FONTANA, CALIF. — A collaboration between Real Estate Development Associates (REDA), Clarion Partners and ECM Management has broken ground on I-10 Almond Commerce Center, a warehouse facility in Fontana. Premier Design + Build Group is constructing the ground-up project. The 210,355-square-foot warehouse will feature 36-foot clear heights, eight-inch reinforced concrete slab and a four-ply built-up roof system, as well as an ESFR sprinkler system and 2,000 GMP fire pump. The facility will also offer an office area with mezzanine space and parking for 101 vehicles and 32 trailers. HPA is serving as architect for the project, which is slated for completion in May 2023. Thienes Engineering and Darin Fong and Associates are providing engineering services for the property.

Western

Content PartnerFeaturesLeasing ActivityLoansMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

How to Maintain Multifamily Investment Momentum in the Face of Rising Interest Rates

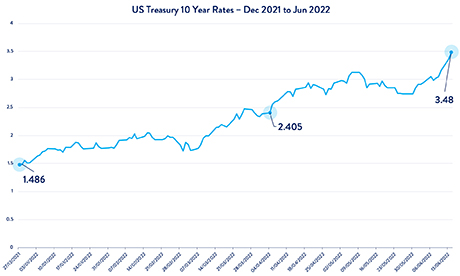

By Melissa Jahnke, associate director of operations, Walker & Dunlop The Federal Reserve raised interest rates by 75 basis points in June and then another 75 basis points in July, sending shockwaves across the commercial real estate industry. Fortunately, there are opportunities and solutions to bypass these potential roadblocks. Specifically, investors in a segment of multifamily housing known as small balance lending (SBL), encompassing five- to 150-unit properties, have several options to realize their aspirations for financing multifamily portfolios. View a higher resolution version of the timeline above here. During a recent webcast “Financing Amid Rising Rates: Best Approaches for $1M-$15M Multifamily Loans,” Walker & Dunlop’s market experts spoke about navigating today’s financing landscape. The expert panel included Allison Williams, senior vice president and chief production officer; Allison Herrera, senior director of SBL; and Tim Cotter, director of capital markets. These experienced professionals have found ways to make deals happen in a wide variety of financing environments and have shared their perspectives and guidance. If you are an owner of five- to 150-unit properties that require loans between $1 million to $15 million, the following will help you navigate today’s financial environment and build your momentum. Step 1: Consider the …

PLAYA DEL REY, CALIF. — PSRS has arranged a $22 million cash-out refinance of Laguna Del Rey Apartments, a multifamily property in Playa del Rey. Seth Ludwick secured the non-recourse loan that features a seven-year interest-only term, which includes a six-month forward rate lock and step-down prepay after year three. The loan was financed with one of PSRS’ life insurance correspondents. Laguna Del Rey Apartments features 130 units in a variety of floor plans, common area amenities and open parking spaces.

RIVERSIDE, CALIF. — CBRE has arranged the sale of Metro 3610, a value-add apartment community located at 3610 Banbury Drive in Riverside. La Palma, Calif.-based Silver Star Real Estate acquired the asset for an undisclosed price. Dean Zander and Stewart Weston of CBRE represented the undisclosed sellers in the deal. Built in 1984 on 15.2 acres, Metro 3610 features 304 apartments; two swimming pools with a spa and wading pool; tennis courts; a resident clubhouse; fitness center; and open green space with picnic areas, grilling stations and a playground. Apartments feature kitchens with a complete appliance package, air conditioning, walk-in closets and washers/dryers in two-bedroom floorplans.

Matthews Negotiates Sale of Vacant 80,000 SF Big Box Retail Space in Cathedral City, California

by Amy Works

CATHEDRAL CITY, CALIF. — Matthews Real Estate Investment Services has brokered the all-cash sale of a vacant big box retail building in Cathedral City. Andrew Gross and Lee Cordova represented the undisclosed seller in the deal. The name of the buyer and acquisition price were not released. Located at 35900 Date Palm Drive, the asset spans 80,000 square feet. The retail space sits on a 262,000-square-foot lot near an Amazon facility, gym and bank.

PHOENIX — Gantry has secured a $20 million permanent loan to refinance a flex industrial building in Central Phoenix. Tim Storey of Gantry arranged the financing on behalf of the borrower, a private investor. The 10-year, fixed-rate loan features interest-only payment terms. One of Gantry’s institutional debt fund lenders provided the loan. A single credit tenant occupies the 100,000-square-foot property, which is customized for use in human and pet pharmaceutical product manufacturing and distribution, on a long-term lease.

PHOENIX — ABI Multifamily has arranged the sale of Village 28, a multifamily property located at 4750 N. 28th St. in Phoenix. A Washington-based seller sold the asset to a Washington-based buyer for $9 million, or $361,000 per unit. Built in 1969 and renovated in 2018, Village 28 consists of 25 garden-style, two-bedroom/one-bath units with private patios and in-unit washers/dryers. John Klocek, Patrick Burch, Mitchell Drake, Carson Griesemer and Dallin Hammond of ABI Multifamily represented both parties in the transaction.

Berkadia Negotiates $93M Sale of The Vines at Riverpark Apartment Property in Oxnard, California

by Amy Works

OXNARD, CALIF. — Berkadia Institutional Solutions has arranged the sale of The Vines at Riverpark, a multifamily community in Oxnard. Champion Real Estate Co. sold the asset to Interstate Equities Corp. for $93 million, or more than $567,000 per unit, in an off-market transaction. Both the buyer and seller were based in California. Adrienne Barr of Berkadia Los Angeles and Mike Murphy of Berkadia Irvine represented the seller in the transaction. Located at 3040 N. Oxnard Blvd., The Vines at Riverpark features 164 apartments that were originally built as two-story condominiums in 2013 and 2014. The Vines offers 136 three-bedroom, two-and-one-half bath units and 28 two-bedroom, two-bath units. Units feature private, two-car direct-access parking garages, separate water heaters, central air and heat and a front porch or balcony. Additional unit features include GE Energy Star stainless steel appliances, granite countertops and backsplashes, brushed nickel hardware and plumbing fixtures, espresso-colored cabinets with stainless steel pulls throughout the kitchens and bathrooms and vinyl wood plank flooring throughout the first floor.

WEST COVINA, CALIF. — CBRE has arranged the sale of Atrium at West Covina, a 138-unit multifamily property located at 1829-1841 E. Workman Ave. in West Covina. Langdon Park Capital acquired the asset from an affiliate of Abacus Capital Group for $48.6 million. Dean Zander and Stewart Weston of CBRE represented the seller in the transaction. Built in 1962 and 1963, Atrium at West Covina features swimming pools, a fitness center and social areas. The community offers mostly two- and three-bedroom layouts that average more than 1,000 square feet. The buyer plans to improve the units while also preserving the property’s workforce housing designation.

CHULA VISTA, CALIF. — Crow Holdings has completed the disposition of a 60,973-square-foot portion of The Shops at Eastlake Terrace, a 363,300-square-foot retail center in Chula Vista. Gersham Properties acquired the asset for $47.8 million. Pete Bethea, Rob Ippolito and Glenn Ruby of Newmark represented the seller in the deal. The traded portion features well-located shops and freestanding buildings. Tenants at The Shops at Eastlake include Walgreens, Chase Bank, Chick-fil-A, Carl’s Jr., Starbucks Coffee, Navy Federal Credit Union, Supercuts and Rubios.