By Scott Reid

Demand for office space nationwide accelerated in the second quarter of 2014, according to research reports by several commercial real estate services firms that track data throughout the United States.

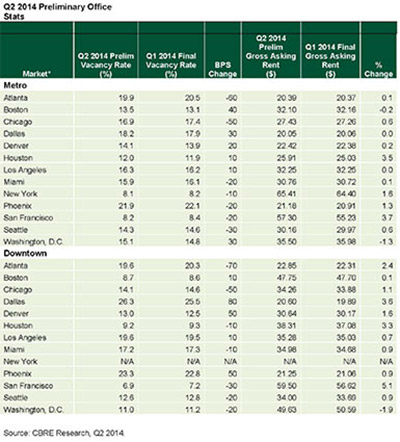

CBRE Group Inc. found that office vacancy rates declined in seven out of 13 major metro office markets during the second quarter of the year. The firm also reported that average asking rents increased during this period.

In its quarterly report, CBRE found that Atlanta led in vacancy declines, with a vacancy rate drop of 60 basis points (bps) during the quarter. Chicago posted a fall of 50 bps in its office vacancy rate, and Seattle’s rate dropped 30 bps due to the expansion in its office stock of high-tech occupiers. Increases in vacancy occurred in Boston (40 bps), Dallas and Washington, D.C. (both 30 bps).

Vacancy rates in markets such as San Francisco and Houston are now near pre-recession levels. San Francisco saw a 3.7 percent increase in its average asking rents, and Houston experienced a 3.5 percent increase. Boston and Washington, D.C., saw decreases in average asking rents — 0.2 percent and 1.3 percent, respectively.

Click on the image above to view a larger version.

Kevin Thorpe, chief economist of Cassidy Turley, says this growth was expected but his firm’s findings pointed to stronger underlying trends.

“The office sector was due for a stronger quarter following the weather disruptions [of the first quarter], but what is telling is that we are now observing stronger demand trends for Class B and C space in many markets, indicating tenant demand is spreading beyond the highest quality product. Although high-quality space still dominates leasing activity, the Class B and C segment of the market accounted for 40 percent of the absorption this quarter, a major shift from the 25 percent averaged earlier in the recovery.”

According to Cassidy Turley’s report, U.S. office markets absorbed 15.1 million square feet of office space in the second quarter of 2014, up 41 percent from the previous quarter. The firm reported that vacancy rates nationwide fell 10 basis points (bps) from 15.2 percent in the first quarter to 15.1 percent in the second quarter.

Cassidy Turley also found that average asking rates in the U.S. rose 2.2 percent to $22.36 per square foot. As the second quarter closed, there was 73 million square feet of new office space under construction, up 34 percent compared to the second quarter of 2013.

The Q2 Cassidy Turley report differed from CBRE in its rankings, however, of the cities with the strongest demand for office space. It reported that the strongest market was New York, with 1.6 million square feet of net absorption, followed by San Jose, Calif., with 1.4 million square feet.

Investment management company JLL reported that overall leasing activity in the second quarter increased 6.2 percent from the first quarter of 2014. According to the company, there were 14 leases exceeding 300,000 square feet signed in the second quarter, compared to eight in the first quarter.

The office sector nationwide experienced 13.9 million square feet of positive net absorption in the second quarter, according to JLL, besting the first quarter by more than 5.5 million square feet, or 63 percent. JLL also found that in the 49 office markets it tracks, rents are increasing in 98 percent of those markets.

“Although development is picking up,” says Cassidy Turley’s Thorpe, “the office sector does not currently face the cyclical headwind of overbuilding, and absorption rates are solid enough in most markets.

“The majority of the country should expect that office rents will grow at an accelerating rate in the second half of the year driven by improving economic data, improving confidence and steady job creation.”