LOS ANGELES — Harbor Associates and Gemdale USA have purchased Agoura Hills Business Park, an office campus located at 30401–30501 Agoura Road in the Agoura Hills submarket of Los Angeles, for $29.7 million. Built in 1987 on six acres, the 113,991-square-foot campus consists of two two-story office buildings around a central plaza and a 193-car parking lot. The acquisition represents the recapitalization of the office property, which Harbor Associates originally purchased in January 2020 in a joint venture with a Kansas City-based real estate investment firm. The sale represents Harbor’s exit from the investment after meeting its business plan. Matt Heyn and Caitlin Hoffman of CBRE will lease the property on behalf of Gemdale USA and Harbor. Andrew Harper, Will Poulsen, Matt McRoskey and Chad Solomon of JLL represented the seller in the transaction.

Western

Boulder Group Arranges $6.8M Sale of Tractor Supply-Occupied Asset in Lafayette, Colorado

by Amy Works

LAFAYETTE, COLO. — The Boulder Group has arranged the sale of a single-tenant retail property located at 825 US Highway 287 in Lafayette. The building traded for $6.8 million. Nashville, Tenn.-based Tractor Supply Co. occupies the 21,930-square-foot building on a net-lease basis. Randy Blankstein and Jimmy Goodman of The Boulder Group represented the California-based 1031 exchange buyer, while Andrew Bogardus of Cushman & Wakefield represented the undisclosed seller in the transaction.

Hanley Investment Negotiates $4.6M Sale of Restaurant Property in Palm Desert, California

by Amy Works

PALM DESERT, CALIF. — Hanley Investment Group Real Estate Advisors has arranged the sale of a newly constructed, single-tenant restaurant property at Monterey Crossing shopping center in Palm Desert. Newport Beach-based Fountainhead Development sold the asset to a Southern California-based private investor for $4.6 million. Located at 73320 Dinah Shore Drive, The Habit Burger Grill occupies the 2,700-square-foot drive-thru restaurant property. Bill Asher and Jeff Lefko of Hanley Investment Group represented the seller and developer, while John Costa, David Fults and Brian McLoughlin of Voit Real Estate Services’ Los Angeles office represented the buyer in the transaction.

Harrison Street Sells Eight Medical Office Buildings in San Francisco, Los Angeles Areas for $215M

by Amy Works

SAN FRANCISCO, SANTA ROSA, DALY CITY, ALAMEDA, GREENBRAE AND LOS ANGELES, CALIF. — Harrison Street has completed the disposition of a portfolio of eight medical office buildings valued at nearly $215 million across California. The properties were held across several of Harrison Street’s funds and managed in partnership with Pinnacle Capital Management Services. Totaling 380,000 rentable square feet, the portfolio is spread across San Francisco, Santa Rosa, Daly City, Alameda, Greenbrae and Los Angeles’ Van Nuys neighborhood. Tenants include leading regional health systems, such as Marin Health, Sutter Health, CommonSpirit Health and Kaiser Permanente. The seller invested more than $17 million in capital during its ownership, including recent building renovations, tenant improvements and leasing commissions. Chris Bodnar, Lee Asher, Jordan Selbiger, Ryan Lindsley, Sabrina Solomiany and Zack Holderman of CBRE’s U.S Healthcare & Life Sciences Capital Markets team represented Los Angeles-based Pinnacle Capital Management Services in the transaction.

DENVER — JLL Capital Markets has secured $135.7 million in refinancing for 1125 17th Street, a Class A office building in downtown Denver. The borrower was a joint-venture partnership between Hines, Pearlmark and an undisclosed limited partnership. Eric Tupler and Chris McColpin of JLL Capital Markets secured the five-year, floating-rate bridge financing through Deutsche Bank for the borrower. Located at 1125 17th St., the 25-story property features 494,689 square feet of office space with 20,000 square-foot average floor plates, parking for more than 400 vehicles and a Starbucks-occupied retail portion on the ground level. Additional tenant amenities include a basketball court, bocce court, full-service fitness club, juice and smoothie bar, electric vehicle charging stations and lounge with conference space. The property was renovated in 2021 and is currently 60 percent leased to a diverse rent roll spanning many industries, including information technology, healthcare, financial services and energy.

ViaWest Group Receives $35.5M Construction Financing for Converge Logistics Center in Phoenix

by Amy Works

PHOENIX — ViaWest Group and its institutional capital partner have received $35.5 million in construction financing for the ground-up construction of Converge Logistics Center, a three-building speculative logistics center located at 15175 S. 50th St. in Phoenix. Situated on 28.6 acres, Converge Logistics Center will feature approximately 500,000 square feet of Class A rentable industrial space. The individual buildings will range from 140,000 square feet to 210,000 square feet and may be leased to a single tenant or are divisible to 23,500 square feet for multi-tenant use. The buildings will feature 32-foot clear heights, a combination of dock-high and grade-level doors and office suites at the front. Construction on all three buildings began in January, with completion slated for fourth-quarter 2022. The borrowers control the lot through a ground lease with Kyrene Elementary School District. Mike Walker and Brad Zampa of CBRE Capital Markets’ Debt & Structured Finance group arranged the nonrecourse, floating-rate loan, which has a three-year term with two extension options. A regional bank headquartered in the southern United States provided the capital.

AURORA, COLO. — Northmarq has arranged the sale of Highline Lofts Apartments, a multifamily property located at 456 S. Ironton St. in Aurora. Lowe Property Group sold the property to Summit Communities for $29.1 million, or $260,000 per unit. Built in 1972, Highline Lofts Apartments features 112 units in a mix of one-, two- and three-bedroom floor plans, ranging from 740 square feet to 1,395 square feet. Alex Possick, Rich Ritter and Seth Gallman of Northmarq’s Colorado Multifamily Investment Sales team represented the seller in the deal.

Pacific Partners Residential Buys Former Transportation Terminal in Boise for Multifamily Redevelopment Project

by Amy Works

BOISE, IDAHO — Pacific Partners Residential has acquired a 0.84-acre site in downtown Boise for an undisclosed price. The buyer plans to redevelop the property, which is located at 1212 W. Bannock St. and formerly used as a transportation terminal for the Greyhound Bus Co., into a residential community. Curtis Cluff of Cushman & Wakefield and Matt Haumann of CBRE co-represented the buyer, while Jay Story of Story Commercial Real Estate represented the seller in the deal.

Faris Lee Brokers Sale of 117,228 SF Ming Plaza Shopping Center in Bakersfield, California

by Amy Works

BAKERSFIELD, CALIF. — Faris Lee Investments has arranged the sale of Ming Plaza, a retail center located on Ming Avenue in Bakersfield. A private family office sold the asset to an undisclosed buyer for $26.5 million. Sean Cox, Alex Moore and Don MacLellan of Faris Lee Investments represented the seller and procured the buyer in the deal. Faris Lee also arranged financing for the buyer. At the time of sale, the 117,228-square-foot property was nearly 100 percent occupied and includes three outparcels leased to Starbucks Coffee, Chase Bank and Long John Silvers.

Berkadia Arranges $35.7M in Acquisition Financing for The Rev Multifamily Community in Tempe

by Amy Works

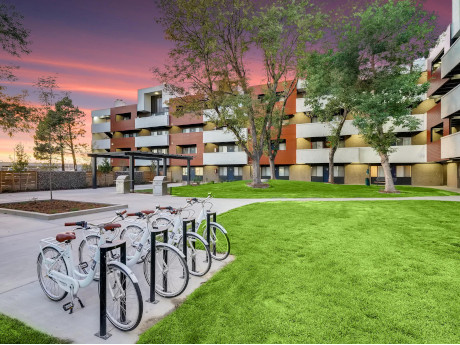

TEMPE, ARIZ. — Berkadia has arranged the sale of The Rev, a garden-style apartment property in Tempe. Washington-based Securities Properties sold the asset to Western Wealth Capital for an undisclosed price. Dan Cheyne, Ric Holway and Mark Forrester of Berkadia Phoenix represented the seller in the transaction. Andy Hill of Berkadia Austin secured $35.7 million in acquisition financing on behalf of the buyer. Benefit Street provided the bridge loan, which features future funding to facilitate completion of upgrades to the property. Located at 3409 S. Rural Road, The Rev features 172 apartments in a mix of studio, one- and two-bedroom layouts. Community amenities include an oversized swimming pool, heated spa, standalone leasing center, resident lounge, business center, fitness center, locker room and large courtyards.