SEATTLE — The Simon | Anderson Multifamily Team at Kidder Mathews has arranged the $19 million sale of Cornelius Apartments, located at 306 Blanchard St. in Seattle’s Belltown neighborhood. Dylan Simon, Jerrid Anderson, Matt Laird and JD Fuller of Simon | Anderson Multifamily represented the undisclosed seller in the deal. The name of the buyer was not released. Built in 1925 as a hotel, the nine-story building features 137 apartments, averaging 455 square feet.

Western

WINDSOR, COLO. — MAG Capital Partners has purchased an industrial complex at 9952 Eastman Park Drive in Windsor in a sale-leaseback with Kodak Moments, a business unit of Kodak Alaris Holdings Limited, for an undisclosed price. Kodak Moments will continue to occupy the 305,984-square-foot property, which has housed its operations since 1970. Mark West and Sam Koziol of JLL represented the seller in the sale-leaseback transaction. Terms of the sale were not released.

EVERETT, WASH. — Gantry has secured a $17.1 million permanent loan to refinance a maturing construction-to-permanent loan for a warehouse property located at 7301 Hardeson Road in Everett. FedEx fully occupies the 123,000-square-foot facility as a regional shipping center. FedEx took occupancy of the property, after construction in 2019, on a long-term lease. Tony Kaufmann and Joe Foley of Gantry secured the loan on behalf of the borrower, a private real estate investor. The 10-year, fixed-rate loan was secured from one of Gantry’s correspondent life company lenders with a partial interest-only period followed by 30-year amortization. Gantry will service the loan.

SRS Real Estate Partners Negotiates $5.9M Sale of Retail Property in Winchester, California

by Amy Works

WINCHESTER, CALIF. — SRS Real Estate Partners has arranged the sale of a three-tenant retail building within French Valley Marketplace at 35974 Winchester Road in Winchester. A Southern California-based private developer sold the asset to a La Jolla, Calif.-based private investor for $5.9 million. The 7,226-square-foot property is occupied by Panera Bread and Toro Sushi on long-term absolute triple-net leases. The asset also has one available unit. Matthew Mousavi, Patrick Luther and Jack Cornell of SRS Capital Markets represented the seller in the transaction.

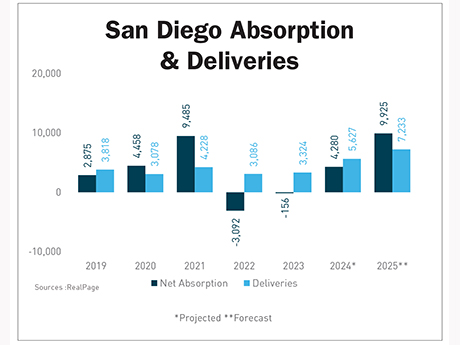

— By Berkadia — San Diego’s apartment market is poised to strengthen in 2025, with demand poised to set a record and fundamentals outperforming most other major California metros. This is a welcome change from 2024, where a slower leasing environment for Class A properties led to more concessions. The big story is demand. More than 9,900 net units are expected to be leased this year, surpassing the previous high of 9,500 in 2021. This figure will also outpace what is likely to be a record year for new deliveries, with 7,233 units slated to debut this year across the metro. By year-end, occupancy is projected to climb to 96.3 percent, up 90 basis points from 2024 and above the market’s 10-year pre-pandemic average. That puts San Diego ahead of Los Angeles, San Francisco-Oakland and San Jose on the occupancy leaderboard. Effective rent is expected to rise 3.1 percent year over year to a projected $2,868, marking a solid improvement from last year’s flat performance. Fundamentals Point to a Solid Year Employment growth remains a tailwind. The metro added 16,200 new jobs between May 2024 and May 2025, pushing total employment to nearly 1.6 million. That economic momentum is supporting …

JLL Arranges $28.5M Construction Financing for 104-Unit Multifamily Project in Santa Maria, California

by Amy Works

SANTA MARIA, CALIF. — JLL Capital Markets, on behalf of Santa Barbara, Calif.-based Vernon Group, has secured a $28.5 million construction financing for The Lofts, a Class A multifamily property in downtown Santa Maria. The project is a component of Phase I in the Santa Maria Town Center redevelopment, a master-planned expansion initiated by the City of Santa Monica to revitalize the downtown core. The Lofts will feature 104 loft-style apartments ranging from 600 square feet to 1,200 square feet. Located at 201 Town Center East, the existing building will be converted to a courtyard format with double-loaded corridors for apartments. Constructed is slated for completion in June 2027. Matt Stewart, Alex Olson, Ace Sudah, Kyle White and Jacob Michael of JLL represented the borrower in the financing.

MORGAN HILL, CALIF. — Steadfast Senior Living has sold Loma Clara, a 67-unit seniors housing community located in Morgan Hill, for an undisclosed price. LTC REIT was the buyer. Completed in 2018, Loma Clara features 42 assisted living units and 25 memory care units. The property was roughly 92 percent occupied at the time of sale. Units total 529 square feet on average. Amenities at the community include a theater, fitness center, activity and game rooms, a library, outdoor courtyard, physical therapy space and bistro. Discovery Management will continue to operate the property. Aaron Rosenzweig and Dan Baker of JLL arranged the sale on behalf of the seller.

SOUTH LAKE TAHOE, CALIF. — Gantry has secured an $11.7 million construction loan for the development of a 14 for-sale townhome project in South Lake Tahoe. Located at 3708 Lake Tahoe Blvd. and 3709 Osgood Ave., South Lake Tahoe Townhomes will offer 14 for-sale townhomes within walking distance of the lake, stateline casinos and other amenities. Peter Hillakas, Robert Slatt and Keegan Bridges of Gantry represented the borrower, a private real estate investor. The 18-month loan was provided from Gantry’s extensive roster of lenders specializing in construction financing.

ANAHEIM, CALIF. — Marcus & Millichap has arranged the sale of Glencrest Apartments, a multifamily property in Anaheim. A local family sold the asset to a limited liability company for $7.6 million. Glencrest Apartments offers 31 apartments, a swimming pool, two onsite laundry facilities and ample garage parking. Drew Holden, Nick Kazemi and Tyler Leeson of The Leeson Group of Marcus & Millichap represented the seller, while Christian Tait procured the buyer in the deal.

PSRS Arranges $6.5M Refinancing for Outdoor Storage, Parking Facility in Gardena, California

by Amy Works

GARDENA, CALIF. — PSRS has secured $6.5 million in refinancing for an outdoor storage and parking facility totaling 117,250 square feet in Gardena. Michael Warner of PSRS arranged the 100 percent cash-out refinance to create liquidity for the beneficiaries on an irrevocable trust. The trust holds the property on behalf of third-generation beneficiaries, both of whom reside out of state. A bank provided the recourse loan, which features a two-year interest-only term and a 55 percent loan-to-value ratio.