PHOENIX, CHANDLER, TEMPE AND SCOTTSDALE, ARIZ. — City Office REIT has completed the disposition of six office buildings totaling 1.2 million square feet in the Phoenix area to Southwest Value Partners for $266 million. Ben Geelan, Will Mast and Charlie von Arenstschildt of JLL Capital Markets represented the seller. Sher Hafeez, Michael Leggett, Dan Freeze and Josh Lieberman of JLL provided advisory services. The portfolio includes:– Block 23, a 307,000-square-foot property at 101 E. Washington St. in downtown Phoenix;– 5090 N. 40th Street, a 173,000-square-foot asset at 5090 N. 40th St. in Phoenix’s Camelback corridor;– SanTan, a 267,000-square-foot asset in Chandler;– Papago Tech, a 163,000-square-foot property at 1600-1700 N. Desert Drive in Tempe;– The Quad, a 163,000-square-foot building at 6200-6390 E. Thomas Road in Scottsdale;– Camelback Square, a 174,000-square-foot building at 6991 E. Camelback Road in Scottsdale.

Western

TUCSON, ARIZ. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of CIRC Tucson, an apartment property in Tucson. Clint Wadlund, Hamid Panahi, Steve Gebing and Cliff David of IPA represented the seller and procured the buyer in the deal. Terms of the transaction were not disclosed. Built in 1986 on 17 acres, CIRC Tucson offers 368 apartments, two swimming pools, a fitness center, package lockers and electric vehicle charging stations.

Kimco Realty, Bozzuto Break Ground on 214-Unit Multifamily Project in Daly City, California

by Amy Works

DALY CITY, CALIF. — Kimco Realty and Bozzuto have broken ground on The Chester at Westlake, a mixed-use development in Daly City. Scheduled to open in winter 2027, The Chester will offer 214 one-, two- and three-bedroom apartments, more than 13,000 square feet of amenities and 9,854 square feet of leasable ground-floor retail space. The community will feature a two-story lobby and two courtyards connected by a clubroom. The west courtyard will serve as an active social hub with an outdoor kitchen and grilling stations, a water feature and ample lounge and dining areas. The east courtyard will feature a covered lounge, fireplace and lush landscaping. Additional amenities will include a 24-hour fitness center and yoga room, collaborative coworking spaces and personal focus areas, a communal bar area with lounge seating and a rooftop sky lounge and patio. Bozzuto Development Co. will serve as lead developer of The Chester, which is located at 99 Southgate Ave. and part of Kimco’s Westlake Shopping Center. The project team includes Bozzuto Management as property manager, BDE Architecture as architect, Kimley-Horn as civil engineer, Vida Design as interior designer, JETT Landscape Architecture & Design as landscape architect and Palisade Builders as general contractor.

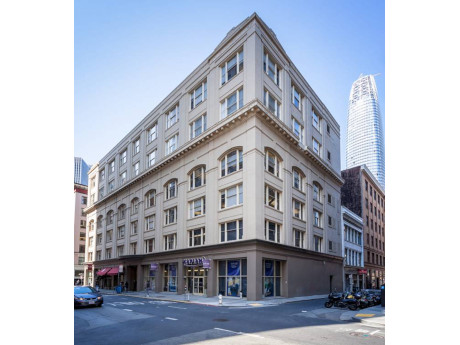

SAN FRANCISCO — TMG Partners and Bridges Capital have purchased 149 New Montgomery Street, an office building in San Francisco’s South Financial District. The partnership acquired the mortgage loan from U.S. Bank as trustee in August and has now acquired the property through a deed in lieu of foreclosure. Originally built in 1907, the property offers 80,000 square feet of office and ground-floor retail space, including Café Madeleine. The new owners plan to renovate the building.

ALBUQUERQUE, N.M. — Hunter Hotel Advisors has arranged the sale of Hyatt Place Albuquerque/Uptown, located at 6901 Arvada Ave N.E. in Albuquerque. An institutional seller sold the asset to Sun Capital Hotels for an undisclosed price. The six-story hotel offers 126 guest rooms, 1,127 square feet of meeting space, a business center, 24-hour fitness center, an outdoor pool and dining options, including the Breakfast Bar and The Placery lobby bar. Brian Embree of Hunter Hotel facilitated the transaction.

— By Sebastian Bernt of Avison Young — The San Diego office market is beginning to stabilize in 2025. However, recovery remains uneven amid elevated vacancy, rising sublease availability and evolving workplace strategies. While quarterly leasing activity has improved modestly— up roughly 7 percent year over year through the second quarter — overall fundamentals remain challenged. San Diego’s total office availability rate stands at 18.2 percent as of the second quarter. This is flat from the previous quarter but still up more than 500 basis points from pre-pandemic norms. Sublease availability exceeds 2.2 million square feet, a lingering effect of corporate downsizing and the continued shift toward hybrid work models. Sublease inventory is most concentrated in suburban nodes such as UTC and Sorrento Mesa, as well as Downtown San Diego. Demand remains strongest for Class A assets in suburban submarkets like UTC, Del Mar Heights and Sorrento Valley where tenants prioritize modern, amenity-rich properties. Even within these markets, average deal sizes have declined by 20 percent to 30 percent compared to 2019 levels, with users often consolidating space and seeking shorter lease terms. Downtown San Diego continues to face pronounced headwinds, with vacancy topping 25 percent in several Class B …

EAH Housing, County of Santa Clara Break Ground on 90-Unit Affordable Housing Project in Los Altos, California

by Amy Works

LOS ALTOS, CALIF. — EAH Housing and the County of Santa Clara have broken ground on Distel Circle, an affordable housing rental community in Los Altos. Located at 330 Distel Circle, the property will offer 90 affordable residences for individuals and families earning between 30 percent to 80 percent of the area median income. Several units will be designated as permanent supportive housing to help address homelessness and housing instability in the region. Designed by KTGY Architects, Distel Circle will offer studio, one-, two- and three-bedroom apartments, a community room, an outdoor courtyard and dedicated on-site services. Construction is underway with completion slated for January 2027. The project’s primary funding source is Low Income Housing Tax Credit and State Credit equity. The County of Santa Clara contributed $25 million toward the development, of which $15.9 million came from the $950 million Measure A Affordable Housing Bond, which was approved by county voters in 2016, with the balance provided through the county’s No Place Like Home and HOME Investment Partnerships Program funds.

VANCOUVER, WASH. — Gantry has secured a $27.8 million permanent loan to refinance maturing debt for Hazel Dell Marketplace, a grocery-anchored retail center in Vancouver. Situated on 28 acres at 408-512 NE 81st St., Hazel Dell offers 227,680 rentable square feet spread across 11 buildings. Current tenants include Safeway, Ross, Marshalls and Parkrose Hardware. Blake Hering and Abi Hunter of Gantry represented the borrower, a family office owner and developer partnership between two family office groups, in the financing. The fixed-rate, 10-year loan was secured from one of Gantry’s exclusive correspondent life company lenders and features an introductory interest-only period and a 30-year amortization schedule. Gantry will service the loan.

PHOENIX — Voit Real Estate Services has arranged the purchase of 4645 E. Cotton Center Boulevard, a multi-tenant office property in Phoenix. PRH XXXXV LLC, a private investor, acquired the asset for $10 million, or $86 per square foot, from an undisclosed seller. Situated within Cotton Corporate Center, the 116,858-square-foot property underwent $9.4 million in renovations and capital improvements over the past decade. Mike Bench of Voit represented the buyer, while Chris Toci, Eric Wichterman and Mike Coover of Cushman & Wakefield represented the seller in the deal.

SANDY, ORE. — Senior Living Investment Brokerage (SLIB) has arranged the sale of Mount Hood Senior Living, a vacant 44-unit assisted living and memory care community located in Sandy, roughly 30 miles southeast of Portland. Totaling 26,000 square feet, the property was updated in 2022. A local operator acquired the community, which it plans to reopen. Jason Punzel, Vince Viverito, Brad Goodsell, Jake Anderson and Taylor Graham of SLIB brokered the transaction.