SEATTLE — Ryan Cos., as builder, and Aegis Living, as developer, unveils plans to develop a five-story assisted living and memory care community on Market Street in Seattle’s Ballard neighborhood. The team broke ground on the project in March, with opening slated for early 2024. Totaling 75,000 square feet, the community will feature 92 residential apartments, dining facilities, a movie theater, activity rooms, a wellness suite and community rooftop space. The property will also include business offices and one level of underground parking. DAHLIN is serving as architect for the project, which will be Aegis’ second senior living community in northwest Seattle. Ryan has built more than 60 senior living communities in 17 states across the country.

Washington

Sterling Realty Organization Sells Lake Tye Business Campus in Monroe, Washington for $45M

by Amy Works

MONROE, WASH. — Sterling Realty Organization has completed the disposition of Lake Tye Business Campus, a flex industrial property in Monroe. Redmond 8660 LLC acquired the asset for $45 million. Situated on 12.6 acres on 14655 Fryelands Blvd. SE., Lake Tye Business Campus features eight buildings offering a total of 214,364 square feet. Built in phases between 2004 and 2019, the campus was 99 percent leased at the time of sale. Zach Vall-Spinosa and Andy Miller of Kidder Mathews represented the seller in the deal.

Gantry Arranges $18M Construction Loan for Spec Industrial Development in Pacific, Washington

by Amy Works

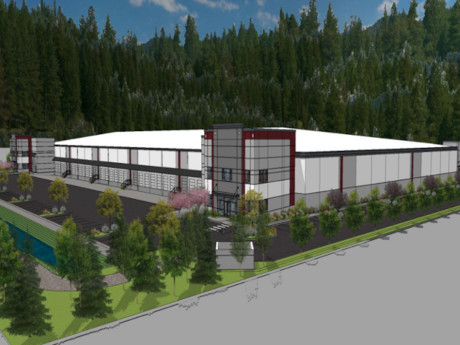

PACIFIC, WASH. — Gantry has secured a $18 million construction-to-permanent loan for the speculative development of an industrial property in Pacific. Situated on 12 acres, the property will feature 160,000 square feet of industrial space. Construction began in second-quarter 2022 and completion is slated for early 2023. Mike Wood and Alex Saunders of Gantry arranged the financing for the borrower, Davis Property Investment. A regional bank provided the seven-year loan with a fixed, sub-4.4 percent interest rate. The financing features an initial two-year interest-only payment period before moving to a 30-year amortization for the remaining term. The initial funding is for $15 million to complete construction, with an additional $3 million earn-out upon lease up and stabilization of the project.

Berkadia Negotiates $145M Acquisition of Granite Pointe Multifamily Property in Washington

by Amy Works

SPOKANE VALLEY, WASH. — Berkadia has brokered the sale of Granite Pointe, a garden-style apartment community in Spokane Valley. A Spokane-based developer sold the asset for $145 million. Kenny Dudunakis, David Sorensen, Benjamin Johnson and George Pallis of Berkadia Bellevue represented the buyer in the transaction. Additionally, Allan Freedman, Ed Zimbler and Nick Provost of Berkadia Los Angeles secured $102.7 million in acquisition financing for the undisclosed buyer. A bank provided the four-year bridge loan. Located at 12707 E. Mansfield Ave., Granite Pointe features 559 one-, two- and three-bedroom floor plans with in-unit washers/dryers and private patios or balconies. Community amenities include a fitness center, movie theater and clubhouse.

Blueprint Arranges Sale of 92-Unit Pinewood Terrace Seniors Housing Community in Colville, Washington

by Amy Works

COLVILLE, WASH. — Blueprint Healthcare Real Estate Advisors has negotiated the sale of Pinewood Terrace, a 92-unit skilled nursing facility located in Colville, a tiny city of fewer than 5,000 residents in the northeastern corner of Washington State. Cascadia Healthcare acquired the property for an undisclosed price. The seller was looking to exit Washington for states with more favorable reimbursement rates and lower regulatory hurdles. Cascadia, meanwhile, is growing its regional team in the Washington and northern Idaho markets to help with quality of care and synergy between local buildings.

VANCOUVER, WASH. — Marcus & Millichap has arranged the sale of East Vancouver Self Storage, a self-storage facility at 515 E. 157th Ave. in Vancouver. A limited liability company sold the asset to another limited liability company for $6 million. Totaling 42,780 square feet, East Vancouver Self Storage features 390 units. At the time of sale, the property was 81 percent occupied. Christopher Secreto of Marcus & Millichap’s Seattle office represented the seller and buyer in the deal.

GXO Logistics Leases 468,272 SF Manufacturing Building Near Seattle from BOSA Development

by Amy Works

EVERETT, WASH. — GXO Logistics has fully leased a 468,272-square-foot manufacturing/distribution facility at Bomarc Business Park in Everett from BOSA Development. With this lease, GXO is expanding its footprint by 35 percent at the building, located at 9205 Airport Road, in addition to extending its lease. Tom Wilson, Taylor Hudson and Ben Conwell of Cushman & Wakefield represented the landlord in the transaction. Situated on more than 30 acres, the building features 24-foot to 27-foot clear heights, dock and grade loading, office and restroom space to support dense occupancy, 673 parking stalls, and ESFR sprinklers.

BREMERTON, WASH. — Security Properties has completed the disposition of Insignia Apartments, a multifamily property at 1060 Insignia Loop in Bremerton. An undisclosed buyer acquired the community for $48.5 million. Built 2017, Insignia Apartments features 162 one- and two-bedroom apartments spread across 12 buildings on 6.2 acres. Community amenities include a fitness center, rec room, playground and dog park. Eli Hanacek, Jon Hallgrimson, Mark Washington and Kyle Yamamoto of CBRE’s Pacific Northwest-based multifamily team represented the seller in the transaction.

Sterling Realty Divests of 103,141 SF Lynnwood Crossroads Retail Center in Lynnwood, Washington

by Amy Works

LYNNWOOD, WASH. — Bellevue-based Sterling Realty Organization has completed the sale of Lynnwood Crossroads, grocery-anchored shopping center in Lynnwood. Orange County, Calif.-based Sakioka Farms acquired the asset for $45 million in an all-cash 1031 exchange transaction. Billy Sleeth and Paul Sleeth of Newmark represented the seller, while Pete Bethea, Glenn Rudy and Rob Ippolito of Newmark represented the buyer in the transaction. Sprouts Farmers Market, LA Fitness, Starbucks Coffee, Jersey Mike’s Subs, Five Guys, The Joint Chiropractic, Great Clips and Qdoba are tenants at the 103,141-square-foot retail space. At the time of sale, the property was 100 percent leased.

SEATTLE — AIMCO has completed the disposition of 2900 on First, an apartment community located in Seattle’s Belltown neighborhood. An undisclosed buyer purchased the asset for $69 million, or $511,111 per unit. 2900 on First features 135 apartments spread across three connected seven-story residential towers. Apartments feature flat-panel cabinetry, full-size washers/dryers, keyless entries and Wi-Fi-enabled thermostats. Select apartments have wood-burning fireplaces and private balconies. Additionally, the community features a standalone amenity building atop a parking garage podium and a 14,644-square-foot retail space. Amenities include a leasing office with a resident clubhouse and kitchen, conference room, multi-level fitness center, courtyard and lawn. A restaurant, spa, bakery, beauty store and pizza delivery service occupy the street-level retail space. Philip Assouad, Giovanni Napoli, Ryan Harmon and Nicholas Ruggiero of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the seller and procured the buyer in the transaction.