JLL represented the borrower in the financing.

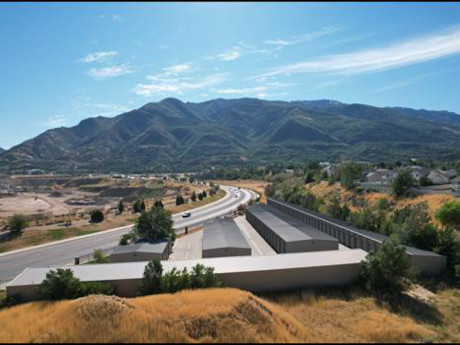

SALT LAKE CITY — Pacific Industrial has completed the construction of Pacific Summit Logistics Center, an industrial facility at 885 N. John Cannon Drive in Salt Lake City. The development and investment firm has already sold the asset on a forward basis to Principal Global Investors, a global real estate investments platform based in Des Moines, Iowa, for an undisclosed price. Situated on 48 acres, the 824,320-square-foot facility features 40-foot clear heights, nearly 200 trailer parking stalls, a private perimeter vehicle access road and a modern entry. At the time of sale, the building was 50 percent preleased to Quality Distribution, a third-party logistics provider headquartered in Utah. Jeff Chiate, Rick Ellison, Mike Adey, Brad Brandenburg and Matthew Leupold of Cushman & Wakefield’s National Industrial Advisory Group together with Tom Freeman and Travis Healey of Cushman & Wakefield’s Salt Lake City office represented the seller. Freeman and Healey were retained by Principal Global Investors to handle leasing of the project. According to Cushman & Wakefield, the transaction is one of the largest ever single-building industrial property sales in Salt Lake City.

J.P. Morgan Divests of 340,960 SF Industrial Portfolio Near Denver International Airport

by Amy Works

DENVER — Institutional investors advised by J.P. Morgan Global Alternatives have sold Airport Central Portfolio, a two-building industrial property near Denver International Airport in Denver. Boston-based TA Realty acquired the asset for an undisclosed price. Jeremy Ballenger, Tyler Carner, Jim Bolt and Jessica Ostermick of CBRE National Partners in Denver represented the seller in the deal. Situated on 15 acres at 11777 E. 55th Ave. and 11475 E. 53rd Ave., the 340,960-square-foot asset includes two multi-tenant distribution buildings. The buildings are 93 percent leased to seven diversified tenants. Current unit sizes range from 19,000 square feet to 86,200 square feet with the ability to divide and combine units in the future as tenant demand dictates. The buildings feature clear heights ranging from 24 feet to 26 feet with dock-high and drive-in loading, ESFR/wet sprinklers and rail service by Union Pacific.

Serfer Land Ventures Sells 48-Acre SiteOne Landscape Supply Industrial Campus in Windsor, Colorado

by Amy Works

WINDSOR, COLO. — Serfer Land Ventures has completed the disposition of a 48-acre industrial campus located at 6166 Weld County Road 74/Harmony Road in Windsor. IA Windsor LLC bought the asset for $9.8 million. SiteOne Landscape Supply fully occupies the site. In 2019, SiteOne constructed a 12,821-square-foot showroom and 14,922-square-foot warehouse on the site. Jared Goodman, Aki Palmer, Cole VanMeveren, Tyler Murray and Nate Heckel of Cushman & Wakefield represented the buyer and seller in the deal.

OGDEN, UTAH — Marcus & Millichap has brokered the sale of South Weber Storage, a self-storage facility in Ogden. Terms of the transaction were not released. Jordan Farrer and Adam Schlosser of Marcus & Millichap’s LeClaire-Schlosser Group represented the seller, a local partnership, and procured the undisclosed buyer. Totaling 26,060 square feet, South Weber Storage consists of five single-story buildings offering a total of 136 non-climate-controlled drive-up units. The facility features brick front dividers with all metal interior walls, slightly pitched standing seam metal roofs, roll-up doors and asphalt driveways.