LAKEWOOD, WASH. — Alliance Residential has purchased a 9.7-acre development site within Lakewood Towne Center, a retail destination in Lakewood. The site is slated for the development of a 285-unit Class A apartment community that will include units under the City of Lakewood’s Multifamily Tax Exemption program. The new multifamily property will help address the growing housing demand in Lakewood, where only one new 100-plus market-rate apartment development has been delivered since 2011. Ross Klinger and Austin Kelley of Kidder Mathews represented the undisclosed seller in the deal. Terms of the transaction were not disclosed.

Western

LOS ANGELES — Los Angeles-based Prime Pizza, a rapidly expanding New York-style pizza restaurant, has signed leases for five new locations in Southern California. The locations are at Alicia Landing Shopping Center in Mission Viejo; Gaslight Square in Brea; Farmers & Merchants Bank Center in Torrance; and two freestanding locations, one in Thousand Oaks and another in Valley Village, Calif. Mark Seferian of RCI Brokerage represented Prime Pizza in the transactions, which ranged from 1,256 to 1,951 square feet. The Mission Viejo and Brea locations are slated to open in the fourth quarter of 2025, while the Valley Village, Thousand Oaks and Torrance locations will open during the second quarter of 2026.

MESA, ARIZ. — Vestar, a shopping center and mixed-use developer based in Phoenix, has partnered with Pacific Proving LLC, a landowning entity that controls 1,805 acres in the state capital’s East Valley, to co-develop a $2 billion mixed-use project. Legacy Park will span 200 acres at Pacific Proving’s site in Mesa near the confluence of Gilbert and Queen Creek. The groundbreaking is set for 2027. “As someone who has believed in the potential of this area and land for decades, we are thrilled to partner with Vestar to bring this phase of our property Legacy Park to life,” says Andrew Cohn, principal of Pacific Proving. “Legacy Park is not just another development. It is a thoughtfully designed community that will bring lasting value and lifestyle to the East Valley. We have waited for the right timing, the right opportunity and the right partners, and that moment is now.” Vestar expects Legacy Park to generate $56 billion in economic output over the next 20 years and to create more than 20,000 jobs. Located adjacent to Mesa Gateway Airport and easily accessible via the new State Route 24 at Williams Field Road, Legacy Park at full build-out will feature: “Legacy Park is a …

Greystar, University of Hawaii at Mānoa Complete Two-Tower Student Housing Community in Honolulu

by Amy Works

HONOLULU — A public-private partnership between Greystar and the University of Hawaii at Mānoa has completed Hale Haukani, a two-tower development on the university’s campus in Honolulu. The community offers 558 beds across 316 fully furnished units in studio, two-, three- and four-bedroom configurations. Shared amenities include study rooms, community lounges and an amenity deck on the 12th floor. An onsite daycare operated by the university is also available to support students with families.

SALT LAKE CITY — Boston-based Longpoint has purchased two separate industrial portfolios in Salt Lake City — the Mountain West Portfolio and the Salt Lake City Infill Portfolio — totaling just over 1 million square feet. Terms of the transactions were not disclosed. The portfolios are located in Northwest Quadrant submarket, which accounts for 71 percent of Salt Lake City’s industrial base. The Mountain West Portfolio consists of nine shallow-bay properties, totaling over 490,000 square feet, with a combined occupancy level of 85 percent at the time of sale. The buildings were built between 1999 and 2006 and feature dock- and grade-level loading, an average of 23-foot clear heights, 100-foot to 200-foot truck court depths and HVAC systems across most warehouses. The Salt Lake City Infill Portfolio includes seven small- and shallow-bay industrial properties totaling over 531,000 square feet. Built between 1995 and 2022, the buildings, which were fully occupied at the time of sale, feature dock- and grade-level loading, an average of 25-foot clear heights, and 75-foot to 130-foot truck court depths.

PACE Equity Provides $63.3M in C-PACE Financing for SkyRidge Resort in Deer Valley, Utah

by Amy Works

DEER VALLEY, UTAH — PACE Equity has funded a $63.3 million mid-construction recapitalization using long-term, fixed-rate C-PACE financing for SkyRidge Resort in Deer Valley. SkyRidge Development is developing SkyRidge Resort. Designed for four seasons, SkyRidge Resort will offer the Stelle Lodge, a six-story resort with a rooftop bar, spa and guest services; a 310-yard golfing range with 15 hitting bays, a three-hole mountain golf course that converts into a nine-hole short course and the Golf Clubhouse with a bar and restaurant, grocer café and curated retail; and an Equestrian Center with a 34-stall barn, indoor and outdoor arena, a European walking path and scenic riding trails. SkyRidge Golf and Clubhouse are slated to open in late 2025, with theStelle Lodge scheduled to open in 2026.

Sack Capital Partners, Belveron Partners Buy 164-Unit Multifamily Property in San Jose, California

by Amy Works

SAN JOSE, CALIF. — A joint venture between Sack Capital Partners and Belveron Partners has acquired Fountain Park, an apartment community in San Jose. Terms of the transaction were not released. Located at 1026 S. De Anza Blvd., Fountain Park offers 164 studio, one- and two-bedroom units. Community amenities include a clubhouse, barbecue area, resort-style swimming pool with spa hot tub, sauna, covered parking with electric vehicle charging and a dog park. The new owners have a long-term commitment to convert a portion of the apartments into affordable housing. Sack will provide property management services for the asset.

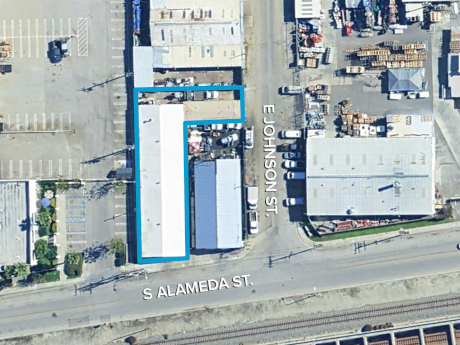

COMPTON, CALIF. — FallTech has purchased an industrial building located at 1414 S. Alameda St. in Compton from Accurate Glass & Mirror Corp. for $1.5 million. Situated on a 9,269-square-foot site, the 6,432-square-foot property features one ground-level door and a clear height of 14 feet. FallTech, which makes fall protection, will use the property to expand its operations. Scott Anderson of The Klabin Co. represented the seller, while Matt Stringfellow of The Klabin Co. represented the buyer in the transaction.

PHOENIX AND TEMPE, ARIZ. — BKM Capital Partners has acquired a portfolio of eight light industrial buildings in Phoenix and Tempe from an affiliate of Equus Capital Partners Ltd. for $167.8 million. The portfolio features 889,352 square feet spread across 46 buildings. Rusty Kennedy, Joe Cesta and Darla Longo of CBRE represented the seller in the deal. The portfolio includes: The properties offer a range of unit sizes, providing leasing flexibility.

SOUTH SALT LAKE, UTAH — Northmarq has arranged a $38 million loan on behalf of SSLC Multifamily-Parking LLC for the refinancing of Bowers Residences, an apartment community located at 55 W. Utopia Ave. in South Salt Lake. John Bradshaw, Nate Barnson, Bracken Ostler and Adam Bradshaw of Northmarq arranged the permanent fixed-rate financing on behalf of the borrower through a relationship with New York Life. Built in 2023, Bowers Residences offers 236 studio, one-, two- and three-bedroom layouts, a fitness center with a bouldering wall and a yoga/spin studio, a spa, private rooftop lounge and courtyard with games and grills, and a coworking space with a rentable clubroom and kitchen.