YUCCA VALLEY, CALIF. — Progressive Real Estate Partners has arranged the sale of a multi-tenant retail building at 57990 29 Palms Highway in Yucca Valley. A Los Angeles County, Calif.-based private investor sold the asset to a Los Angeles County-based private investor for $1.9 million. Crazy Bargains, Luxury Nail Spa and No Limits Boutique are tenants at the 13,593-square-foot property. Lance Mordachini of Progressive Real Estate Partners represented the seller, while the buyer was self-represented in the transaction.

Western

CENTENNIAL, COLO. — Burgeon Properties Denver LLC has purchased an office building, located on 0.76 acres at 4901 E. Dry Creek Road in Centennial, from Non Paddle LLC for $1.7 million. Built in 1979, the 19,409-square-foot property features private offices, open work areas and suites with kitchens. The building was 80 percent occupied at the time of sale, providing a revenue stream while allowing space for the buyer’s operations. Paul Cattin of Platinum Commercial Real Estate represented the seller in the deal, while the buyer was unrepresented in the transaction.

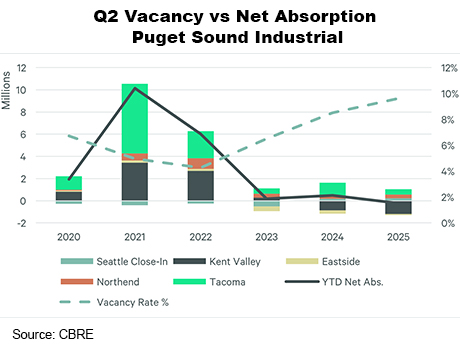

— By Andrew Hitchcock of CBRE — The Puget Sound industrial market is showing signs of modest recovery through the first half of 2025. Tenants are increasingly seeking flexible leases, renewing in place and right-sizing operations, resulting in smaller or more cautious leasing commitments rather than long-term deals. Shifts in port activity have also affected leasing decisions, exacerbated by the raft of universal tariff announcements in April. While some submarkets have regained momentum after a slow start, demand across the region is still uneven, with lingering uncertainty keeping vacancy rates elevated. Submarkets demonstrating momentum include Tacoma, which recorded 308,153 square feet of positive net absorption in the second quarter, alongside notable third-party logistics provider (3PL) leasing activity. The Seattle Close-In area also saw vacancy decrease to 9.3 percent, driven by healthy tenant demand from companies like Evergreen Goodwill and South West Plumbing. Conversely, Kent Valley faced challenges. The vacancy rate climbed to 8.4 percent due to significant speculative deliveries that outpaced absorption and traditional users downsizing. Port activity temporarily dampened demand, compounded by a 21.2 percent year-over-year drop in international imports in May. This reflects uncertainty surrounding future tariff rates. On the plus side, year-to-date container volumes remain above 2024 …

BEVERLY HILLS, CALIF. — Cain International has provided updates on One Beverly Hills, a 17.5-acre mixed-use project in metro Los Angeles that is valued at roughly $10 billion. Luxury fashion brand Dolce & Gabbana, as well as restaurants Casa Tua Cucina and Los Mochis, have been confirmed as three of the first tenants within the development’s 200,000-square-foot retail district, which is planned to ultimately feature 45 shopping and dining options. In addition, construction is underway on Aman Beverly Hills, which will consist of a 78-suite hotel, two residential towers, a private club and 10 acres of botanical gardens and open space. The latter element will connect The Beverly Hilton hotel, which is currently being renovated, and the Waldorf Astoria Beverly Hills hotel.

JLL Secures $102.4M in Construction Financing for Otay Business Park Spec Project in San Diego

by Amy Works

SAN DIEGO — JLL Capital Markets has arranged $102.4 million in construction financing for the first phase of Otay Business Park, a speculative Class A industrial development in San Diego’s Otay Mesa submarket. The borrower is a joint venture between Elevation Land Co. and a real estate fund advised by Crow Holdings Capital. Aldon Cole and Ben Choromanski of JLL Capital Markets arranged the three-year, floating-rate loan through New York Life Real Estate Investors for the borrower. Phase I of Otay Business Park will deliver 612,240 square feet spanning four freestanding warehouse and distribution buildings, ranging from 79,760 square feet to 233,880 square feet. The single-story, reinforced concrete tilt-up structures will feature 32-foot clear heights and be divisible into suites as small as 45,000 square feet. Upon full build-out, the 119-acre Otay Business Park will feature 1.8 million square feet of industrial space across nine buildings. Construction for Phase I is underway, with completion slated for mid-2026. The project is expected to reach stabilization by mid-2027.

ONTARIO, CALIF. — MDH Partners has purchased Ontario Commerce Park II, a four-building, 133,400-square-foot industrial asset situated within California Commerce Center in Ontario. James Hwang of MDH Partners served as acquisition lead and Michael Hefner of Voit Real Estate Services represented the undisclosed seller in the deal. Terms of the transaction were not released. Divisible to up to 19 individual units, Ontario Commerce Park II consists of two buildings at 720 and 780 S. Milliken Ave. totaling 31,448 square feet and featuring grade-level loading and 16-foot warehouse clearance; and two buildings, totaling 101,952 square feet, at 740 and 760 S. Milliken Ave. with 25- to 26-foot warehouse clearance, dock-high loading and grade-level ramps. At the time of sale, the buildings were fully leased to nine tenants.

BISON Partners, PCCP Receive $29M in Financing for Bernal Plaza Shopping Center in San Jose, California

by Amy Works

SAN JOSE, CALIF. — A joint venture between BISON Partners and PCCP has received $29 million in acquisition financing for Bernal Plaza, an open-air retail center in San Jose. Alex Olson, Todd Sugimoto, Lauren Sackler and Danny Ryan of JLL Capital Markets secured the floating-rate acquisition loan through Forbright Bank for the borrower. The joint venture acquired the asset from a private seller, which had owned the property for 20 years, in an off-market transaction. Situated on 16 acres at 101-125 Bernal Road, Bernal Plaza offers 139,559 square feet of retail space that was 94 percent leased at the time of sale. Current tenants include Ross Dress for Less, McDonalds, Shell and a Tesla charging station.

LAS VEGAS — CBRE has arranged the sale of a 24,362-square-foot office property located at 9501 Hillwood Drive in Las Vegas. A local owner-user acquired the asset from Hillwood Properties LLC for $6.4 million. The property features an outdoor amphitheater, rotunda entrance and an auditorium. Marc Magliarditi of CBRE represented the seller in the deal.

Bally’s Unveils Plans for 35-Acre Entertainment Resort Destination on Las Vegas Strip

by John Nelson

LAS VEGAS — Bally’s Corp. (NYSE: BALY) has announced plans for Bally’s Las Vegas, an entertainment resort destination planned on the 35-acre site of the former Tropicana Las Vegas hotel and casino. The casino and sports entertainment operator is partnering with JLL and Marnell Cos. on the development, which is being submitted to Clark County for entitlements. Bally’s Las Vegas will share the site with the new Las Vegas Athletics Major League Baseball ballpark, a move by the Oakland Athletics that was announced and approved in 2023. Bally’s expects construction at Bally’s Las Vegas to begin in the first half of 2026. “Bally’s Las Vegas represents a once-in-a-generation opportunity to redefine the heart of the Strip,” says Soo Kim, chairman of the board of directors at Bally’s. “With world-class partners like JLL and Marnell, and with the arrival of Major League Baseball, we are not just building an integrated resort. We are creating a landmark destination that unites sports, entertainment, dining and hospitality on a scale only Las Vegas can deliver.” Plans for Bally’s Las Vegas include two luxury hotel towers totaling 3,000 rooms, an entertainment venue with a seating capacity of 2,500 and more than 500,000 square feet of …

Merrimac Ventures, Fort Partners Break Ground on $1B Four Seasons Resort and Residences Telluride in Colorado

by Amy Works

MOUNTAIN VILLAGE, COLO. — Merrimac Ventures and Fort Partners have broken ground on the $1 billion Four Seasons Resort and Residences Telluride and closed on a construction financing package for the project. Slated for completion in 2028, construction is underway and more than 30 percent of the property’s inventory is already sold. Situated on 4.4 acres in Mountain Village, the project is backed by the successful closing on the land and a $417 million construction loan from J.P. Morgan, with additional financing from CanAm Enterprises. Merrimac and Fort Partners worked with the Town of Mountain Village, Telluride Ski and Golf and TMVOA to secure the land and bring the project to life. The development will feature 26 private residences ranging from two to five bedrooms, 43 hotel residences ranging from one to four bedrooms and 52 hotel guest rooms. Residences will offer floor-to-ceiling windows, terraces and in-home oxygenation systems. Penthouses will offer private terraces and outdoor spa pools. Resort amenities will include ski-in/ski-out access, ski valet and private lockers, a fitness center, spa and recovery center, an indoor lap pool, an outdoor hot tub, underground parking and a private residents’ club. The project team includes Olson Kundig as architect and Clements …