WHITTIER, CALIF. — Progressive Real Estate Partners has arranged the sale of La Pico Plaza, a neighborhood shopping center located at 9150 Painter Ave. in Whittier. An Orange County-based private investor sold the asset to Desert Capital Ventures for $5.8 million. Circle K anchors the 20,939-square-foot retail center, which was fully leased to 14 tenants at the time of sale. Greg Bedell of Progressive Real Estate Partners represented the seller, while Drew Wetherholt of Marcus & Millichap represented the buyer in the deal.

Western

ARCADIA, CALIF. — Unibail-Rodamco-Westfield (URW) has sold Westfield Santa Anita, a 1.5 million-square-foot regional mall located roughly 15 miles northeast of Los Angeles in Arcadia, for $537.5 million. The transaction represents the largest price paid for a regional mall in the U.S. since 2018, according to Eastdil Secured, which acted as financial advisor to the seller. The buyer is an undisclosed real estate investor that owns other retail assets in Southern California. The acquisition was funded through a combination of equity and new debt, and reflects a sub-6 percent net initial yield and a 10.7 percent discount to the property’s latest appraisal price. The Class A regional mall was 96 percent leased at the time of sale to tenants including J.C. Penney, Macy’s, Nordstrom, Sephora, Free People, Kate Spade, Fabletics, Coach, lululemon, Michael Kors, Steve Madden, Victoria’s Secret, Zara and Abercrombie & Fitch, among others. The property is also home to AMC Theatres; entertainment concepts such as Bowlero, Luxy Karaoke and Dave & Buster’s; and restaurants including The Cheesecake Factory, Benihana, California Pizza Kitchen and Din Tai Fung. URW made headlines earlier this week with the announcement of redevelopment plans for Westfield Garden State Plaza, a 2.1 million-square-foot regional mall …

Clarius Partners, Walton Street Capital Sell Big-Box Distribution Building in Goodyear, Arizona for $109.2M

by Amy Works

GOODYEAR, ARIZ. — A joint venture between Clarius Partners and Walton Street Capital has completed the sale of Lakin Park Building 1A, a big-box distribution building on 45 acres in Goodyear. BentallGreenOak acquired the asset for $109.2 million. Located at 17315 W. MC 85, the 730,760-square-foot facility features 40-foot clear heights, a full HVAC warehouse, 70-foot speed bays, 200-foot concrete truck courts, r-38 roof insulation, ESFR sprinklers, multiple points of ingress and egress, 120 dock-high doors, 171 trailer parking stalls and 6,000 amps (expandable to 12,000 amps) of power. Delivered in first-quarter 2022, a single tenant fully occupies the property. Will Strong, Greer Oliver and Connor Nebeker-Hay of Cushman & Wakefield’s national industrial advisory group represented the seller in the transaction. Mike Haenel and Andy Markham, also of Cushman & Wakefield, provided leasing advisory.

BREMERTON, WASH. — Security Properties has completed the disposition of Insignia Apartments, a multifamily property at 1060 Insignia Loop in Bremerton. An undisclosed buyer acquired the community for $48.5 million. Built 2017, Insignia Apartments features 162 one- and two-bedroom apartments spread across 12 buildings on 6.2 acres. Community amenities include a fitness center, rec room, playground and dog park. Eli Hanacek, Jon Hallgrimson, Mark Washington and Kyle Yamamoto of CBRE’s Pacific Northwest-based multifamily team represented the seller in the transaction.

Mesa West Capital Provides $139.9M Loan for Acquisition, Repositioning of Terracina Apartments Near Denver

by Amy Works

BROOMFIELD, COLO. — Mesa West Capital has provided Sares Regis Group with $139.9 million in first mortgage debt for its acquisition and repositioning of Terracina Apartments, located at 13620 Via Varra Road in Broomfield. Built in 2010, the 16.5-acre community features 386 apartments in a mix of one- and two-bedroom apartments spread across four four-story residential buildings. On-site amenities include a pool and hot tub, clubhouse, fitness center, coworking lounge, dog park, pet wash, fire pit and grilling area, and outdoor games area. At the time of sale, the property was 95.1 percent leased. Brian Torp of Jones Lang LaSalle arranged the financing. A portion of the loan proceeds will help fund the borrower’s capital improvement plan that will feature upgrades to unit interiors, as well as the renovation of the community’s common areas. The floating-rate loan features a five-year term.

MIDVALE, UTAH — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of North Union, a multifamily community in Midvale. Rockworth Cos. sold the asset to Keller Investments for an undisclosed price. Built in 2022, North Union features 223 apartments, common areas with full kitchens, dining rooms, workstations and a game room. Outdoor amenities include an outdoor rooftop deck with firepits, barbecue grilling stations and outdoor lounging seating; a fitness center with a yoga studio; a pool and hot tub area; and a bocce ball court. Additionally, the community features a pet spa and dog wash; secure parking and storage; a ski and bike repair center; and 7,455 square feet of main-floor retail space. Danny Shin and Brock Zylstra represented the seller in the transaction. Anita Paryani-Rice of IPA Capital Markets arranged the financing for the buyer. A debt fund provided the capital, which features a 73 percent loan-to-cost ratio. The nonrecourse loan has a term of three years with extensions that offer the borrower flexibility on exit.

PHOENIX — VIVO Development Partners has purchased Camelwest Plaza, a two-building office asset in Phoenix. Hawaii-based BW Camelwest LLC sold the property for $14 million. Located at 1951 and 2011 W. Camelback Road, the four-story, multi-tenant office buildings offer a total of 175,308 square feet of office space. At the time of sale, the property was 71 percent leased to a mix of tenants across various industries, including financial, technology, insurance, marketing, medical, legal services and government. Geoffrey Turbow, Gary Cornish, Barry Gabel and Chris Marchildon of CBRE represented the seller in the deal.

Arbor Realty TrustContent PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastSoutheastTexasWestern

Arbor: Multifamily Market Well-Positioned to Withstand Economic Headwinds

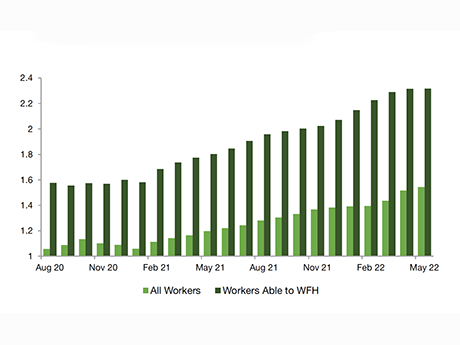

While rising interest rates, inflation and economic volatility have hurt many sectors of the economy, the rental housing market has maintained solid footing, according to Arbor Realty Trust’s Summer 2022 Special Report: Rental Housing Market Exhibits Cyclical Stability, Contains Structural Questions. The report was written by Ivan Kaufman, Arbor’s chairman and CEO, and Sam Chandan, founder of Chandan Economics. In a time of economic uncertainty, renting has become more appealing. Households seeking an affordable place to live, those who are delaying homeownership and others who prefer the flexibility and amenities associated with multifamily units all add to the increasing numbers of potential renters. Less traditional factors may also increase interest in renting, especially outside of tier-one markets. The expansion of work-from-home (WFH) culture is likely to be another reason rental demand is high right now. Meanwhile, the flexibility to work where the cost of living is lower and space is at less of a premium is pushing some renters who work remotely to explore living outside traditional hotspots. Economic Uncertainty Spreads as Interest Rate, Inflation Rise The Arbor Realty Trust report highlights a host of factors that are leading to economic uncertainty. Inflation (and its secondary effects) are contributing to …

Greenwater Investments Sells Villas Los Limones Apartment Property in Phoenix for $58.2M

by Amy Works

PHOENIX — Greenwater Investments has completed the disposition of Villas Los Limones, an apartment community in Phoenix. Rincon Partners acquired the asset for $58.2 million, or $260,000 per unit. Situated on nine acres, Villas Los Limones features 224 apartments spread across 18 buildings. The average apartment size is 678 square feet. Community amenities include a pool, clubhouse and laundry facilities. Cliff David, Steve Gebing, Hamid Panahi and Clint Wadlund of Institutional Property Advisors, a division of Marcus & Millichap, represented the seller and procured the buyer in the deal.

SCOTTSDALE, ARIZ. — Revel Communities has completed construction of Revel Scottsdale and Revel Legacy, both independent living communities in Scottsdale. Then properties are the 12th and 13th independent living communities the brand has opened since launching in 2018, and its first two in Arizona. Revel Scottsdale offers 157 units near the bustling shops and dining of Old Town Scottsdale, with rents starting at $3,695 per month. Revel Legacy offers 169 units among the mountain views of North Scottsdale with rents starting at $3,795 per month.