TEMPE, ARIZ. — Transwestern Real Estate Services has arranged the sale of two office buildings located at 8530-8550 S. Priest Drive in Tempe. Widewaters acquired the asset from Target Corp. for $20.5 million. Built in 2003 and renovated in 2019, the asset features two two-story, 94,480-square-foot buildings and a two-level parking garage. The 25-acre lot offers direct access to Interstate 10 and Loop 202. Paul Borgesen, Dylan Sproul and Royden Hudnall of Transwestern represented the buyer, while Bill Bayless of CBRE represented the seller in the deal. William Zurek and Jim Achen Jr. of Transwestern joined the acquisition team to market the property for either sale or lease.

Western

OAKLEY, CALIF. — RealSource Group has arranged the ground lease sale of a single-tenant convenience store and fuel station located at 1050 Laurel Road in Oakley. California Capital & Investment Group sold the asset to 7-Eleven, which exercised its Right of First Refusal on the property, for an undisclosed price. Jonathan Schiffer and Austin Blodgett of RealSource represented the seller in the deal. 7-Eleven occupies the 3,795-square-foot building that was built in 2019 on 1.2 acres. The property is subject to a triple-net ground lease with over nine years remaining on the initial 15-year term, 10 percent rent increases every five years and three five-year renewal options.

Spectrum Retirement Receives $330M Refinancing for Seniors Housing Portfolio in Midwest, Southwest

by John Nelson

DENVER — Spectrum Retirement, a Denver-based seniors housing owner-operator, has received $330 million for the refinancing of a portfolio of eight seniors housing properties that are located across the Midwest and Southwest United States. Ryan Stoll and Taylor Mokris of BWE, a national commercial and multifamily mortgage banker, arranged the financing on behalf of Spectrum Retirement. The nonrecourse debt was structured with full-term interest-only payments and a “competitive” interest rate. “We are honored that Spectrum chose BWE to represent them in the debt capital markets for such a complex transaction,” says Stoll, national director of BWE’s Seniors Housing and Care team. “It is a privilege to partner with one of the industry’s most respected owners and operators, and Spectrum exemplifies the highest standard of excellence.” The direct lender was not released, but BWE disclosed that the lender was a “global private credit investor.” BWE also said the transaction drew interest from multiple capital sources, including agencies, life insurance companies, banks and private credit firms. The eight-property portfolio spans major metropolitan areas in four states, all of which benefit from attractive demographics and sustained demand for high-quality senior living, according to BWE. The properties include Green Oaks Senior Living and Palos Heights …

Ellis Partners, Baupost Group Buy 460,000 SF Multi-Building Office Campus in Santa Clara, California

by Amy Works

SANTA CLARA, CALIF. — Ellis Partners, in partnership with The Baupost Group, has purchased Campus at Scott, a Class A office campus in Santa Clara, from New York-based Clarion Partners for an undisclosed price. The three-building, 460,000-square-foot property is located at 3315, 3325 and 3355 Scott Blvd. The partnership plans to upgrade the asset’s amenities including fitness, food and outdoor areas.

Newcastle Partners Breaks Ground on 406,138 SF Industrial Development in Hesperia, California

by Amy Works

HESPERIA, CALIF. — Newcastle Partners has broken ground on an industrial development located at 9260 Mesa Linda St. in Hesperia. Situated on 18.3 acres with immediate access to I-15, the project will offer 406,138 square feet of Class A industrial space. Ryan Lal and Dante Borruso of Voit Real Estate Services are overseeing all marketing, sales and leasing efforts for the property.

Marcus & Millichap Arranges $24M Sale of Vacant Retail Building in Glendale, California

by Amy Works

GLENDALE, CALIF. — Marcus & Millichap has arranged the sale of a vacant retail building located on 2.4 acres at South Central Avenue and Chevy Chase Drive in Glendale. Aria Investments LLC sold the asset to the City of Glendale for $24 million. The city plans to develop a park and recreation center on the site, which includes a 33,818-square-foot retail building formerly occupied by JoAnn Fabrics. Sheila Alimadadian of Marcus & Millichap represented the seller and procured the buyer in the deal.

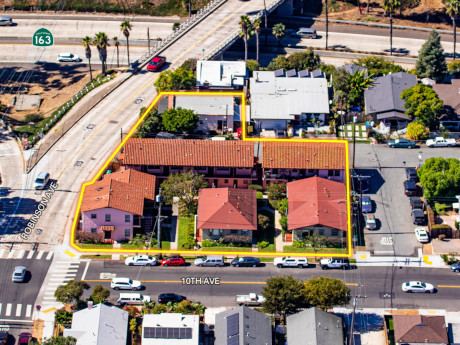

SAN DIEGO — Pacific Coast Commercial Real Estate has negotiated the sale of Del Oro Apartments, a value-add multifamily property in San Diego’s Hillcrest neighborhood. John Lopez and Cheryl Lopez acquired the asset from an undisclosed seller for $4.5 million. Citizens Private Bank provided acquisition financing for the buyers. Located at 3748-3772 Tenth Ave. and 918 Robinson Ave., Del Oro Apartments consists of an 18-unit apartment building and an adjacent duplex. The properties offers 15 studios averaging 326 square feet and five one-bedroom/one-bath units averaging 447 square feet. Zoned RM-3-9, the property also features nine garages. Ken Robak and David Dilday of Pacific Coast Commercial represented the seller, while Patti McKelvey of Coldwell Bank West represented the buyers in the transaction. Chicago Title Co. managed escrow and title services.

DENVER — Pinnacle Real Estate Advisors has directed the $2.9 million sale of an industrial building located at 4571 Ivy St. in Denver. Mark Alley of Pinnacle handled the transaction. The names of the buyer and seller were not released. The 15,500-square-foot building features a secure yard for outdoor storage.

MOUNTAIN HOUSE, CALIF. — Brixton Capital has purchased The Market Mountain House, a neighborhood shopping center in Mountain House, from Shea Properties for $32 million. The fully leased property offers 86,872 square feet of retail space spread across five buildings. Current tenants include Safeway and its affiliated fuel station, Starbucks Coffee, The UPS Store, Great Clips and Haagen-Dazs. Rob Ippolito, Pete Bethea, Glenn Rudy, Nicholas Ricardo and Warren McClean of Newmark represented the Aliso Viejo, Calif.-based seller, while Brixton was self-represented in the transaction.

SRS Real Estate Arranges $9.3M Sale of KinderCare-Occupied Flex Property in Broomfield, Colorado

by Amy Works

BROOMFIELD, COLO. — SRS Real Estate Partners has brokered the sale of a newly developed flex building located at 1101 Spring Place in Broomfield. A Denver-based private developer sold the property to a Kansas City-based private investor for $9.3 million. Ryan Tomkins of SRS Capital Markets represented the seller in the transaction. Portland, Ore.-based KinderCare occupies the 12,000-square-foot property under a 15-year corporate-guaranteed, triple-net lease. KinderCare operates more than 2,400 locations in 40 states.