TUKWILA, WASH. — Dalfen Industrial has purchased Olympic Logistics Center, an industrial property in Tukwila, a suburb of Seattle. Terms of the off-market transaction were not released. Rainier Industries fully occupies the 137,266-square-foot facility. The property is near interstates 5 and 405 and State Route 176 and offers access to Seattle-Tacoma International Airport, Port of Seattle and Port of Tacoma. The acquisition brings Dalfen’s metro Seattle footprint to approximately 850,000 square feet.

Washington

TUKWILA, WASH. — Dalfen Industrial has purchased Olympic Logistics Center, an industrial property in Tukwila, a suburb of Seattle. Terms of the off-market transaction were not released. Rainier Industries fully occupies the 137,266-square-foot facility. The property is in close proximity to interstates 5 and 405 and State Route 176 and offers access to Seattle-Tacoma International Airport, Port of Seattle and Port of Tacoma. The acquisition brings Dalfen’s Seattle footprint to approximately 850,000 square feet.

TACOMA, WASH. — 6th & Alder Partners LLC has completed the disposition of Sixth & Alder, an apartment building in Tacoma, to an undisclosed buyer for $46.2 million. Austin Kelley and Ben Norbe of Kidder Mathews represented the buyer in the off-market transaction. Located at 3118 6th Ave., Sixth & Alder features 111 apartments and 75,240 square feet of retail space. Community amenities includes an on-site dog washing station, electric vehicle charging, fitness center and rooftop putting green.

Cushman & Wakefield Arranges $91.9M Construction Loan for Bellevue Station Apartment Project in Washington

by Amy Works

BELLEVUE, WASH. — Cushman & Wakefield has arranged $91.9 million in construction financing for Legacy Partners and New York Life Real Estate Investors for the development of Bellevue Station, a transit-oriented multifamily property in Bellevue. Located at 1525 132nd Ave. NE in Bellevue’s Bel-Red submarket, Bellevue Station will feature 288 apartments, including 230 market-rate units and 58 below-market Multifamily Tax Exemption units. Community amenities will include a gym with a separate yoga zone, coffee bar, rooftop club room with terrace and an indoor/outdoor/games room. Additionally, the lobby will offer co-working space with open booths for residents. Upon completion in first-quarter 2025, Bellevue Station will sit along the newly expanded East Link light rail station. Dave Karson, Chris Moyer and Keith Padien of Cushman & Wakefield Equity, Debt & Structured Finance represented the borrower in the financing, which JPMorgan Chase provided. The team also arranged the joint-venture equity for the development of the project earlier this year on behalf of Legacy Partners.

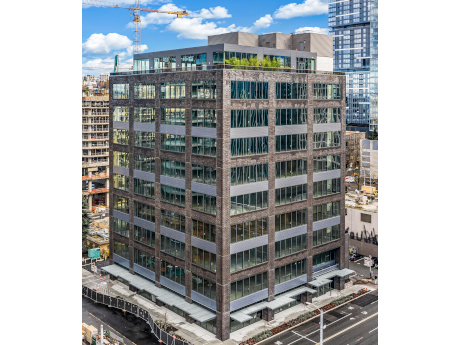

SEATTLE — Oxford Properties Group has completed the conversion of the 136,000-square-foot Boren Lofts office building into Boren Labs, a life sciences facility in downtown Seattle. Located at 1930 Boren Ave. in the South Lake Union neighborhood, the building features 15,000-square-foot floor plates, pre-built lab suites and move-in-ready research and development suites. The 10-story building features nine levels of labs and support office space, ground-level retail and a newly built amenity floor, which features a shared rooftop deck and conferencing center, fostering collaboration between occupants. The converted building features 15-foot floor-to-floor heights, fully upgraded MEP systems and ample subsurface parking. Each floor also features natural light and a private deck with outdoor access. Current tenants include Icosavax, Tune Therapeutics and GentiBio.

CBRE Secures $196.2M in Financing for Chapter Buildings Mixed-Use Development in Seattle’s University District

by Amy Works

SEATTLE — CBRE has arranged joint-venture equity and $196.2 million in construction financing for Chapter Buildings I and II, two mixed-use buildings in Seattle’s University District. Seattle-based Touchstone, Atlanta-based Portman Holdings and Houston-based Lionstone Investments comprise the development team. Tom Pehl, Charles Safley, Todd Tydlaska of CBRE Capital Markets West Coast, along with James Scott and Brian Myers of CBRE Capital Advisors, arranged the equity. Brad Zampa, Mike Walker and Megan Woodring of CBRE Debt & Structured Finance arranged the financing. Construction of Building I commenced earlier in 2022 and construction of Building II will begin in late 2022, with expected delivery in 2024. Totaling more than 400,000 square feet, the Chapter Buildings will consist of two assets. Chapter Building I, located at 4530 12th Ave. NE, will rise 12 stories featuring 240,000 square feet of office space and 9,000 square feet of ground-floor retail. The 10-story Chapter Building II will feature 154,000 square feet of life sciences and research & development space above 4,000 square feet of retail space. Greg Inglin, David Abbott and Laura Ford of CBRE are marketing the buildings for lease.

JLL Capital Markets Arranges $29.6M Refinancing for Mirror Lake Village Seniors Housing Community Near Seattle

by Amy Works

FEDERAL WAY, WASH. — JLL Capital Markets has arranged a $29.6 million refinancing for Mirror Lake Village, a Class A seniors housing community situated on three acres at 3100 9th Place in SW in Federal Way. Mirror Lake Village features 30 assisted living units, 66 memory care units and 18 independent living cottages averaging 378 square feet. The community also features an outdoor courtyard with covered patio, common dining room, commercial kitchen, hair salon, theater, library and exercise room. Alanna Ellis of JLL Capital Markets represented the borrower, Mirror Lake Village LLC, in securing the financing through a regional bank together with retroactive C-PACE financing.

Landmark Properties to Break Ground on 500-Bed Student Housing Community Near University of Washington

by Amy Works

SEATTLE — Landmark Properties is set to break ground on The Mark at Seattle, a 500-bed student housing development located near the University of Washington campus. The Athens, Georgia-based company recently closed on the acquisition of the development site for the project at 1200 NE 45th St. in Seattle. The community will offer a mix of one- to five-bedroom fully furnished units. Shared amenities will include a 24-hour study lounge, computer lab, fitness center, club room, rooftop deck with a swimming pool and a sauna, alongside 3,300 square feet of ground-floor retail space. Landmark Construction will serve as general contractor for the duration of the project, which is scheduled for completion ahead of the fall 2025 semester. This is Landmark’s second project in the Seattle area, with The Standard at Seattle currently under construction. “Landmark is excited to start our second project at the University of Washington,” says Wes Rogers, Landmark president and CEO. “This location was particularly attractive as it is in the heart of the University District neighborhood and is just steps from campus. Given the high barriers to entry in this market and strong fundamentals at the University of Washington, this project fits our investment criteria perfectly.”

KENT, WASH. — Colliers has arranged the sale of two industrial properties in Kent. Holman Logistics sold the assets to Lift Partners for $106.1 million. Matt McGregor and Bill Condon of Colliers represented both parties in the off-market transaction. Totaling 381,790 square feet, the buildings are located at 22434 and 22408 76th Ave. South. The properties feature a mix of dock-high and grade-level loading doors, 200,000 square feet of excess yard and rail access to the Burlington Northern Santa Fe line. The buyer has agreed to a 12-month leaseback of the properties with the seller, which will continue to operate in the current buildings while it completes construction and relocation plans for new facilities in Fredrickson and Sumner.

Arriba Capital Arranges $63.9M Construction Loan for AC Hotel by Marriott in Downtown Seattle

by Amy Works

SEATTLE — Arriba Capital has closed an $63.9 million syndicated construction loan for the development of an AC Hotel by Marriott in downtown Seattle. The borrower is a privately held hospitality management and development group based in the Southeast. Situated in the South Lake Union neighborhood, the hotel will feature 200 guest rooms.