SAN DIEGO — Golden Columbia, a real estate investment platform sponsored by locally based GANMI Corp., has completed the acquisition of two Class A office properties in downtown San Diego. Together, the buildings total 707,623 square feet. The sales price was not disclosed, but The San Diego Union-Tribune reports the properties traded for $103.5 million. The newspaper also reports that the seller, Regent Properties, purchased the two buildings for a combined $223.5 million in June 2021. The properties include One Columbia Place, a 27-story office tower located at 401 W. A St., and Two Columbia Place, a 12-story office building located at 1230 Columbia St. One Columbia Place comprises 556,943 square feet, and Two Columbia Place spans 150,680 square feet. According to a statement issued by GANMI Corp., long-term plans for One and Two Columbia Place include repositioning the properties into an “experience-driven workplace destination designed to support tenants, employees and the broader downtown ecosystem.” Enhancements at the buildings will be implemented in phases. “People don’t come back to the office for desks alone — they come back for energy, community and convenience,” says Casey Gan, CFO of GANMI Corp. “Our mission at Columbia Place is to build a complete workplace experience by …

Western

PHOENIX — CapRock Partners has completed CapRock West 202 Logistics, a 3.4 million-square-foot industrial warehouse complex in central Phoenix. The final phase of the infill development features 825,000 square feet of Class A space spread across three buildings on 43 acres in the Southwest Phoenix submarket. Located at 675 N. 55th Ave, Phase 2 includes Building F (301,771 square feet), Building G (295,586 square feet) and Building H (227,107 square feet). The facilities feature clear heights ranging from 32 feet to 36 feet and a combined 139 dock-high doors. The project completion coincides with CapRock securing a 1.1 million-square-foot lease for Building C, the largest building within the project, to an undisclosed corporate tenant. As part of Phase 1, Building C is a cross-dock facility with a clear height of 40 feet, 159 dock-high doors, four drive-in ramp doors, 500 auto parking stalls and 279 trailer parking stalls. Currently 85 percent occupied, Phase 1 features five buildings totaling 2.5 million square feet across 140 acres. Payson MacWilliam, Don MacWilliam, Chris Reese and Casey Koziol of Colliers represented CapRock in the Building C lease transaction and are handling all leasing efforts for CapRock West 202 Logistics.

SAN BERNARDINO, CALIF. — TireHub, a national tire distributor created by The Goodyear Tire & Rubber Co. and Bridgestone Americas, has signed a lease to occupy 404,725 square feet of industrial warehouse space at 1089 E. Mill St. in San Bernardino. Singapore-based Mapletree owns and manages the property, along with more than 66 million square feet of industrial assets across the United States. Kenneth Andersen and Rick John of Daum Commercial Real Estate Services, alongside Steve Provencio of Mapletree, represented Mapletree in the transaction.

COSTA MESA, CALIF. — Newmark has brokered the sale of 1901 Newport Boulevard, a three-story office property in Costa Mesa. A private, high-net-worth investor acquired the asset from an undisclosed seller for $24.4 million. Paul Jones, Ryan Plummer, Brandon White, Kevin Shannon and Ken White of Newmark represented the seller in the deal. Originally developed in 1985 and renovated in 2001, the 134,387-square-foot asset features a three-style atrium, custom marble flooring, open-air courtyards and seven fountains. Situated on 4 acres, the building is currently 85 percent occupied by a variety of tenants, including medical offices, traditional office users and retail.

TEMPE, ARIZ. — Creation, as developer, and LGE Design Build, as architect and general contractor, have completed Source Business Center, a Class A industrial facility in Tempe. Situated on 15 acres at the southeast corner of Warner Road and Hardy Drive, the 144,885-square-foot Source Business Center features a clear height of 32 feet, extensive power and an expansion 6 acres of contiguous yard space to support flexible storage and vehicle parking. Designed to accommodate up to two tenants, the property provides 204 parking spaces, including eight electric vehicle charging spaces, as well as bicycle parking and separate pedestrian paths. Creation developed the facility with CrossHarbor Capital Partners as an investor.

IndiCap, Invesco Sell 566,121 SF Building at Virgin Industrial Park Near Glendale, Arizona

by Amy Works

WADDELL, ARIZ. — IndiCap and Invesco Ltd. have completed the disposition of a modern industrial facility located within Virgin Industrial Park in Waddell, an unincorporated community in Maricopa County, Ariz. An undisclosed buyer acquired the property for $90.6 million. VIP Industrial Holdings LLC holds the 566,121-square-foot asset, which is located at 15784 W. Hatcher Road. Marc Hertzberg, Riley Gilbert and Kelly Royle of JLL represented the sellers, while Sean Kropke, Michael Haenel and Justin Smith of Cushman & Wakefield represented the buyer in the deal.

GARDENA, CALIF. — Cityview and Stockbridge have completed Apollo, an apartment property located at 12888 Crenshaw Blvd. in Gardena. The project team includes Westport Construction, AC Martin, Nadia Geller Designs and MJS Landscape Architecture. The eight-story Apollo features 265 studio, one- and two-bedroom floor plans with full-size in-unit washers/dryers, luxury vinyl plank flooring, stainless steel appliances, quartz countertops, designer backsplashes, soft-close cabinetry, under-cabinet lighting and gas ranges. The units also include smart home systems, including thermostats and keyless entry, and smart lighting switches in select units. Additionally, some units offer floor-to-ceiling windows, private balconies and walk-in closets. Community amenities include community-wide high-speed internet and Wi-Fi connectivity, a pool, spa, terrace with lounge seating, an outdoor kitchen, a media and club room, an outdoor game deck, an indoor sports simulator, an indoor fitness center, an outdoor training deck and CV Works coworking space with high-speed Wi-Fi and tech-enabled workspaces. The property also features covered bike storage, electric vehicle charging stations, a parcel room, controlled access parking and a pet-friendly playground and wash station.

Buchanan Street Partners Breaks Ground on 760-Unit Self-Storage Facility in Scotts Valley, California

by Amy Works

SCOTTS VALLEY, CALIF. — Buchanan Street Partners has broken ground for the development of a climate-controlled self-storage facility situated on 2.6 acres at 10 Victor Square in Scotts Valley. Buchanan acquired the site for $5.2 million after 14 months of entitlement efforts and project due diligence. The property, which formerly housed a vacant 39,000-square-foot office/flex building, will be redeveloped into a three-story, 99,500-square-foot Class A self-storage facility offering 760 units. Demolition commenced in January, and completion of the project is slated for April 2027. The project team includes DAI General Contracting and Valli Architecture. East West Bank is providing construction financing for the project.

DENVER — Cushman & Wakefield has brokered the sale of Leetsdale Marketplace, a 111,669-square-foot grocery-anchored retail center at 7150 Leetsdale Drive in Denver. Legacy Capital Partners sold the asset to a partnership led by Citivest Commercial for $13 million. Jon Hendrickson and Aaron Johnson of Cushman & Wakefield represented the seller in the transaction.

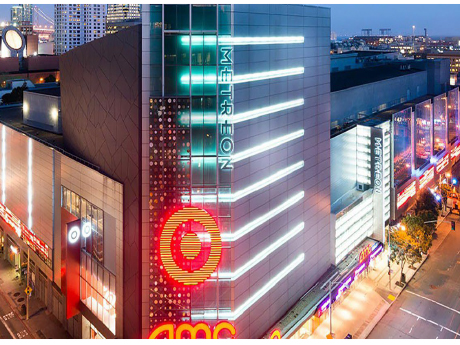

TMG, Bridges Capital Acquire 320,000 SF Metreon Shopping Center in Downtown San Francisco

by John Nelson

SAN FRANCISCO —TMG Partners and equity partner Bridges Capital LLC have acquired Metreon, a 320,000-square-foot, vertically oriented shopping center in downtown San Francisco. Built in 1999, the retail and entertainment destination is anchored by Target and a 16-screen AMC Theatres that features the tallest IMAX screen in North America. Locally based TMG and Bridges Capital purchased the four-story property from Acore Capital in a deed-in-lieu transaction. The sales price was not disclosed. The City and County of San Francisco will continue to retain ownership of Metreon’s ground lease through at least 2082, according to the San Francisco Business Times. The news outlet also reported Acore Capital was the mortgage lender for Metreon on behalf of the previous owner, Starwood Capital Group. “This investment in Metreon is a powerful vote of confidence in our downtown recovery,” says San Francisco Mayor Daniel Lurie. “We’re grateful for [TMG’s] partnership as we work to accelerate San Francisco’s comeback.” Metreon is located at 135 4th St. at Mission in the city’s Yerba Buena neighborhood. The property includes City View at Metreon, a 31,000-square-foot events venue with floor-to-ceiling windows offering views of the San Franisco skyline. TMG will rebrand the venue and partner with Skylight, a …