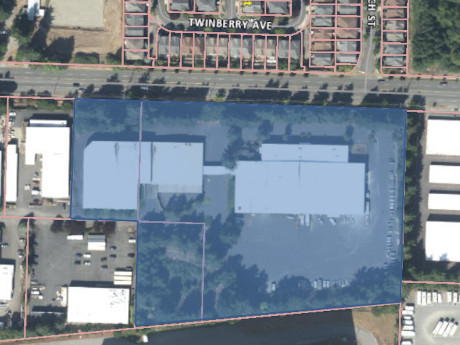

TACOMA, WASH. — Tacoma Public Schools (TPS) has purchased a two-building industrial property in Tacoma from Broadstone Cable LLC for $12.1 million. Located at 4401 S. Orchard St. on 6.1 acres, the asset offers 86,000 square feet of industrial space. The buyer plans to use the property for its construction and operational plans. Vladimir Olyanich and Bob Frederickson of Coldwell Banker Commercial Danforth managed the transaction for TPS.

Washington

CASHMERE, WASH. — Senior Living Investment Brokerage (SLIB) has arranged the sale of a seniors housing community located in Cashmere in central Washington. Situated on roughly 1.5 acres, the community comprises 42 units. A regional owner-operator seeking to expand its footprint in the state acquired the property for an undisclosed price. The seller was a local owner-operator exiting the industry. Jason Punzel, Vince Viverito, Jake Anderson and Taylor Graham of SLIB brokered the transaction.

Gantry Secures $10.2M Refinancing for Terminal Sales Office Building in Downtown Seattle

by Amy Works

SEATTLE — Gantry has secured a $10.2 million permanent loan to refinance the historic Terminal Sales office building in downtown Seattle. Located at 1932 1st Ave., adjacent to Pike Place Market, the 11-story, 92,400-square-foot building was originally delivered in 1925. The property was eventually renovated to serve as modern creative office space and includes street-level retail space. Mike Wood and Tim Brown of Gantry represented the borrower, a private real estate investor. The 10-year, fixed-rate nonrecourse loan was secured by Gantry’s network of insurance company correspondent lenders with 25-year amortization. Gantry will service the loan for the lender.

BOTHELL, WASH. — Colliers has arranged the sale of the Wright Group Building, an office and flex property located at 19201 120th Ave. NE in Bothell’s North Creek business park. RH Wright LLC sold the asset to Gravestone Partners for $10.2 million. Totaling 59,830 square feet, the building offers 25,000 square feet office space supported by flex and warehouse elements. The property features at least 20-foot clear heights, two dock-high doors, eight grade-level doors and 1,000 amps of power. At the time of sale, the building was partially occupied by a mix of office and service-oriented tenants, including Trane Technologies, Element Materials Technologies, ISEC Construction, Taekwondo Way, Biogenesis and Barry Glenn State Farm. David Gunther of Colliers represented the seller in the deal.

TUKWILA, WASH. — InSite Property Group has acquired Tukwila Self Storage, a 53,200-square-foot self-storage facility in Tukwila. Terms of the transaction were not disclosed. Located at 5950 Southcenter Blvd., Tukwila Self Storage features 621 climate-controlled units. Jacob Becher, Nat Fliflet, Dan Haddock and Harrison Cohen of Colliers represented InSite in the acquisition.

OLYMPIA, WASH. — Northmarq has arranged the sale of Merritt Manor, a mid-rise apartment community in Olympia. Fourth Street’s Merritt Manor LLC sold the asset to Merritt Manor LLC for $19.5 million. Joe Kinkopf, Steve Fischer and Tyler Smith of Northmarq’s Seattle Investment Sales team represented the seller in the transaction. Located at 3335 Martin Way E, Merritt Manor features 82 two- and three-bedroom apartments with stainless steel appliances, granite countertops, moving kitchen islands, full-size washer/dryers, carpets bedrooms and walk-in closets. Community amenities include a community garden, grilling area, playground, basketball court, community lounge, EV charging station, ample off-street parking, elevator access and video patrol. The property was built in 2020.

LYNNWOOD, WASH. — Integral NW has completed the disposition of Allegro Lynnwood, an apartment community located at 16525-16605 Ash Way in Lynnwood. The Housing Authority of Snohomish County acquired the asset for $77.5 million. Bryon Rosen, Tim McKay, Dan Chhan, Matt Kemper, Jacob Odegard, Dylan Roeter, David Karson and Chris Moyer of Cushman & Wakefield represented the seller and procured the buyer in the transaction. Allegro Lynnwood features 240 studio, one- and two-bedroom apartments delivered in two phases — Allegro Ash Creek in 2019 and Allegro at The Woods in 2025. Community amenities include a resort-style outdoor pool and spa, a fitness center, resident clubhouse with social and work-from-home spaces, a dog park, secure underground parking and lofted ceilings in select homes.

SEATTLE — Amazon (NASDAQ: AMZN) has unveiled plans to close its Amazon Go and Amazon Fresh physical stores, converting various locations into Whole Foods Market stores. The Seattle-based e-commerce giant states that it hasn’t “yet created a truly distinctive customer experience with the right economic model needed for large-scale expansion.” Customers can continue to shop Amazon Fresh online in available areas for delivery. At the same time, Amazon plans to open more than 100 new Whole Foods Market stores over the next few years, citing increased investment in “physical stores that are resonating with customers.” Amazon acquired the Austin-based natural and organic foods grocer in 2017 in a $13.7 billion deal. Since then, the brand has experienced over 40 percent sales growth and expansion to more than 550 locations. There are 14 Amazon Go convenience stores located in Washington, California, Illinois and New York. According to the company, Amazon Go locations served as innovation hubs where Amazon developed Just Walk Out technology — now a scalable checkout-free solution operating in over 360 third-party locations across five countries. There are 58 Amazon Fresh grocery stores located in California, Illinois, New York, New Jersey, Maryland, Pennsylvania, Washington, Viriginia and Tennessee. Amazon says …

Mesa West Capital Originates $201.5M Loan Package for mResidences Portfolio Acquisition

by Amy Works

LOS ANGELES — Mesa West Capital has provided a joint venture between Interstate Equities Corp. and PGIM with a $201.5 million loan package for the previously announced acquisition of the mResidences Portfolio. The four properties, located in Mountain View, Redwood City and Sunnyvale, Calif., and Seattle, offer a total of 564 units. Eastdil Secured arranged the financing.

FEDERAL WAY, WASH. — Lument has provided a $21.5 million loan for the refinancing of a seniors housing community located in Federal Way, roughly 25 miles south of Seattle. Village Green of Federal Way totals 170 units, with 136 assisted living units and 34 independent living cottages. Casey Moore of Lument arranged the HUD/FHA Section 232/223(f) loan on behalf of the borrower, a family-owned company. The loan features a fixed interest rate and 35-year term.

Newer Posts