OGDEN, UTAH — Greystone has arranged a $22.5 million loan to refinance debt on TREEO South Ogden, a seniors housing community in Ogden, approximately 30 miles north of Salt Lake City. Tyler Armstrong, managing director at Greystone, placed the bank loan for Leisure Care, which owns the 143-unit independent living community. The regional bank loan was executed as a floating-rate financing carrying a five-year term and 30-year amortization. The loan featured 12 months of interest-only payments and a mid-200 basis points loan spread.

Utah

Dwight Capital Provides $21.4M HUD Loan for Paxton 365 Apartment Complex in Salt Lake City

by Amy Works

SALT LAKE CITY — Dwight Capital has provided a $21.4 million HUD 223(f) loan for Paxton 365, a mixed-use multifamily property in Salt Lake City. The refinancing benefitted from a Green Mortgage Insurance Premium Reduction, as Paxton 365 is Energy Star certified. The asset features a five-story building with 121 residential units and three commercial spaces, including Paxton Pub. Community amenities include a dog park, courtyard with fire pit, fitness center, roof terrace, community lounge, grill areas and electric vehicle charging stations.

Matthews Brokers $7.7M Sale of Sunbelt Rentals-Occupied Retail Facility in Salt Lake City

by Amy Works

SALT LAKE CITY — Matthews Real Estate Investment Services has arranged the all-cash sale of a retail property located at 1545-1555 W. 2100 South in Salt Lake City. The property traded for $7.7 million, or $462.24 per square feet. Sunbelt Rentals, an equipment and tool rental company, occupies the 16,658-square-foot facility. Ahstead Group owns Sunbelt, which is the second largest equipment rental company in the United States and has more than 1,150 locations nationwide. Isaac Wulff and Alexander Harrold of Matthews represented the seller in the transaction. The names of the seller and buyer were not released.

SPRINGVILLE, UTAH — Regents Park Brixton has completed the disposition of Next Step Business Park, a three-building industrial campus in Springville, a suburb of Provo. San Diego-based Hearthstone Capital acquired the 75,864-square-foot asset for an undisclosed price. Located at 317 N. 2000 W, Next Step Business Park consists of three single-story, newly constructed buildings ranging in size from 18,926 square feet to 28,480 square feet. The property is fully leased to a variety of tenants. Bryce Blanchard of Newmark brokered the transaction.

SALT LAKE CITY — Pacific Industrial has completed the construction of Pacific Summit Logistics Center, an industrial facility at 885 N. John Cannon Drive in Salt Lake City. The development and investment firm has already sold the asset on a forward basis to Principal Global Investors, a global real estate investments platform based in Des Moines, Iowa, for an undisclosed price. Situated on 48 acres, the 824,320-square-foot facility features 40-foot clear heights, nearly 200 trailer parking stalls, a private perimeter vehicle access road and a modern entry. At the time of sale, the building was 50 percent preleased to Quality Distribution, a third-party logistics provider headquartered in Utah. Jeff Chiate, Rick Ellison, Mike Adey, Brad Brandenburg and Matthew Leupold of Cushman & Wakefield’s National Industrial Advisory Group together with Tom Freeman and Travis Healey of Cushman & Wakefield’s Salt Lake City office represented the seller. Freeman and Healey were retained by Principal Global Investors to handle leasing of the project. According to Cushman & Wakefield, the transaction is one of the largest ever single-building industrial property sales in Salt Lake City.

OGDEN, UTAH — Marcus & Millichap has brokered the sale of South Weber Storage, a self-storage facility in Ogden. Terms of the transaction were not released. Jordan Farrer and Adam Schlosser of Marcus & Millichap’s LeClaire-Schlosser Group represented the seller, a local partnership, and procured the undisclosed buyer. Totaling 26,060 square feet, South Weber Storage consists of five single-story buildings offering a total of 136 non-climate-controlled drive-up units. The facility features brick front dividers with all metal interior walls, slightly pitched standing seam metal roofs, roll-up doors and asphalt driveways.

LAYTON, UTAH — A local investment and development group has completed the disposition of Storage General – Layton, an 86,105-square-foot self-storage facility located on Antelope Drive in Layton. A REIT acquired the asset for an undisclosed price. Jordan Farrer and Adam Schlosser of Marcus & Millichap represented the seller and procured the buyer in the transaction. Storage General – Layton features 11 single-story buildings offering interior, drive-up, climate-controlled and traditional self-storage units with roll-up doors. The property has cinderblock front dividers with all metal interior walls, slightly pitched standing seam metal roofs, roll-up doors and driveways.

TWG Plans $13M Residences at Fireclay Affordable Seniors Housing Project in Murray, Utah

by Amy Works

MURRAY, UTAH — TWG has unveiled plans for Residences at Fireclay, a $13 million affordable seniors housing community in Murray. Construction is slated to begin this year, with the first units available in 2025. Located at 152 W. 4250 South, the four-story building will feature 40 one-bedroom apartments for seniors age 62 and older. The units are also reserved for those earning up to 50 percent of the area median income, with a preference for military veterans. Additionally, the project includes four units reserved for disabled seniors and five units available for seniors who have experienced homelessness. Community amenities will include a fitness room, community-raised garden, community room with kitchen and a computer room. TWG has partnered with First Step House, a Salt Lake City-based nonprofit that addresses addiction, mental health, homelessness and criminal justice, to provide services and referrals for residences. The project was made possible with Low Income Housing Tax Credits from the Utah Housing Corp. Additional key partners include Olene Walker Housing Loan Fund, Raymond James and Horizon Bank.

Safehold Arranges $26.5M Ground Lease for Multifamily Development in South Salt Lake, Utah

by Amy Works

SOUTH SALT LAKE, UTAH — Safehold (NYSE: SAFE) has arranged a $26.5 million ground lease to facilitate the ground-up development of One Burton, an apartment community in South Salt Lake’s new downtown district. Abstract Development Group, an affiliate of a New York-based multifamily real estate owner, will develop the 180-unit community within a Qualified Opportunity Zone.

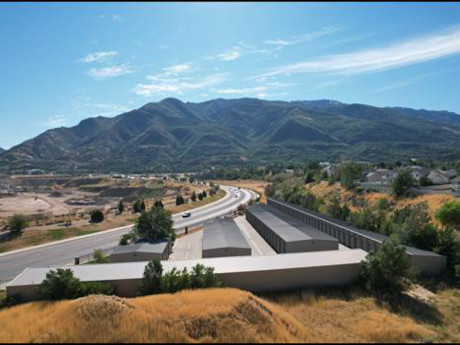

MARRIOTT-SLATERVILLE, UTAH — St. John Properties has broken ground on 12th Street Exchange, a 19-acre business park located at 1200 South and S 1900 West in Marriott-Slaterville, approximately 35 miles north of Salt Lake City. Once completed, 12th Street Exchange will offer 170,000 square feet of commercial flex/R&D and retail space. This project is St. John Properties’ fourth Utah development and its first project north of Salt Lake City in Weber County.