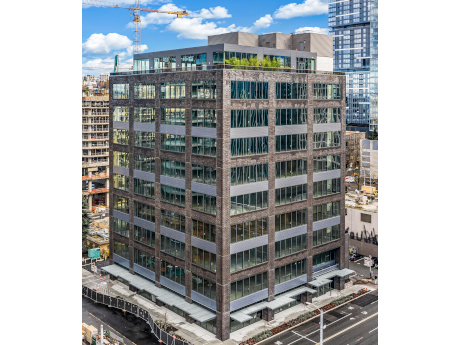

SEATTLE — Oxford Properties Group has completed the conversion of the 136,000-square-foot Boren Lofts office building into Boren Labs, a life sciences facility in downtown Seattle. Located at 1930 Boren Ave. in the South Lake Union neighborhood, the building features 15,000-square-foot floor plates, pre-built lab suites and move-in-ready research and development suites. The 10-story building features nine levels of labs and support office space, ground-level retail and a newly built amenity floor, which features a shared rooftop deck and conferencing center, fostering collaboration between occupants. The converted building features 15-foot floor-to-floor heights, fully upgraded MEP systems and ample subsurface parking. Each floor also features natural light and a private deck with outdoor access. Current tenants include Icosavax, Tune Therapeutics and GentiBio.

Western

Security Properties Acquires Summit Riverside Apartments in Littleton, Colorado for $78.5M

by Amy Works

LITTLETON, COLO. — Security Properties and Tokyu Land US Corp. have jointly purchased the Summit Riverside multifamily community in Littleton for $78.5 million. The seller was not disclosed. Summit Riverside is located on the South Platte River, comprising 21 residential buildings and 248 studio, one- and two-bedroom units with an average unit size of 777 square feet. Security Properties now owns five properties in Colorado. The residential complex is Tokyu’s first investment in the Denver metropolitan area. Security Properties Residential will manage the property.

LAS VEGAS — Greenlite Partners, an affiliate of WG Group, has completed the disposition of an office building located at 9075 W. Diablo Drive in Las Vegas. KB Acquisitions, part of Kingsbarn Realty Capital, acquired the property for $26 million, or $387 per square foot. Originally constructed in 2008, the three-story, multi-tenant property features 67,145 square feet of Class A office space. At the time of sale, the property was 97 percent leased. Marlene Fujita Winkel, Emily Brun and Alex Casingal of Cushman & Wakefield’s Private Capital Group in Las Vegas represented the seller in the deal.

DENVER — NorthPeak Commercial Advisors has arranged the sale of an apartment building located at 2920 W. 32nd Ave. in Denver. The property traded for $12.9 million, or $641 per square foot. The names of the seller and buyer were not released. The 27,932-square-foot residential building features 41 apartments. Kevin Calame and Matt Lewallen of NorthPeak Commercial Advisors represented the buyer and seller of the transaction.

SANTA MONICA, CALIF. — Matthews Real Estate Investment Services has arranged the sale of a self-storage facility located at 1620 14th St. and 1621 Euclid St. in Santa Monica. Invesco Real Estate acquired the asset. The seller and price were not released. The 56,490-square-foot facility features 1,070 units. The two-parcel facility sits on 1.3 acres at the intersections of Colorado Avenue and 14th Street. Bill Pedersen, Shane Avera and Maxx Bauman of Matthews represented the seller in the transaction.

CBRE Secures $196.2M in Financing for Chapter Buildings Mixed-Use Development in Seattle’s University District

by Amy Works

SEATTLE — CBRE has arranged joint-venture equity and $196.2 million in construction financing for Chapter Buildings I and II, two mixed-use buildings in Seattle’s University District. Seattle-based Touchstone, Atlanta-based Portman Holdings and Houston-based Lionstone Investments comprise the development team. Tom Pehl, Charles Safley, Todd Tydlaska of CBRE Capital Markets West Coast, along with James Scott and Brian Myers of CBRE Capital Advisors, arranged the equity. Brad Zampa, Mike Walker and Megan Woodring of CBRE Debt & Structured Finance arranged the financing. Construction of Building I commenced earlier in 2022 and construction of Building II will begin in late 2022, with expected delivery in 2024. Totaling more than 400,000 square feet, the Chapter Buildings will consist of two assets. Chapter Building I, located at 4530 12th Ave. NE, will rise 12 stories featuring 240,000 square feet of office space and 9,000 square feet of ground-floor retail. The 10-story Chapter Building II will feature 154,000 square feet of life sciences and research & development space above 4,000 square feet of retail space. Greg Inglin, David Abbott and Laura Ford of CBRE are marketing the buildings for lease.

Mesa West Capital Provides $108M Acquisition Loan for Skywater at Town Lake Apartments in Tempe, Arizona

by Amy Works

TEMPE, ARIZ. — Mesa West Capital has provided KB Investment & Development Co. with $108 million in first mortgage debt for its acquisition of an apartment community in Tempe. The five-year, floating-rate loan is for Skywater at Town Lake, located at 601 W. Rio Salado Parkway. Built in 2015, the five-acre property offers 328 apartments in a mix of studio, one-, two- and three-bedroom floor plans spread across five four-story, elevator-served buildings. Community amenities include a sundeck; swimming pool; top-floor resident clubhouse with a full kitchen, pool tables and wrap-around balcony; outdoor kitchen and entertainment space with firepits and games; two-story fitness center with a yoga studio and Peloton bikes; electric vehicle charging stations; bike/paddle board/kayak storage room; underground parking structure; and onsite coffee shop. At the time of closing, the property was 96.6 percent leased. Rocco Mandala of CBRE arranged the financing.

Manhattan West, Local Development Plan Two Multifamily Properties in Los Angeles’ Echo Park

by Amy Works

LOS ANGELES — Manhattan West Real Estate, a division of Manhattan West, and its joint venture partner Local Development plan to develop two multifamily properties totaling 102 units in Los Angeles’ Echo Park neighborhood. The partnership is currently pursuing development entitlements with the City of Los Angeles via its Transit Oriented Communities Affordable Housing Incentive Program for 801-809 N. Alvarado St. and 900-908 N. Alvarado St., which are situated one block apart from each other. Earlier this month, the joint venture acquired 900 Alvarado, which totals 15,000 square feet of land, for $4 million. In December 2021, it purchased 801 Alvarado, a 12,678-square-foot site, for $4.2 million. The existing vacant structures on the sites are scheduled for demolition in early September. Once entitlements are finalized, construction on both projects is slated to begin in late 2023, with completion targeted for approximately two years later. The properties will offer one-, two- and three-bedroom units with balconies in most units and a rooftop deck, among other amenities. The property at 900 Alvarado will feature 47 apartments over a fitness center and two-level, 48-car, subterranean parking garage. The 801 Alvarado property will offer 55 units over a two-level, 40-car, subterranean parking garage. Warren …

JLL Capital Markets Arranges $29.6M Refinancing for Mirror Lake Village Seniors Housing Community Near Seattle

by Amy Works

FEDERAL WAY, WASH. — JLL Capital Markets has arranged a $29.6 million refinancing for Mirror Lake Village, a Class A seniors housing community situated on three acres at 3100 9th Place in SW in Federal Way. Mirror Lake Village features 30 assisted living units, 66 memory care units and 18 independent living cottages averaging 378 square feet. The community also features an outdoor courtyard with covered patio, common dining room, commercial kitchen, hair salon, theater, library and exercise room. Alanna Ellis of JLL Capital Markets represented the borrower, Mirror Lake Village LLC, in securing the financing through a regional bank together with retroactive C-PACE financing.

BELLEVUE, WASH. — JB Capital has partnered with Taylor Street for its Real Estate Lending Income Fund. The fund provides capital to professional owners, operators and developers of multifamily and industrial real estate assets in key markets across the United States. Under the partnership, JB Capital will leverage Taylor Street’s national real estate expertise, further allowing Taylor Street to serve its clients across to institutional alternative asset management. While the equity gap required to invest continues to increase, professionals are looking outside traditional sources of capital with equity and mezzanine structured solutions. The fund’s purpose is to continue JB Capital’s commitment to providing its investors with a high-yield debt investment that delivers consistent monthly income while minimizing the risk of loss of principal and maintaining near-term liquidity.