LAS VEGAS — JMAC Industries LP has completed the disposition of an industrial property located in the southwest submarket of Las Vegas. MCA Realty acquired the asset for $16.9 million. Located at 7201 Post Road, the property features 80,677 square feet of industrial space. Dan Doherty, Paul Sweetland, Chris Lane and Jerry Doty of Doherty Industrial Group of Colliers International represented the seller in the deal.

Western

HAYDEN, IDAHO, AND LAYTON, UTAH — An affiliate of Livingston Street Capital has completed the disposition of two medical office properties, totaling 31,500 square feet, in Idaho and Utah. AEI Net Lease Portfolio 19 DST acquired the assets for $14.4 million. The properties, which include a 15,000-square-foot building at 8300 N. Cornerstone Drive in Hayden and a 16,500-square-foot building at 781 Heritage Park Blvd. in Layton, are both fully leased to BioLife Plasma Services, which collects the plasma that is processed into plasma-based therapies.

FAIRFIELD, CALIF. — StoragePRO Management has opened a new multi-level self-storage facility situated on five acres at 475 Lopes Road in Fairfield. The 131,000-square-foot facility offers 930 indoor storage units and a two-story RV, boat and vehicle storage on the ground floor with secure, drive-up access. The property also features a property-wide 24-hour surveillance video system, electronic smart locks on each unit, entry and exit property access keypads, fenced and gated property perimeters, motion-censored interior and exterior LED lighting, fire sprinklers and onsite managers, as well as a leasing office and no-contact online rentals and bill pay. Elk Grove-based GC Construction and Development served as the project’s general contractor.

SANTA ANA, CALIF., AND WARSAW, MO. — BridgeCore has funded a $3.6 million bridge loan to finance the purchase of a to-be-built retail building that 7-Eleven will occupy in Santa Ana. The loan was cross-collateralized with a Taco Bell-occupied asset in Warsaw. The name of the borrower was not released. The loan features a 12-month term with six months of yield maintenance, which will allow the seller of the 7-Eleven property to complete its construction of the build-to-suit on behalf of the borrower and meet its delivery obligations to 7-Eleven.

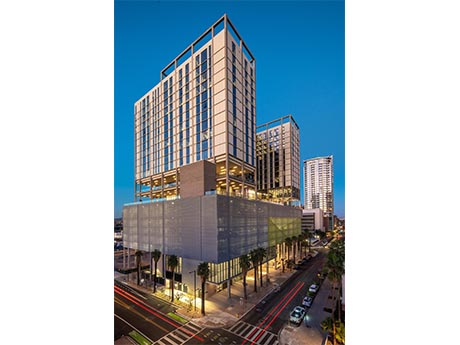

PHOENIX — Chicago-based developer The X Co. has completed X Phoenix, a 20-story multifamily high-rise project located at 200 W. Monroe St. in the state capital’s downtown area. The 731,321-square-foot building houses 330 residential units and represents Phase I of a larger development. Phase II of X Phoenix will feature a 26-story multifamily tower that will be developed on an adjacent parcel. Construction of Phase II is scheduled to begin this spring. Phase I of X Phoenix included a parking garage with 612 stalls, plus an indoor mezzanine storage space with 159 bike parking spots and a wash station. The eighth floor of the building houses two pools with a poolside bar and restaurant that is scheduled to open in April. In addition, the ninth floor of the building features a 9,000-square-foot fitness center with locker rooms and a yoga studio. Lastly, the building contains 50,000 square feet of commercial space that will be built out to support restaurant and coworking uses. Chicago-based Fitzgerald & Associates designed X Phoenix, with Workshop/APD handling interior design. Clayco, a design-build firm with five offices across the county, provided construction management services. Kimley-Horn and Peterson Associates provided engineering services. The X Co. has built …

LAS VEGAS — Griffin Capital has completed the disposition of South Beach Apartments, a 220-unit multifamily community in the Las Vegas submarket of Summerlin/Spring Valley. Logan Capital Advisors acquired the asset for $97.5 million, or $443,180 per unit. Taylor Sims, Carl Sims and Brady Cleary of Cushman & Wakefield’s Multifamily Advisory Group in Las Vegas represented the seller in the deal. Located at 8920 W. Russel Road, South Beach Apartments features a mix of one- and two-bedroom floor plans, with loft and den options, ranging from 680 square feet to 1,380 square feet. Onsite amenities include saltwater pools, a beach volleyball court, soccer field, half basketball court, yoga studio, Pilates studio, indoor and outdoor fitness centers, a dog wash and a 16-foot TV by the pool. The community was built in 2017.

GLENDALE, ARIZ. — SB Real Estate Partners has purchased Cantamar Apartments, a garden-style multifamily community located at 16630 N. 43rd Ave. Glendale, for $58.1 million. The buyer will rebrand the 180-unit asset as Portola On Bell. Built in 1988, the community offers one-, two- and three-bedroom floor plans averaging 1,086 square feet, with washers/dryers, nine-foot ceilings and balconies. Community amenities include a swimming pool, fitness center and resident clubhouse with a business center. SB Real Estate is planning a $4 million capital improvement program to enhance the property’s curb appeal, common area amenities and unit interiors.

Avison Young Negotiates $54.5M Sale of Hyatt Place/Hyatt House Hotel in North Scottsdale

by Amy Works

SCOTTSDALE, ARIZ. — Avison Young has brokered the sale of Hyatt Place/Hyatt House, a dual-flagged select-service and extended-stay hotel in Scottsdale. A joint venture between Gardner Batt and private investors sold the asset to a joint venture between KKR and Riller Capital for $54.5 million. Located at 18513 N. Scottsdale Road, the property features 229 guest rooms, an onsite restaurant, bar area, breakfast area, business center, meeting space, fitness center, heated outdoor pool and hotel-wide Wi-Fi. The nine-story property opened in March 2021. Jay Maddox, Keith Thompson, Andrew Broad and David Genovese of Avison Young represented the seller in the transaction.

Ziegler Arranges $23.6M Bond Financing for Seniors Housing Asset in Mill Valley, California

by Amy Works

MILL VALLEY, CALIF. — Ziegler has arranged $23.6 million in bond financing for The Redwoods, a nonprofit continuing care retirement community in Mill Valley, a suburb of San Francisco. The Redwoods features 148 independent living units, 130 assisted living units and a 58-bed skilled nursing facility. The Redwoods will use the proceeds of the bonds, together with an equity contribution of $5 million, to refinance its outstanding 2013 bonds, fund a bond reserve account, pay an insurance premium to the Cal-Mortgage Loan Insurance Program and pay costs of issuance. While federally taxable, the bonds were issued through the California Municipal Finance Authority to allow for exemption from State of California income tax. The bonds amortize over a 15-year period, which is eight years shorter than the maturity on the existing 2013 bonds, and carry a bond yield of 2.9 percent. The bonds were issued with a 10-year par call.

PHOENIX — Stos Partners, in partnership with a high-net-worthy family office, has purchased an industrial property located at 2757 E. Chambers St. in Phoenix for $4.4 million in an off-market transaction. At the time of acquisition, the 28,520-square-foot building had a short-term tenant in place. David Wilson and Carter Wilson of DAUM Commercial Real Estate Services represented the buyer in the deal.