BOTHELL, WASH. — Security Properties has completed the disposition of Woodstone Apartments, a multifamily property located at 16520 North Road in the Seattle suburb of Bothell. An undisclosed buyer acquired the asset for $34.7 million. Eli Hanacek, Mark Washington, Kyle Yamamoto and Natalie Kasper of CBRE represented the seller in the deal. Built in 1989 on 6.4 acres, Woodstone Apartments features 124 one-, two- and three-bedroom units, 86 percent of which are renovated. Community amenities include a pool, spa, fitness center, playground and clubhouse.

Washington

Kauri Investments Buys Medical Office Building in Bellevue, Washington for 150-Room Hotel Redevelopment

by Amy Works

BELLEVUE, WASH. — Seattle-based Kauri Investments has acquired a freestanding medical office building, located at 1300 116th Ave. in the Seattle suburb of Bellevue, for $6.7 million. The seller and existing tenant, Eye Clinic of Bellevue, will lease back the 5,519-square-foot building until the ophthalmology practice moves into a more modern facility. Once the lease ends, Kauri plans to redevelop the asset, which is on a large parcel, into a 150-key hotel. Kauri Investments currently owns six other hotel sites Washington and Oregon. Pat Mutzel of Cushman & Wakefield’s private capital group in Seattle brokered the off-market transaction.

SEATTLE, WASH. — Marcus & Millichap has brokered the sale of a 5,178-square-foot land parcel at 849 NW Market St. in Seattle. A private investor acquired the asset for $1.8 million, or $51,000 per unit. Jake Morse, Ryan Dinus and Sidney Warsinske of Marcus & Millichap’s Seattle office represented the buyer in the deal. The 5,178-square-foot parcel is fully entitled for a 35-unit multifamily development.

American Capital, Clarion Partners to Develop 316-Unit Enso Multifamily Project in Lynnwood, Washington

by Amy Works

LYNNWOOD, WASH. — American Capital Group and Clarion Partners have formed a joint venture to develop Enso, an apartment community in Lynnwood, approximately 15 miles north of Seattle. Pacific Life Insurance Co. served as construction lender for the project, with construction scheduled to commence in August for completion in summer 2026. Located at 4001 198th St. SW, Enso will feature 312 apartments, more than 4,200 square feet of retail space, ample parking, a 2,600-square-foot co-working space, a 3,000-square-foot fitness facility, a 2,400-square-foot game lounge and a 2,600-square-foot resident lounge, as well as a dog wash and bike storage.

MERCER ISLAND, WASH. — Gantry has secured a $40 million permanent loan for the refinancing of Mercer Apartments on Mercer Island, a Puget Sound community between Seattle and Bellevue. Located at 7650 SE 27th St. and 2558 76th Ave. SE, Mercer Apartments features 235 apartments and 20,000 square feet of ground-floor retail space. The unit mix includes studio, one- and two-bedroom floorplans. Community amenities include barbecue areas, an outdoor heated pool and spa, community clubhouse, fitness facilities and concierge services. A restaurant, nail salon and interior design studio and showroom occupy the retail space. Mike Wood and Alicia Sabanero of Gantry secured the loan on behalf of the borrower, a private real estate investor. The 10-year, non-recourse loan features a fixed rate with full-term interest-only payments. A life insurance company provided the capital.

Graystoke Receives $16.9M Acquisition Loan for The Landing at Saddlerock Multifamily Property in Wenatchee, Washington

by Amy Works

WENATCHEE, WASH. — Graystoke Capital Partners has received $16.9 million in acquisition financing for The Landing at Saddlerock, a garden-style apartment property located at 1105 Red Apple Road in Wenatchee, approximately midway between Seattle and Spokane. Tony Nargi and Brock Knapp of JLL’s debt advisory team originated the seven-year, fixed-rate, near-stabilization. Fannie Mae loan, which JLL Real Estate Capital will service. Formerly known as Eleven01 at Saddlerock, The Landing at Saddlerock features 84 one-, two- and three-bedroom units featuring quartz countertops, stainless appliances and nine-foot ceilings. Community amenities include a leasing office, dog run, gazebo, gas grills and access to local trail systems. At the time of sale, the property was 82 percent occupied and 85 percent leased. The community opened in December 2023. Fortified Property Solutions, Graystoke’s integrated property management company, will manage the asset. The seller and price were not disclosed.

VANCOUVER, WASH. — JLL has directed the sale of Van Mall Retirement, a seniors housing community in Vancouver, just across the Columbia River from Portland, Oregon. Lytle Enterprises sold the asset to a regional Pacific Northwest owner and operator for $28 million. Located at 7808 NE 51st St., Van Mall Retirement features 191 independent living and assisted living units in one- and two-bedroom layouts. The property was constructed in 1989 and expanded in 1994. The pet-friendly community features an on-site theater; salon and barbershop; fitness center; activity and games room; arts and crafts studio; library; and bistro. Jay Wagner, Rick Swartz, Aaron Rosenzweig, Alanna Ellis, Dan Baker and Dean Ferris of JLL Capital Markets represented the seller, procured the buyer and procured acquisition financing from a regional bank on behalf of the buyer in the transaction.

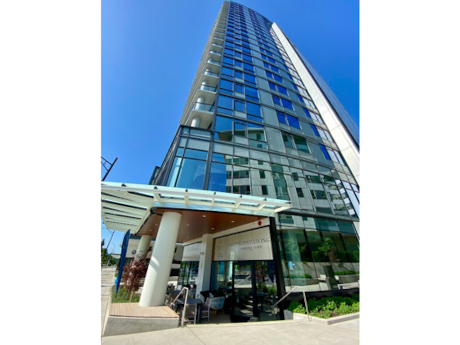

BELLEVUE, WASH. — Watermark Retirement Communities and Alliance Residential Co. have completed construction of a new independent living tower at Watermark at Bellevue in the Seattle suburb of Bellevue. The community now offers a continuum of care, with its existing assisted living and memory care spaces. The property features 110 assisted living apartments and 26 memory care units. The expanded Watermark at Bellevue, now totaling 360,000 square feet, spans an entire city block. The 155-unit, 22-story independent living tower features studios, one-bedroom and two-bedroom apartments. Watermark at Bellevue is adjacent to the 190-unit Broadstone Savoie, which is a luxury multifamily project featuring studios, one-bedroom and two-bedroom apartments, as well as townhomes.

Vista Residential Partners Breaks Ground on 238-Unit One26 Vista Multifamily Project in Vancouver, Washington

by Amy Works

VANCOUVER, WASH. — Vista Residential Partners, along with PCCP and Principal Asset Management, has broken ground on One26 Vista, an apartment community in Vancouver, just across the Columbia River from Portland, Oregon. Situated on nine acres on NE 72nd Avenue, One26 Vista will feature 238 one-, two- and three-bedroom apartments, averaging approximately 920 square feet. LSW Architects designed the garden-style apartment property, which will offer secure access entries, stainless steel appliances, quartz countertops, kitchen tile backsplashes, laminate cabinets and flooring, roller shades and air conditioning. Community amenities will include a clubhouse, fitness center, pool, hot tub, enclosed dog park and package concierge. Krevolin & Horst of Atlanta represented Vista Residential Partners.

— By Candice Chevaillier, CCIM, Principal, Lee & Associates | Pacific Northwest Multifamily Team — Absorption still lags supply in the Seattle MSA contributing to higher vacancy and flat rents. In Q1 2024 3,000 units were delivered, yet only 2,800 were absorbed. Vacancy is stabilizing at 6.9 percent this quarter and then is expected to trend down starting in Q3, finally allowing meaningful growth in rents. Construction costs remain high and options for financing limited, curtailing new development. This is creating demand for existing value-add acquisitions. 2024 and 2023 sale volume in the Seattle MSA is still a trickle of what it was in 2022 and 2021, shifting Cap Rates slowly upwards. This trend is expected to be short-lived. As interest rates finally begin to fall, and rents begin to rise, investors who catch this inflection point will prevail from best pricing and benefit while more conservative capital sits on the sidelines.