ALBUQUERQUE, N.M. — Northmarq has brokered the sale of Villas Esperanza, an affordable apartment property located at 3901 Lafayette Drive in Albuquerque. Aspen, Colo.-based Copper Street Capital sold the asset to Los Angeles-based Element Property Group for an undisclosed price. Cynthia Meister, Trevor Koskovich, Bill Hahn and Jesse Hudson of Northmarq’s investment sales team represented the seller in the transaction. Griffin Martin, Brandon Harrington, Bryan Mumman and Tyler Woodard of the Northmarq debt & equity team arranged financing for the buyer through its relationship with Freddie Mac. Built in 1972 on 10.5 acres, Villas Esperanza features 188 apartments in a mix of one-, two-, three- and four-bedroom layouts spread across 24 two-story residential buildings. The units offer either one or two bathrooms and range in size from 602 square feet to 1,128 square feet. The gated community features onsite laundry facilities, a children’s playground, barbecue grills and a picnic area. All units at the property are designated for residents earning 60 percent or less of the area median income with the project’s Land Use Restrictive Agreement (LURA) expiring in 2037. Additionally, 40 percent of the units, a total of 75, are project-based Section 8 housing with additional rent restrictions as …

Western

NewMark Merrill Cos. Breaks Ground on 96,011 SF Rialto Village Shopping Center in California

by Amy Works

RIALTO, CALIF. — NewMark Merrill Cos. has broken ground on Rialto Village, a 96,000-square-foot shopping center in Rialto. Brian McDonald, Walter Pagel and Hannah Curran of CBRE, along with Greg Giacopuzzi of NewMark Merrill, are marketing the center for lease. Currently, 18 tenants are slated to join the project, which is located at the southwest corner of San Bernardino and Riverside avenues. Signed tenants include Sprouts Farmers Market, Burlington, Ulta, Five Below, Mattress Firm, Arrowhead Credit Union, Quick Quack Car Wash, In-N-Out Burger, Cold Stone Creamery, The Joint, Nekter Juice Bar, Coffee Bean & Tea Leaf and West Coast Dental, along with multiple local tenants. NewMark Merrill Cos. closed escrow on the 10.9-acre site in early August with lease commitments representing 97 percent of the total shopping center square footage. One 2,700-square-foot retail suite remains available for lease.

JLL Arranges $12.7M Sale of Student Housing Development Site Near San Diego State University

by Amy Works

SAN DIEGO — JLL Capital Markets has arranged the $12.7 million sale of a 0.35-acre development site located adjacent to the San Diego State University campus in California. Situated at 5505 Lindo Paseo, the site is currently home to a fraternity house and is suitable for a dense, vertical development, according to JLL. Stewart Hayes, Scott Clifton, Teddy Leatherman, Kevin Kazlow and Jack Goldberger of JLL represented the sellers, Amplify Development Co. and Blue Vista Capital Management, in the disposition. An affiliate of Champion Real Estate Company acquired the property.

TEMPE, ARIZ. — CBRE has negotiated the sale of a freestanding warehouse property situated on 3.3 acres at 3001 S. Wilson St. in Tempe. Bio Huma Netics purchased the asset from Tempe-based Phoenix Plastics Products for $10.5 million. Built in 2004, the 40,182-square-foot building features 3,000 amps, 277/480-volt electrical service, 24-foot to 40-foot clear heights and Union Pacific rail service. Mike Parker of CBRE represented the buyer and seller in the deal.

GXO Logistics Leases 468,272 SF Manufacturing Building Near Seattle from BOSA Development

by Amy Works

EVERETT, WASH. — GXO Logistics has fully leased a 468,272-square-foot manufacturing/distribution facility at Bomarc Business Park in Everett from BOSA Development. With this lease, GXO is expanding its footprint by 35 percent at the building, located at 9205 Airport Road, in addition to extending its lease. Tom Wilson, Taylor Hudson and Ben Conwell of Cushman & Wakefield represented the landlord in the transaction. Situated on more than 30 acres, the building features 24-foot to 27-foot clear heights, dock and grade loading, office and restroom space to support dense occupancy, 673 parking stalls, and ESFR sprinklers.

By Mike Adams, Managing Director, Stream Realty Partners The state of office is transitioning to a desire for dynamic spaces. Tenants in the Orange County office market are gravitating toward assets that act and function like hotels. They are seeking out the newest buildings and the most unique office environments. This is evidenced through leasing activity being the strongest in the Irvine/Tustin Legacy and Irvine Spectrum submarkets. Employers are looking for a reason to bring their workforce back to the office and are recruiting high-caliber employees. One way to do this is through office space. Creative office space is still in high demand — and won’t likely change soon. Companies focused on employee retention want to create an “Instagram-worthy” type office environment. They are looking for office space that will create a buzz and function as a recruiting tool. Office buildings are unique assets that facilitate collaboration, culture and training. This interest in new development signifies a flight to quality of office assets — for landlords and tenants alike. Several trends related to the desire for quality include: Hotelization — office spaces that act and function as hotels Biophilic design — the concept of connecting a building with nature Proptech — using innovative technology and …

Sudberry Properties Starts Construction of 268-Unit Luma at El Corazon Apartments in Oceanside, California

by Amy Works

OCEANSIDE, CALIF. — Sudberry Properties has started construction of Luma at El Corazon, a mixed-use apartment community in Oceanside. Located at 3546 Village Commercial Drive, Luma is situated within El Corazon, a 465-acre multi-phase development on a former crystal silica mine. Luma at El Corazon will feature 23 three-story residential buildings with a mix of 113 one-bedroom, 120 two-bedroom and 35 three-bedroom apartments. Ranging in size from 691 square feet to 1,440 square feet, the units come in 11 floor plan configurations, all featuring an outdoor deck, balcony or patio, stainless steel appliances, quartz countertops, wood-style flooring and in-unit washers/dryers. Community amenities will include a furnished club room with demonstration kitchen and covered patio; conference room; indoor/outdoor fitness center; and a pool and spa area with lounges and barbecue facilities. Luma will also feature two 2,350-square-foot retail suites on either side of the main entrance. The community will be built in phases, with the leasing center and first apartments slated to open in fall 2023. The development team includes Bassenian Lagonia, architect; Hunsaker & Associates, civil engineer; Wermers Construction, general contractor; Schmidt Design Group, landscape architect; and Design Tec, interior design.

Institutional Property Advisors Arranges Sale of 277-Unit Active Adult Community Near Salt Lake City

by Amy Works

DRAPER, UTAH — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of The Ivy at Draper, a 277-unit active adult community. Located in the Salt Lake City suburb of Draper, the community features freeway access, with connectivity to interstates 15, 215 and 80 and immediate access to Bangerter Highway, a main thoroughfare throughout the Wasatch Front. The buyer, seller and price were not disclosed. “Draper’s prestigious location at the Point of the Mountain, in the south end of Salt Lake Valley and north end of Utah Valley, allows for easy connectivity to all areas in Salt Lake and Utah counties,” says Danny Shin, IPA senior managing director of investments. Shin and Brock Zylstra, IPA senior vice president of investments, represented the seller. “Being a top leader in the state’s economy as part of the Silicon Slopes tech corridor, and with over 1,000 businesses in various industries operating in our city, multifamily assets are highly coveted and garner significant attention from interested buyers,” says Zylstra. “The Ivy at Draper was a prime example of this, especially given its purpose to provide a resource-driven lifestyle to residents. With strong neighboring demographics, including a five-mile radius population of …

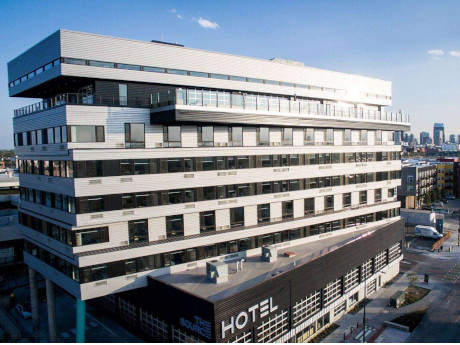

DENVER — Stockdale Capital Partners has acquired The Source, a hotel located in Denver’s River North Arts District, for $61.9 million. The transaction also included a 300-stall parking garage and 17,000-square-foot surface parking lot. The Source features 100 guest rooms, a full-service rooftop restaurant, 5,575 square feet of event space, a fitness center, rooftop pool and business center. Additionally, the hotel offers 44,000 square feet of onsite restaurant and retail space in its Market Hall I & II locations. Stockdale Capital plans to refresh guest rooms, re-imagine the rooftop restaurant, “activate the hotel lobby experience” and create additional revenue drivers for the hotel’s retail space. The name of the seller was not released.

SALT LAKE CITY — GO Industrial, in partnership with a Crow Holdings Capital-advised real estate fund, has completed the disposition of 5600 | Logistics Southwest, a Class A industrial campus located at 1464 and 1568 S. 5500 West in Salt Lake City. The two buildings offer a total of 505,692 square feet. CBRE | National Partners negotiated the deal for the sellers. Terms of the transaction were not released. Situated on 14.9 acres, the 265,120-square-foot Building A features 32-foot clear heights, 50 dock-high doors, four grade-level doors, 177 car parking spaces and 72 trailer parking spaces. The 240,654-square-foot Building B features 32-foot clear heights, 46 dock-high doors, four grade-level doors, 158 employee parking spaces and 62 trailer spaces on 13.2 acres. Layton Construction’s National Building Group recently completed the buildings, which AE Urbia designed. CBRE’s Chris Liddell, Tom Dishman and Matt McAfee are leasing agents for the project.