By Wes Drown, Broker Associate, REMAX Commercial The Las Vegas Valley continues to see growth in the demand, velocity, rates and a decline in incentives as Vegas bounces back. This is led by the return of our entertainment industries, which are almost to pre-COVID levels, in addition to the massive demand for housing and commercial construction. All you have to do is take a drive around the 215-Beltway to see that activity is everywhere. The news-grabbing projects that are seemingly announced weekly are once again turning heads. They’re attracting young college graduates and stimulating the needs for goods and services, almost to a pre-COVID level. Office construction is underway in earnest, with expansion in Summerlin, the SW “Curve” and West Henderson. High- and mid-rise office with parking structures are being leased up in the Westside areas, with predominantly single-story popping up in Henderson. Rates for suburban office products are pushing over $2.10 per square foot, per month, including operating costs. The spread between asking price and closed deals is shrinking significantly. Incentives are back to “normal” with landlords offering new carpet and paint, or maybe a partial month early occupancy rather than the free rent or step-up rents we’ve seen in the past. …

Western

Wharton Industrial, Madison Ventures Receive $224.1M Construction Loan for Industrial Park in Mesa, Arizona

by Amy Works

MESA, ARIZ. — Wharton Industrial and Madison Ventures Plus have received $224.1 million in acquisition and construction financing for The HUB @ 202, a master-planned, 1.5-million-square-foot industrial park in Mesa. John Alascio, Dave Karson, Chris Moyer, Will Strong, Kirk Kuller, TJ Sullivan, Chuck Kohaut and Zachary Smolev of Cushman & Wakefield Capital Markets arranged the financing. Situated on 101 acres, The HUB @ 202 will feature 11 Class A buildings with 28-foot to 36-foot clear heights, ample truck and car parking, grade- and dock-high loading doors and functional divisibility with a variety of bay sizes. Construction is slated to begin in second-quarter 2022.

TUCSON, ARIZ. — Monarch Investment and Management Group has completed the disposition of Yardz on Kolb, an apartment complex located in Tucson. Greenwater Real Estate Management acquired the asset for $65.5 million, or $159,756 per unit. Constructed between 1972 and 1974 on 17-plus acres, Yardz on Kolb features 410 garden-style apartments. Hamid Panahi and Steve Gebing of Institutional Property Advisors, a division of Marcus & Millichap, represented the seller and procured the buyer in the deal.

SALT LAKE CITY — Timberlane Partners has completed the disposition of The Morton, an apartment property in Salt Lake City. Nearon Enterprises acquired the complex for an undisclosed price. Built in 2019, The Morton features 137 apartments, access-controlled garage parking, a rooftop terrace with firepits and barbecue grills, a 24-hour fitness center and yoga studio, and a package locker system. Apartments features at least nine-foot ceilings, smart-home technology, walk-in closets and private patios or balconies, with an average unit size of 677 square feet. Danny Shin and Brock Zylstra of Institutional Property Advisors, a division of Marcus & Millichap, represented the seller and procured the buyer in the transaction.

MJW, Artisan Capital Acquire 508-Bed Student Housing Community Near the University of Nevada, Reno

by Amy Works

RENO, NEV. — A joint venture between MJW Investments and Artisan Capital has acquired a 508-bed student housing community located near the University of Nevada, Reno. Built in 2020, the property offers units with bed-to-bath parity alongside shared amenities including study rooms, a fitness center, lounge, game room, pet care station, rooftop courtyard and indoor bike and ski storage. Barings provided financing for the acquisition. “The property’s close proximity to the new developments on campus as well as the City of Reno’s economic development plan for the area are just a few reasons we’re excited to own this property,” says Mark Weinstein, president and founder of MJW investments.

Ware Malcomb Completes 93-Unit Westmont of Encinitas Seniors Housing Community in California

by Jeff Shaw

ENCINITAS, Calif. — Ware Malcomb has completed construction of Westmont of Encinitas, an assisted living community in the San Diego suburb of Encinitas. Ware Malcomb provided architectural services for the 91,334-square-foot project. The two-story building sits on 3.2 acres and features 93 units in studio, one- and two-bedroom options. Westmont Construction was the general contractor. Westmont Living is the operator.

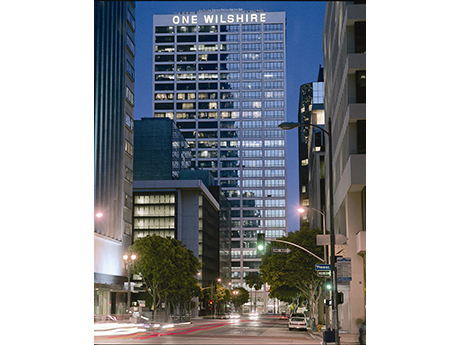

LOS ANGELES — JLL has arranged the $389.2 million refinancing of One Wilshire, a multi-tenant data center located at 624 S. Grand Ave. in downtown Los Angeles. The borrower is GI Partners, an alternative investment firm based in San Francisco. The 30-story, 661,553-square-foot data center features five separate utility power risers and 13 onsite generators with fuel storage for 24 hours of operation, along with separate and redundant data risers. The property also features office space, a multi-tower antenna array and fiber connectivity to the rooftop. Kevin MacKenzie, Brian Torp, Jake Wagner, Samuel Godfrey and Darren Eades of JLL arranged the 10-year, fixed-rate, non-recourse, interest-only loan through Goldman Sachs. “As one of the largest internet exchanges in the world, One Wilshire is truly a best-in-class asset recognized as the premier telecommunications hub of the Western United States,” says MacKenzie. “GI Partners has done an excellent job managing the asset to maximize utilization and creating significant value.” The demand for fast, secure and reliable data storage and delivery is at an all-time high and will continue to escalate for the foreseeable future thanks to the widespread appeal of content streaming services, social media and virtual connectivity. As a data center market, …

DENVER — MG Properties has purchased 3300 Tamarac Apartments, a multifamily community located in Denver’s Hampton neighborhood. Gelt sold the asset for $141 million. 3300 Tamarac features 564 apartments within walking distance of a variety of shopping and dining options, as well as parks and recreation opportunities. David Martin and Brian Mooney of Northmarq represented the seller, and Northmarq’s Scott Botsford and Joe Giordani arranged the financing for the buyer.

Contour Real Estate Buys 112-Acre Site for Industrial Development Near Mesa Gateway Airport

by Amy Works

MESA, ARIZ. — An entity controlled by California-based Contour Real Estate has acquired an approximately 112-acre industrial site at the southwest corner of Warner and Sossaman roads in Mesa. Structures Investment sold the asset for an undisclosed price. Contour plans to develop a master-planned industrial park with eight buildings totaling more than 1.5 million square feet of manufacturing, logistics and e-commerce space. The property will be developed in two phases. Paul Borgesen and Dylan Sproul of SVN Desert Commercial Advisors negotiated the transaction on behalf of the buyer and seller.

Berkadia Negotiates $73.2M Sale of Bungalows on Estrella Apartments in Goodyear, Arizona

by Amy Works

GOODYEAR, ARIZ. — Berkadia Institutional Solutions has arranged the sale of The Bungalows on Estrella, a garden-style apartment community located at 15545 W. Hudson Way in Goodyear. Arizona-based Cavan Cos. sold the asset to Georgia-based St. Clair Holdings for $73.2 million. The Bungalows on Estrella features 183 one-, two- and three-bedroom apartments with in-unit washers/dryers, 10-foot ceilings and walk-in closets. Community amenities include a swimming pool, fitness center, clubhouse, dog park and covered parking. Mark Forrester and Andrew Curtis of Berkadia Phoenix completed the sale on behalf of the seller.