SEATTLE — German investment firm Deka Immobilien has acquired Lakefront Blocks, a 635,000-square-foot office complex in Seattle’s South Lake Union neighborhood, for $802 million. Tech giant Google is the anchor tenant. Completed in 2019 and designed by Graphite Design Group, the development spans two city blocks — Block 31 and Block 25 — offering four six-story office buildings. The property also includes two apartment towers, Helm and Mera, which were not included in the transaction. The office buildings on Block 31 are separated by a sky bridge and include retail space leased to Tapster, a self-serve beer and wine tasting bar, and 203 Degrees Fahrenheit coffeehouse. The buildings on Block 25 are separated by a public alley. Kevin Shannon, Alex Foshay, Nick Kucha, Ken White, Rob Hannan, Jesse Ottele and Michael Moll of Newmark brokered the transaction on behalf of the seller, Seattle-based Vulcan Real Estate. Kevin Smith, Gerry Casimir, Bill Burke, Nikki Lam and Tom Weber of Cushman & Wakefield advised the buyer in the transaction and will assist with ongoing management of the campus. “This project, in my opinion, was the best core office offering on the West Coast in 2021,” says Shannon. “The combination of credit, asset quality, ESG [environmental, social …

Washington

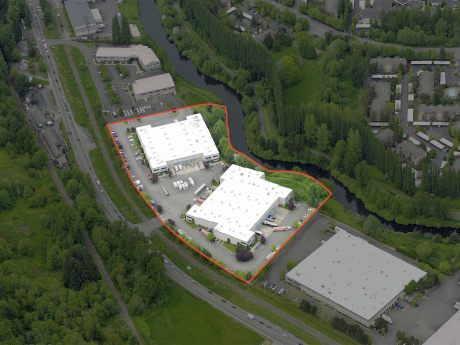

Kidder Mathews Brokers $33.5M Sale of Two Buildings at Woodinville West Business Park in Washington

by Amy Works

WOODINVILLE, WASH. — Kidder Mathews has arranged the sale of Buildings C and D of Woodinville West Business Park, located at 16650 and 16750 Woodinville Redmond Road NE in Woodinville. A private investor acquired the assets from Woodinville West CD for $33.5 million. Buildings C and D are high-quality, concrete and steel-framed buildings totaling 122,750 square feet of industrial space. Zach Vall-Spinosa of Kidder Mathews represented the seller in the deal.

Urban Visions Receives $90M in Construction Financing for Office Development in Seattle

by Amy Works

SEATTLE — Urban Visions has obtained $90 million in construction financing for The Jack, an office development under construction at 74 S. Jackson St. in Seattle’s Pioneer Square. Slated for delivery in first-quarter 2023, The Jack will offer 146,000 square feet of office space in 20,000-square-foot flexible floorplates. The property will also feature 42 below-grade parking spots, onsite secure bike storage and a 17,000-square-foot outdoor terrace/roof deck. Olson Kundig designed the eight-story brick and glass building. Bruce Ganong, Kaden Eichmeier and Christopher DuCharme of JLL secured the construction financing, which an affiliate of Mack Real Estate Credit Strategies provided.

Castle Lanterra Properties Divests of 108-Unit Lumen Apartment Complex in Everett, Washington

by Amy Works

EVERETT, WASH. — New York-based Castle Lanterra Properties has completed the disposition of Lumen, a multifamily community in Everett. An undisclosed private investor acquired the asset for $36.7 million. Castle Lanterra originally purchased the property in 2018 for $22.6 million. The 108-unit property features fully equipped kitchens, upgraded cabinets/countertops, state-of-the-art appliances, washer/dryer connections and walk-in closets. Community amenities include a large rooftop deck, barbecue area, clubhouse, garage with ample parking and ground-floor retail space, which a Mexican restaurant currently occupies. Castle Lanterra completed interior renovations and unit upgrades, as well as an overhaul of the amenity space, which included adding a community room, expanding the fitness center and improving the rooftop deck.

Ready Capital Closes $7.3M in Financing for Multifamily Property in Spokane Valley, Washington

by Amy Works

SPOKANE VALLEY, WASH. — Ready Capital has closed $7.3 million in financing for the acquisition, renovation and stabilization of an apartment community in Spokane Valley’s Dishman Hills submarket. Upon acquisition, the undisclosed borrower will implement a capital improvement plan curing deferred maintenance, renovating unit interiors and building exteriors while performing various common area upgrades. Ready Capital closed the non-recourse, interest-only, floating-rate loan, which features a 36-month term, two extension options, flexible prepayment and a facility to provide future funding for capital expenditures.

VANCOUVER, WASH. — SB Real Estate Partners has acquired Bridge Creek Apartments, a garden-style multifamily community in Vancouver. An undisclosed seller sold the property, which will be rebranded as Portola Bridge Creek, for $75 million. The community is located at 9211 NE 15th Ave. within the Hazel Dell North area of Vancouver, about 14 miles north of Portland, Ore. Built in multiple phases from 1984 and 1989, the property features 270 apartments in a mix of one-, two- and three-bedroom floor plans ranging from 650 to 1,150 square feet. Community amenities include a swimming pool with poolside barbecue stations, a playground, dog parks, a fully automated Amazon package locker system and a 24-hour modern fitness center.

HENDERSON, NEV., AND MILLWOOD, WASH. — Faris Lee Investments has brokered the sales of two single-tenant grocery stores, totaling 106,254 square feet in Henderson and Millwood. The properties sold for a combined consideration of $22.4 million. Jeff Conover and Scott DeYoung of Faris Lee Investments represented the undisclosed buyers and seller, a Southern California-based family private office, in the deal. Located in Henderson, the 58,254-square-foot property is an absolute triple-net lease to Albertsons with 14 years remaining on its lease. The second property, located in Millwood, is a 48,000-square-foot, freestanding Safeway, with 18 years remaining on its lease.

SEATTLE — Shea Properties has opened EdgePoint Apartments, a multifamily community located at 320 N. 85th St. in Seattle’s Greenwood neighborhood. The six-story, 203-unit property features a mix of open one-, one- and two-bedroom units ranging in size from 561 square feet to 990 square feet. Units offer quartz countertops, wood-style flooring, stainless steel appliances and high-end finishes throughout. Additionally, the property features a sky deck, lounge, fitness center, pet spa and 4,500 square feet of onsite retail space. Rush served as general contractor and Runberg Architecture Group served as architect for the project.

Africatown, Community Roots Break Ground on Affordable Housing Development in Central Seattle

by Amy Works

SEATTLE — Africatown Community Land Trust (ACLT) and Community Roots Housing (CRH) have broken ground on 23rd and East Spring Street in Seattle’s Central District. Situated on a half-acre site, the seven-story building will feature 126 affordable housing units, including 59 studio apartments for households earning up to 50 percent of the area median income (AMI). Additionally, the community will feature 36 one-bedroom and 31 two- and three-bedroom units for households earning up to 60 percent of AMI. The landlord will provide heat, hot water, potable water, sewer and trash collection for the residents. The building’s ground floor will contain space for ACLT’s new headquarters, an affordable commercial kitchen to be used by local culinary entrepreneurs, a community room and bike storage. The design team includes GGLO, DREAM Architects and David Baker Architects. The general contractor group is a joint venture between Absher and MAD Construction, which is an African American-owned general contractor. In addition, 30 percent of the total value of the mechanical, electrical and plumbing work has been awarded to Adept Mechanical & General Contracting, an African American-owned subcontractor. KeyBank Community Development Lending and Investment is providing $37.4 million of construction financing and $14.2 million of permanent financing, …

Marcus & Millichap Brokers $5.2M Sale of Riviera Multifamily Property in Kent, Washington

by Amy Works

KENT, WASH. — Marcus & Millichap has arranged the sale of Riviera I & II, a multifamily community located at 10718 SR 238th St. in Kent. A limited liability company sold the asset to a limited liability company for $5.2 million. Riviera I & II consists of three residential buildings offering a total of 26 apartments. The property features one 14-unit building, which was built in 1978, and two six-unit buildings that were built in 1968. The property offers a mix of one-bedroom/one-bath, two-bedroom/one-bath and two-bedroom/one-and-a-half baths. Kellan Moll and Scott Morasch of Marcus & Millichap’s Seattle office represented the seller and the buyer in the deal.