VANCOUVER, WASH. — JLL has directed the sale of Van Mall Retirement, a seniors housing community in Vancouver, just across the Columbia River from Portland, Oregon. Lytle Enterprises sold the asset to a regional Pacific Northwest owner and operator for $28 million. Located at 7808 NE 51st St., Van Mall Retirement features 191 independent living and assisted living units in one- and two-bedroom layouts. The property was constructed in 1989 and expanded in 1994. The pet-friendly community features an on-site theater; salon and barbershop; fitness center; activity and games room; arts and crafts studio; library; and bistro. Jay Wagner, Rick Swartz, Aaron Rosenzweig, Alanna Ellis, Dan Baker and Dean Ferris of JLL Capital Markets represented the seller, procured the buyer and procured acquisition financing from a regional bank on behalf of the buyer in the transaction.

Washington

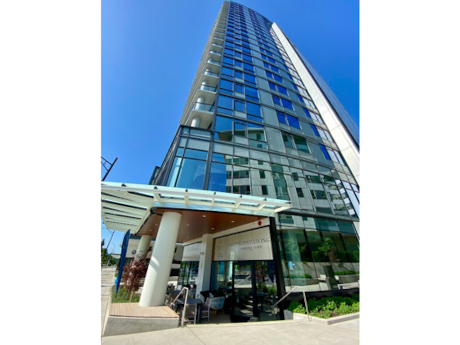

BELLEVUE, WASH. — Watermark Retirement Communities and Alliance Residential Co. have completed construction of a new independent living tower at Watermark at Bellevue in the Seattle suburb of Bellevue. The community now offers a continuum of care, with its existing assisted living and memory care spaces. The property features 110 assisted living apartments and 26 memory care units. The expanded Watermark at Bellevue, now totaling 360,000 square feet, spans an entire city block. The 155-unit, 22-story independent living tower features studios, one-bedroom and two-bedroom apartments. Watermark at Bellevue is adjacent to the 190-unit Broadstone Savoie, which is a luxury multifamily project featuring studios, one-bedroom and two-bedroom apartments, as well as townhomes.

Vista Residential Partners Breaks Ground on 238-Unit One26 Vista Multifamily Project in Vancouver, Washington

by Amy Works

VANCOUVER, WASH. — Vista Residential Partners, along with PCCP and Principal Asset Management, has broken ground on One26 Vista, an apartment community in Vancouver, just across the Columbia River from Portland, Oregon. Situated on nine acres on NE 72nd Avenue, One26 Vista will feature 238 one-, two- and three-bedroom apartments, averaging approximately 920 square feet. LSW Architects designed the garden-style apartment property, which will offer secure access entries, stainless steel appliances, quartz countertops, kitchen tile backsplashes, laminate cabinets and flooring, roller shades and air conditioning. Community amenities will include a clubhouse, fitness center, pool, hot tub, enclosed dog park and package concierge. Krevolin & Horst of Atlanta represented Vista Residential Partners.

— By Candice Chevaillier, CCIM, Principal, Lee & Associates | Pacific Northwest Multifamily Team — Absorption still lags supply in the Seattle MSA contributing to higher vacancy and flat rents. In Q1 2024 3,000 units were delivered, yet only 2,800 were absorbed. Vacancy is stabilizing at 6.9 percent this quarter and then is expected to trend down starting in Q3, finally allowing meaningful growth in rents. Construction costs remain high and options for financing limited, curtailing new development. This is creating demand for existing value-add acquisitions. 2024 and 2023 sale volume in the Seattle MSA is still a trickle of what it was in 2022 and 2021, shifting Cap Rates slowly upwards. This trend is expected to be short-lived. As interest rates finally begin to fall, and rents begin to rise, investors who catch this inflection point will prevail from best pricing and benefit while more conservative capital sits on the sidelines.

SEATTLE — Kidder Mathews has arranged the sale of Dexter Hayes, a multifamily property at 1701 Dexter Ave. N. in Seattle’s Westlake neighborhood. The asset traded for $18.8 million, or $290,000 per unit. Opened in 2016, Dexter Hayes offers 65 apartments with high-end finishes, spacious floor plans and large windows. Community amenities include a clubhouse, rooftop deck and an open-air central courtyard. Dylan Simon, Jerrid Anderson, Matt Laird and JD Fuller of the Simon and Anderson team at Kidder Mathews’ Seattle headquarters represented the undisclosed seller and buyer in the deal.

EVERETT, WASH. — A private investor has acquired Park Place Townhomes in Everett, a suburb north of Seattle, for $5.7 million. Located at 1225 W. Casino Road, Park Place Townhomes features 28 two- and three-bedroom townhome-style apartments, with an average size of 1,027 square feet. At the time of sale, the property was fully occupied. Zachary Mazzuca, Ryan Dinius and Sidney Warsinske of Marcus & Millichap’s Seattle office represented the seller, a private investor. Tanner Fogle, Dinius and Warsinske of Marcus & Millichap secured and represented the buyer in the deal.

— By Alex Muir, Senior Vice President, Lee & Associates | Seattle — As we near the halfway mark of 2024, capital markets activity in Seattle remains slow. The year has largely consisted of price discovery and waiting for interest rates to drop. With that said, the sales volume for office assets has nearly surpassed the 2023 total. Four transactions over $30 million have occurred year-to-date, all of which are larger than any deal last year. These sales are emblematic of the type of deals that are driving investment activity, with three being owner-user acquisitions — Alaska Airlines, Costco, Seattle Housing Authority — and the fourth involving a loan assumption. Distressed sales are occurring more frequently as well, with several buildings in downtown Seattle trading below $150/SF. While it has yet to materially impact vacancy, there are signs of life in the leasing market. Pokémon recently signed a lease for 16 floors in The Eight, an under-construction tower in the Bellevue CBD. This is the largest lease in the market in three years. Other tenants, such as ByteDance and Snowflake, have signed leases larger than 100,000 SF, as a new wave of tech companies grow in the market. With the …

SEATTLE — King County has purchased the Dexter Horton Building, an office building in downtown Seattle, for $36.6 million. The county worked with ING Group, a lender to the original property owner, to create a deal to transfer ownership. CIM Group acquired the asset in 2019 for $151 million. King County’s Department of Public Defense is one of nine tenants in the building and will now expand its presence at the property. The deal will save King County nearly $2 million per year in leasing costs and has the potential to be a future source of additional revenue to the county when new tenants fill the vacant space currently available in the building.

CAMAS, WASH. — Portland, Oregon-based WDC Properties has completed the disposition of Clara Flats, a mixed-use multifamily property in Camas, just across the Columbia River from Portland. An undisclosed, out-of-state buyer acquired the asset for $11.9 million. Located at 608 NE Birch St., the two-building Clara Flats features 30 apartments and two fully leased retail spaces. Completed in 2020, the property features mountain and river views. Jordan Carter, Clay Newton and Tyler Linn of Kidder Mathews represented the seller in the deal.

— By Vanessa Herzog, SIOR, CCIM, Principal, Lee & Associates | Seattle — Industrial markets in the Pacific NW are adjusting to new parameters but remaining steady. Vacancy rates are hovering around 7% in the 6-county region along the I-5 corridor (Arlington to Vancouver, WA). Leasing activity slowed in the first quarter but started picking up as we progress through the second quarter. New construction is active with permitted projects, but the regional project pipeline is diminishing, not due to demand, but due to high land price expectation, stabilized rental rates and continued high costs of new construction. We think this trend will continue well into 2025 leaving Developers and Land Sellers frustrated. Regionally, large land parcels are difficult to find or assemble, leaving Developers looking at infill assemblages, land use changes or full site redevelopment. IOS specialized properties are slowing in demand from Tenants. Finally, we are seeing the small owner user facilities for sale or lease, and the demand from this user group level off. Here are some statistics: Total Inventory at 398M SF, Current Vacancy rate 7% (27.8M SF), Market Asking Rates $1.12/SF/Mo., Sublease Space 20% of total vacancy (5.6 M/SF): New Construction underway 9.9M SF. Demand …