MOAB, UTAH — MAG Capital Partners has purchased 27 resort condominiums at 2331 Mesa Road in Moab, with plans to develop 60 additional units at the site. The assets are part of the seven-acre Sage Creek at Moab resort. The bank-owned property was acquired for an undisclosed amount, with many of the existing 48 units pre-sold prior to construction and now operating as vacation rentals. Sage Creek at Moab’s amenities include a tiered pool with waterfalls, grotto-style hot tub and pool house facilities that operate year-round. A community deck and patio includes an outdoor fireplace barbecue grills, outdoor showers and bocce ball court. The community also features custom exterior bike storage and gated parking for RVs and boats. The condos each feature three full-sized bedrooms, two-and-a-half bathrooms, a full-sized laundry room and private balconies, some with private hot tubs. Led by principals Dax Mitchell and Andrew Gi, MAG Capital Partners plans to add food and beverage services at the site this summer, among other facility amenities, to serve the local community and annual visitors.

Western

Marcus & Millichap Negotiates $8.8M Sale of Mammoth Main Street Promenade Shopping Center in Mammoth Lakes, California

by Amy Works

MAMMOTH LAKES, CALIF. — Marcus & Millichap has arranged the sale of Mammoth Main Street Promenade, a retail center located in Mammoth Lakes. A private investor sold the asset to an undisclosed buyer for $8.8 million. At the time of sale, the 42,809-square-foot shopping center was 98 percent leased to 22 tenants, including Mammoth Laundry and Sun & Ski Sports. The property was built in 1988. Patrick Toomey, Jose Carrazana, Jessica Baram and Enrique Wong of Marcus & Millichap represented the seller in the deal.

PORTLAND, ORE. — Senior Living Investment Brokerage (SLIB) has negotiated the sale of Cornerstone Care Option, a 38-unit, 56-bed skilled nursing facility in Portland. The community was originally built in 1955 on 7.3 acres, with renovations in 2006. The 98,700-square-foot asset was 98 percent occupied. The seller was a local owner-operator looking to retire from seniors housing. A regional group based in the West acquired the property for an undisclosed price. Jason Punzel, Brad Goodsell and Vince Viverito of SLIB handled the transaction.

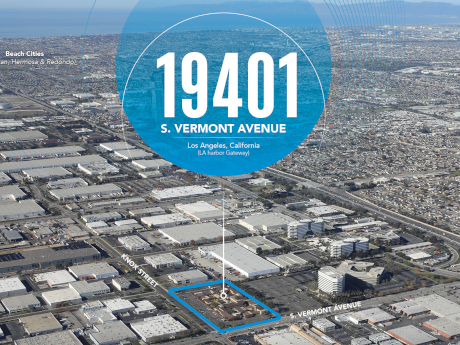

Harbor Gateway Sells Office-to-Industrial Conversion Property in Los Angeles for $39.8M

by Amy Works

LOS ANGELES — Harbor Gateway LLC has completed the disposition of a 5.4-acre industrial redevelopment property located at 19401 S. Vermont Ave. in Los Angeles’ South Bay market. Atlas Capital acquired the asset for $39.8 million. The property currently comprises 12 office buildings totaling 94,113 square feet. The location offers close proximity to two of the busiest seaports in North America and Los Angeles International Airport, as well as immediate access to the 105, 110, 710, 405 and 91 freeways. Kevin Shannon, Scott Schumacher, Ken White, Bret Hardy, Jim Linn, Andrew Briner, John McMillan and Danny Williams of Newmark represented the seller.

VERNON, CALIF. — Prime Data Centers has released plans for a three-story, 261,000-square-foot data center in Vernon. Additionally, the company will construct an electrical substation to serve the new site. The completed facility will deliver up to 33 megawatts of power to its tenants. The new carrier-neutral facility offers opportunities for tenants to obtain wholesale dark fiber in volume to all five of the central interconnection hubs in downtown Los Angeles: One Wilshire, 600 W. Seventh Street, 530 W. Sixth Street, 900 N. Alameda and 818 W. Seventh Street. The new facility will offer dedicated office, storage and staging options, as well as secure onsite parking. Completion is slated for as early as fourth-quarter 2023. Darren Eades of JLL handled the land parcel acquisition. Terms of the deal were not released.

ANTELOPE, CALIF. — Agora Realty and Management has purchased Antelope Marketplace, a retail center located at 7901 Walerga Road in Antelope, a suburb of Sacramento. Philips Edison & Co. sold the asset for $33 million. Built in 1992 and remodeled in 2005, the 115,522-square-foot shopping center was 98 percent occupied at the time of sale. Current tenants include Bel Air, 24 Hour Fitness, Banfield Pet Hospital, Round Table Pizza, Leslie’s Pool Supplies, Wing Stop, Jamba Juice, Supercuts and State Farm Insurance. Ryan Thompson and Roman Benvenuti of Palmer Capital represented the buyer and seller in the transaction.

Dwight Capital Provides $53.4M HUD Financing for Two Multifamily Properties in Modesto, California

by Amy Works

MODESTO, CALIF. — Dwight Capital has provided a total of $53.3 million in HUD-insured loans for two apartment communities in Modesto. Josh Sasouness of Dwight Capital originated the loans for the borrower, Tesseract Capital Group. The firm closed a $30.9 million in HUD 223(f) refinancing for Summerview Apartments, a 136-unit multifamily property in Modesto. The property consists of 19 two-story residential buildings and a leasing/management office situated approximately five acres. Renovated in 2020, the community features a barbecue/picnic area, fitness center, pool and spa. Dwight Capital also provided a $22.4 million HUD 223(f) loan for The Marc at 1600, a 100-unit garden-style apartment property in Modesto. Renovated in 2020, The Marc at 1600 features 17 two-story residential buildings situated on approximately 4.3 acres. Community amenities include a pool, fitness room and gated parking. The HUD loans benefitted from Green Mortgage Insurance Premium Reductions because both properties are National Green Building Standard certified.

MESA, ARIZ. — Marcus & Millichap has arranged the sale of La Gran Plaza, a retail property located at 1245 E. Southern Ave. in Mesa. An Arizona-based developer sold the asset to a California-based investor for $12.3 million. Sanford Burstyn of Marcus & Millichap represented the seller, while Bryan Ledbetter and Bryan Baits of Western Retail Advisors represented the buyer in the deal. Built in 1986 and remodeled in 2014, La Gran Plaza features 79,743 square feet of retail space. At the time of sale, the property was 96 percent occupied. Current tenants include El Super Grocery, Panda Express, Los Altos Ranch Market, dd’s Fashion, Taco Bell, WSS Shoes, Aaron’s, Walgreens and T-Mobile.

LOS ANGELES — Rexford Industrial Realty has purchased four industrial assets for an aggregate acquisition price of $163.8 million in off-market transactions. The purchases were funded using a combination of cash on hand, the company’s line of credit and units in the company’s operating partnership (OP Units). In May and June, the company purchased: 2020 South Central Ave. in Compton, Calif., for $10.8 million, or $110 per land square foot. The 2.3-acre, industrial-zoned land site contains a fully occupied, 30,233-square-foot, single-tenant building. Upon lease expiration, Rexford plans to redevelop the site by constructing a 45,000-square-foot, Class A industrial building. 14200-14220 Arminta St. in Panorama City, Calif., for $90.2 million, or $451 per square foot. Situated on 8.5 acres, the 200,000-square-foot, Class A building is leased long-term to a credit tenant. The acquisition was completed using $24.5 million of cash and 954,000 OP Units at a value of $68.84 common stock. Michael Bogle of CBRE represented both Rexford and the seller, Powell Plaza Associates, in the transaction. 1172 Holt Blvd. in Ontario, Calif., for $17.8 million, or $404 per square foot. Built in 2021 on 2.1 acres, the 44,000-square-foot, Class A building is adjacent to the Rexford’s recently purchased 1154 Holt …

Coastal Ridge, Goldman Sachs Acquire 448-Bed Student Housing Community Near Northern Arizona University

by Amy Works

FLAGSTAFF, ARIZ. — A joint venture between Coastal Ridge Real Estate and Goldman Sachs Asset Management has acquired the Commons at Sawmill, a 448-bed student housing community near Northern Arizona University in Flagstaff. The property offers studio, two- and four-bedroom, fully furnished units. Shared amenities include a newly built clubhouse, fitness center, game area, theater, study lounge and outdoor courtyard. Jaclyn Fitts, Casey Schaefer and William Vonderfecht with CBRE brokered the acquisition of the property from an undisclosed seller. Coastal Ridge will manage the community.