CHANDLER, ARIZ. — San Diego-based MG Properties has purchased 2150 Arizona Ave South Apartments I, a multifamily property in Chandler, for $107 million. Rebranded as 2150 Apartments, the community features one-, two- and three-bedroom floor plans. The number of units was not disclosed. Mark Forrester and Dan Cheyne with Berkadia represented the undisclosed seller in the deal. Chuck Christensen and Lowell Takahashi of Berkadia originated acquisition financing through Fannie Mae for the buyer.

Western

VanTrust Real Estate Completes 246,400 SF Industrial Building at Tropical Distribution Center in North Las Vegas

by Amy Works

NORTH LAS VEGAS, NEV. — VanTrust Real Estate has completed construction of a fourth building at the 120-acre, 1.6 million-square-foot Tropical Distribution Center in North Las Vegas. Designed by HPA Architecture, Tropical IV totals 246,400 square feet of Class A industrial space with convenient access to interstates 15 and 215 via Tropical Parkway. The building features 36-foot clear heights with 43 dock-high doors and two grade-level doors, as well as a large truck court, 51 trailer parking spaces and 203 automobile parking spaces. Martin-Harris Construction served as general contractor for the project.

Gantry Arranges $18M Construction Loan for Spec Industrial Development in Pacific, Washington

by Amy Works

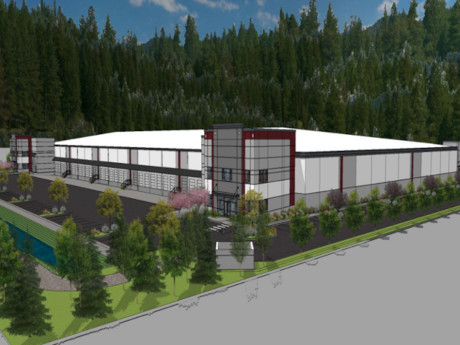

PACIFIC, WASH. — Gantry has secured a $18 million construction-to-permanent loan for the speculative development of an industrial property in Pacific. Situated on 12 acres, the property will feature 160,000 square feet of industrial space. Construction began in second-quarter 2022 and completion is slated for early 2023. Mike Wood and Alex Saunders of Gantry arranged the financing for the borrower, Davis Property Investment. A regional bank provided the seven-year loan with a fixed, sub-4.4 percent interest rate. The financing features an initial two-year interest-only payment period before moving to a 30-year amortization for the remaining term. The initial funding is for $15 million to complete construction, with an additional $3 million earn-out upon lease up and stabilization of the project.

Gateway Co. Sells 13,000 SF Retail Building at Towngate Promenade in Moreno Valley, California

by Amy Works

MORENO VALLEY, CALIF. — Gateway Co. has completed the disposition of a retail building at the Towngate Promenade in Moreno Valley. A private party acquired the asset for $2.8 million. The buyer will use the 13,000-square-foot building to accommodate a Kids Empire franchised location. Kids Empire encourages healthy, happy active play for children of all ages and features age-appropriate play structures, climbing walls, slides and rides. Headquartered in Southern California, Kids Empire currently has more than 30 locations in 10 states across the country. Located at 12650 Day St., the Kids Empire indoor playground location is slated to open in 2023. Pablo Velasco and Albert Lopez of Progressive Real Estate Partners represented the seller in the deal.

GARDENA, CALIF. — SBH Real Estate has completed the sale of a triple-net leased retail asset located at 15015 Crenshaw Blvd. in Gardena. KOAM Property Investment purchased the property for $3.5 million. Super Star Car Wash signed a 25-year triple-net ground lease for the property. The location opened for business in early 2022 and the tenant has invested more than $3 million into the location. Jeremy McChesney of Hanley Investment Properties represented the seller, Eric Silverman of SBH Real Estate, while Frank Choi of Win Realty & Properties represented the buyer in the transaction.

FULLERTON, CALIF. — Core Spaces has announced plans for Hub Fullerton, a 1,047-bed student housing development in Fullerton. Groundbreaking is scheduled for later this year. DLR Group designed the project, which will serve students attending California State University-Fullerton, Hope International University and Pacific Christian College. The six-story building will offer shared amenities including a rooftop deck, swimming pool, hot tub, workspaces, a yoga and fitness center, spa and resident lounge space. The development will also feature a ground floor coffee shop and a landscaped public park space with seating. The community is scheduled for delivery in 2025 and will offer units in townhome and apartment configurations.

PRESCOTT VALLEY, ARIZ. — Bellwether Enterprise Real Estate Capital (BWE) has provided a $75 million HUD loan for the construction of Legado Apartments, a multifamily property in downtown Prescott Valley. Jim Swanson of BWE’s Phoenix office originated the loan through HUD’s 221(d)(4) mortgage insurance program on behalf of the developer, Fain Signature Group. The non-recourse, fully assumable loan features a 40-year, fully amortizing term. The HUD-insured financing provides a combined construction and permanent loan for market-rate multifamily projects. The mid-rise apartment property will feature 329 units in a mix of one-, two- and three-bedroom layouts. Units will offer Energy Star appliances, washers/dryers, patio/balcony storage and scenic views. Community-wide amenities include electric vehicle charging stations, elevators serving all apartment floors and a parking garage. Common area amenities will include a community room/clubhouse with free Wi-Fi, poolside cabanas and spa, fitness center, a picnic area with barbecue grills, and recreation area with a dog run and dog washing station. As part of the mixed-use residential and commercial development project in the Prescott Valley Entertainment District, the property will have a rooftop restaurant open to the public and a variety of other foodservice outlets, including cafés, plus retail space on first and sixth …

Stan Johnson Negotiates Acquisition of 56,000 SF Retail Property Leased to Target in Huntington Park, California

by Amy Works

HUNTINGTON PARK, CALIF. — Stan Johnson Co. has brokered the purchase of a freestanding retail property located at 5731 Bickett St. in Huntington Park, just southeast of downtown Los Angeles. A New York-based private investor acquired the asset for $48.7 million. Principal Life provided acquisition financing. Developer Shane Cos. is slated to complete the 56,000-square-foot building in January 2023. Target has leased the property under a long-term, triple-net lease. Situated on 4.1 acres, the site will feature a Starbucks Coffee, Tesla charging station and an urban-format Target. Jason Maier of Stan Johnson Co. represented the buyer, while Alvin Mansour of The Mansour Group at Marcus & Millichap represented the undisclosed seller in the transaction.

SBH Real Estate Sells Pollo Campero-Occupied Restaurant Property in Covina, California for $4.6M

by Amy Works

COVINA, CALIF. — SBH Real Estate Group has completed the disposition of a restaurant property located at 1477 N. Azusa Ave. in Covina. HB Property Management acquired the asset for $4.6 million. Pollo Campero, a fast-casual restaurant, signed a 15-year, triple-net ground lease for the property. Construction is almost complete on the restaurant, which is slated to open at the end of September. Matt Schwartz of Newmark represented Eric Silverman of SBH Real Estate Group, while Moon Lim of JLL represented the buyer in the deal.

FORT COLLINS, COLO. — NorthPeak Commercial Advisors has arranged the sale of an office building located at 3555 Stanford Road in Fort Collins. The property traded for $3.3 million, or $171 per square foot. Kevin Calame and Matt Lewallen of NorthPeak Commercial Advisors represented the undisclosed seller in the deal. The name of the buyer was not released. The 19,323-square-foot building features 13 office suites.