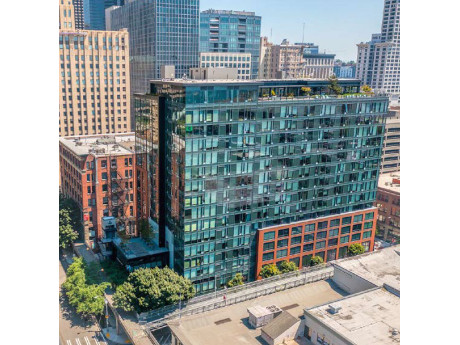

SEATTLE — Kennedy Wilson and the real estate business within Goldman Sachs Asset Management have purchased Coppins Well, a high-rise multifamily property in Seattle, for $106.5 million, excluding closing costs. Kennedy Wilson has a 30 percent ownership interest in the property, which the partnership acquired with a total equity investment of $44 million and a $66 million loan. The ownership team plans to roll out a value-add asset management plan, which includes investing $4 million to renovate unit interiors, refresh common areas and enhance amenities. Completed in 2012, the 17-story building features 236 apartments in a mix of studio, one- and two-bedroom layouts, a movie lounge, fitness center and dog runs. Ground-floor retail tenants include a coffee house, restaurant and bank.

Washington

FIFE, WASH. — Orange County, Calif.-based MCA Realty, through its MCA Realty Industrial Growth Fund, has purchased Fife Business Center located at 4624 and 4630 16th St. in Fife for $10.4 million in an off-market transaction. At the time of sale, the 65,342-square-foot property was 96 percent occupied by a variety of tenants. MCA plans to implement a series of upgrades, including new roof overlays, HVAC repairs, new landscaping and an updated paint scheme. Joel Jones and Nick Ratzke of Neil Walter Co. represented MCA Realty in the transaction.

Marcus & Millichap Negotiates $4.3M Sale of Shoreline Park Office Building in Shoreline, Washington

by Amy Works

SHORELINE, WASH. — Marcus & Millichap has arranged the sale of Shoreline Park, an office building located at 19940 Ballinger Way NE in Shoreline. A private investor sold the asset to an undisclosed buyer for $4.3 million. Shoreline Park features 13,503 square feet of office space. At the time of sale, the property was 85 percent occupied by a mix of professional tenants. John Marks and Stren R. Lea of Marcus & Millichap’s Seattle office represented the seller in the deal.

Patrinely Group, Dune Real Estate Partners Buy Development Site for Office Tower in Downtown Bellevue, Washington

by Amy Works

BELLEVUE, WASH. — Patrinley Group, in partnership with affiliates of Dune Real Estate Partners, has acquired a fully entitled development site for a 484,000-square-foot office tower in downtown Bellevue. The joint venture purchased the 0.9-acre site with an advanced building design from an affiliate of FANA Group of Cos. Terms of the transaction were not released. Located at the southeast corner of NE Fourth and 106th Avenue NE, the 21-story FOUR106 office building will feature 480,000 square feet of office space and 6,500 square feet of street-level retail space. Additionally, the tower will offer a fully equipped fitness center with shower and locker facilities, tech capabilities, hands-free elevators and hands-free restrooms. The property has also been designed to meet LEED Gold standards. Construction is slated to commence this spring, with delivery scheduled for fourth-quarter 2024. FOUR106’s project team includes CollinsWoerman, Gensler, Mortenson Construction and DCI. Paul Sweeney, Jason Furr and Colin Tanigawa of The Broderick Group will handle leasing for the completed project. Kevin Shannon, Ken White and Tim O’Keefe of Newmark represented the seller in sale of the site. Bill Fishel, Tom Wilson and Rachael Lewis of JLL arranged financing for the project.

TACOMA, WASH. — Los Angeles-based Cypress Equity Investments (CEI) has completed the construction of Hailey, a multifamily property in Tacoma. Located at 1210 Tacoma Ave. South, Hailey features 186 apartments in a mix of studio, open one-bedroom, one-bedroom and two-bedroom floor plans with custom cabinetry, quartz countertops, stainless steel appliances, tiled backsplashes and in-unit washers/dryers. The property offers a rooftop deck with harbor and mountain views, a second-floor outdoor terrace, fitness center, community barbecue facilities, bike storage, lounge seating, barbecue stations and fire pits. Studio19 Architects served as architect and Gig Harbor-based The Rush Cos. served as general contractor for the project. Construction began in late 2017 and the community received its certificate of occupancy in October 2021.

MIG Real Estate Purchases 152-Unit BluWater Multifamily Property in Everett, Washington

by Amy Works

EVERETT, WASH. — MIG Real Estate has acquired BluWater, a multifamily property located at 11311 19th Ave. SE in Everett. BluWater is the fifth Seattle-area multifamily community managed by MIG. Terms of the transaction were not released. Built in 1991, BluWater features seven three-story buildings offering a total of 152 one-, two- and three-bedroom apartments with eight-foot ceilings. Amenities include a clubhouse, leasing center, indoor/outdoor swimming pool with sauna, fitness center, children’s playground, multiple walking paths and playgrounds. MIG plans to renovate BluWater including apartment interiors, refreshing the buildings’ exterior paint, expanding the clubhouse and leasing center, and enhancing common area amenities. Giovanni Napoli and Phillip Assouad of Institutional Property Advisors, a division of Marcus & Millichap, brokered the transaction.

PCCP Provides $75M Acquisition, Repositioning Loan for The Post Apartments in Downtown Seattle

by Amy Works

SEATTLE — PCCP has provided a $75 million senior loan to Griffis Residential for the acquisition and repositioning of The Post, a 16-story multifamily community located at 888 Western Ave. in downtown Seattle. Situated in the Seattle Central Business District, Waterfront and Pioneer Square submarkets, The Post features 208 apartments with quartz countertops, vinyl-plank flooring, steel appliances, floor-to-ceiling windows and views of downtown Seattle, Elliott Bay and the Olympic Mountains. Community amenities include a rooftop deck with grilling areas and a reflection pool, multiple rooftop lounges, a media room, dog run, yoga studio, library and fitness center.

Northmarq Arranges $28.1M Construction Loan for Tacoma Central Logistics Project in Washington

by Amy Works

TACOMA, WASH. — Northmarq has arranged a $28.1 million construction loan for the development of Tacoma Central Logistics at 1950 S. State St. in Tacoma. Scott Moline and Bob Spiro of Northmarq secured the three-year, interest-only loan through the firm’s relationship with a national bank for the undisclosed borrower. Totaling 248,000 square feet, the speculative building will feature 36-foot clear heights, 183 auto stalls, four grade-level doors, 56 dock doors and 50 trailer parking stalls. The Tacoma News Tribune previously occupied the site, but the former building was demolished.

BELLEVUE, WASH. — Evergreen Point Development has completed the disposition of Cerasa, a multifamily property located at 10961 NE 2nd Place in Bellevue. Virtu Investments acquired the asset for $109 million, or $707,792 per unit. Completed in 2019, Cerasa features 154 apartments, including top-floor penthouses with 11-foot to 14-foot ceilings. Community amenities include a clubhouse, resident lounge with fireplace and gated underground parking garage with electric car charging stations. Philip Assouad and Giovanni Napoli of Intuitional Property Advisors, a division of Marcus & Millichap, represented the seller and procured the buyer in the deal.

Fortress Investment Purchases Seven-Acre Industrial Property in Auburn, Washington for $22M

by Amy Works

AUBURN, WASH. — Fortress Investment has acquired a seven-acre industrial property in Auburn from MK Holdings for $22 million in an off-market transaction. Matt Murray and Matt McLennan of Kidder Mathews brokered the deal. Located at 904 W. Main St., the land includes a 24,000-square-foot building. Utility Trailer Sales of Washington Co. occupies the property.