TACOMA, WASH. — Cushman & Wakefield and Greystone have jointly closed a $44 million loan for the for the refinancing of Koz on MLK Way, a newly built apartment community in Tacoma. Dave Karson, Chris Moyer, Paul Roeter, John Spreitzer and Jason Blankfein of Cushman & Wakefield’s Equity, Debt & Structured Finance team represented the borrower, an affiliate of Koz Development, in the financing. Greystone provided the Fannie Mae DUS loan. Located on Martin Luther King Junior Way, the six-story property features 161 apartments in a mix of studio, one-, two- and three-bedroom units averaging 395 rentable square feet. On-site amenities include a furnished courtyard space with barbecues and lounge seating; laundry facilities, including in-unit washers/dryers; and private balconies on select units. Additionally, the property features 6,370 square feet of ground-floor retail space.

Washington

Providence Sells 484,039 SF Office Portfolio in Renton, Washington to Seattle Children’s Hospital for $84M

by Amy Works

RENTON, WASH. — Providence has completed the disposition of the two-building Southgate Campus and four-building Valley Office Park in Renton. Seattle Children’s Hospital acquired the assets for a total of $84 million. Totaling 484,039 square feet, the portfolio includes: Southgate I, a 114,186-square-foot building at 2201 Lind Ave. SW Southgate II, a 160,853-square-foot property at 2001 Lind Ave. SW Valley Office Park, a 209,000-square-foot asset at 1801 Lind Ave. SW Valley Office Park is the current local headquarters of Providence and includes a Pacific Medical Group multi-specialty clinic. Garth Hogan, Kevin Shannon and Cavan O’Keefe of Newmark represented the seller in the transaction.

EVERETT, WASH. — CBRE has arranged the sale of Greentree Plaza, a shopping center located at 305-505 SE Everett Mall Way in Everett. ACF Property Management sold the retail center to Transnational Management for $23.7 million. Built between 1998 and 2004, Greentree Plaza offers 83,035 square feet of retail space. At the time of sale, the property was 96 percent leased to 18 tenants, including Chipotle, Starbucks Coffee, Sportsman’s Warehouse, Jamba Juice, Visionworks, Bank of America, Subway and Supercuts. The plaza shares a parking lot with a Target store, which was not included in the sale. Dino Christophilis and Daniel Tibeau of CBRE’s National Retail Partners represented the seller in the deal.

RENTON, WASH. — Clarion Partners has completed the disposition of Renton Logistics Center, a Class A industrial building located at 2501 E. Valley Road in Renton. An institutional buyer acquired the asset for an undisclosed price. Brett Hartzell and Paige Morgan of CBRE National Partners in the Pacific Northwest represented the seller in the deal. Built in 1996, the 459,349-square-foot, cross-dock facility features 30-foot clear heights, 75 dock-high doors, trailer parking, heavy power, recent upgrades to ESFR and energy-efficient lighting. At the time of sale, three tenants fully leased the property: Graybar, Swire Coca-Cola and Sealed Air.

It’s been quite the run for Seattle. Like many secondary markets out West, the Emerald City was a pandemic darling, racking up loads of new residents and workers over the past few years. Seattle-area employers added more than 102,600 workers in 2021 alone, according to Marcus & Millichap’s second-quarter market report, which predicts the area will add another 85,000 workers by year’s end. The report also forecasts Seattle’s population will increase by more than 220,000 residents over the next five years. All this activity has led to a bull run for multifamily owners, investors and developers. Net absorption in Seattle’s central business district surpassed the 5,000-unit mark for the first time on record last year, while rents have risen by 14 percent year over year. Demand was so fierce that all 20 of the metro’s submarkets recorded vacancy compression over the past four quarters, resulting in an average 2.8 percent vacancy rate, according to Marcus & Millichap. This is the lowest rate in two decades. Nearly 9,000 units — representing 1.9 percent of the supply — were added over the 12-month period that ended in March, with another 25,000 units still under construction at the end of the second quarter. …

Low Tide Properties, Continental Properties Receive $110M Refinancing for Met Tower Apartments in Downtown Seattle

by Amy Works

SEATTLE — Affiliates of Low Tide Properties and Continental Properties have obtained $110 million in financing for Met Tower, a multifamily property located at 1942 Westlake Ave. in Seattle. Citibank provided the loan, which Dave Karson, Alex Hernandez, Chris Moyer, Alex Lapidus and Meredith Donovan of Cushman & Wakefield Equity, Debt & Structured team arranged. Built in 2001, Met Tower features 366 apartments in a mix of studio, one- and two-bedroom floor plans along with 10,139 square feet of retail space and an attached, eight-level parking garage.

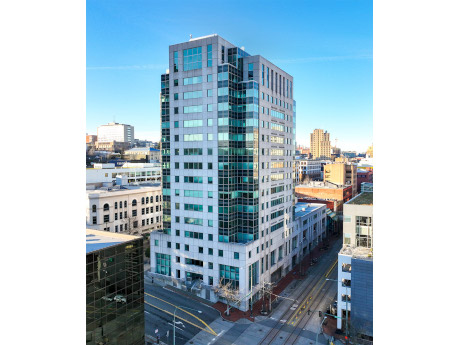

TACOMA, WASH. — Kirkland-based MJR Development has released plans to renovate the office building at 1145 Broadway in downtown Tacoma. Renamed as Tacoma Centre, the 15-story, 200,000-square-foot office building will include a café, bar, lounge areas, conference rooms and a fitness center with locker rooms. With the renovations, the tower will offer office space optimized for a culture of work/life balance and creative collaboration. Once complete, Tacoma Centre will offer a high-end lounge to accommodate casual team meetings, happy hours and corporate events and soirees. The remodeling will focus on common areas, and the building will remain open to tenants during construction. Interior designs will use natural materials, tall windows and expansive views. The renovation is slated for completion in summer 2023. MJR acquired the property, previously known as Tacoma Financial Center, in January 2022. Will Frame, Drew Frame and Ben Norbe of Kidder Mathews represented MJR in the sale and are now managing the leasing.

Marcus & Millichap Negotiates Sale of 19,200 SF Industrial Building in Lakewood, Washington

by Amy Works

LAKEWOOD, WASH. — Marcus & Millichap has brokered the sale of an industrial building located at 2520 112th St. S in Lakewood. A limited liability company sold the asset for $3.4 million. The buyer is a locally owned vehicle upfitter for law enforcement agencies and will occupy the 19,200-square-foot property for its own use. Matthew Herman and Stren Lea of Marcus & Millichap’s Seattle office represented the seller in the deal.

SEATTLE — Northmarq has arranged the $20.8 million cash-out refinancing of Carkeek Park Place Apartments in Seattle. Stuart Oswald of Northmarq’s Seattle office secured the 35-year, fixed-rate loan using the FHA 223(f) program through the firm’s in-house HUD/FHA division. The borrower is a multi-generational family business. Carkeek Park Place is a five-story building offering 80 market-rate apartments and 15,430 square feet of ground-floor commercial space. The building is part of a larger commercial shopping center that includes a QFC grocery store, which was not part of the collateral, and strip retail space.

Gantry Secures $12.5M Acquisition Loan for Industrial Building in Woodinville, Washington

by Amy Works

WOODINVILLE, WASH. — Gantry has secured $12.5 million in permanent financing for a private real estate investor’s purchased of a single-tenant industrial property in Woodinville. Mike Wood and Alex Saunders of Gantry secured the 10-year, fixed-rate loan through one of the firm’s life company lenders. Redapt, a technology service provider, occupies the 66,000-square-foot facility for its corporate office and production facility. The property is located at 14051 NE 200th St.