PHOENIX — Empire Group, a multifamily and commercial real estate development firm based in Scottsdale, Ariz., has obtained an $88.5 million construction loan for the development of Village at Bronco Trail. The 354-unit build-to-rent (BTR) community will be situated on a 30-acre site at 29th Avenue and Sonoran Desert Drive on the city’s north side.

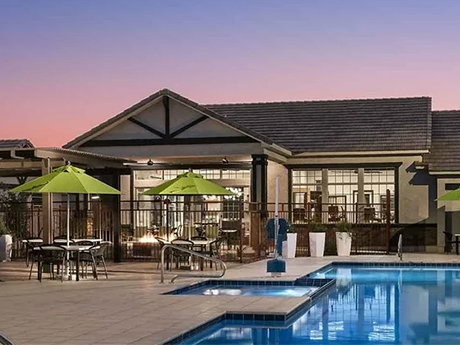

Empire Group expects to deliver the first swath of single-family homes at Village at Bronco Trail in 2024. Homes will average 920 square feet and amenities will include detached garages, a dog park, grilling area, resort-style pool, clubhouse and common area open spaces.

Each home will have a private yard; kitchen with quartz countertops, stainless steel appliances and backsplashes; full-size washers and dryers; and upgraded smart-home features and technology.

The property will be situated within two miles of the chip manufacturing plant for Taiwan Semiconductor Manufacturing Co., which is a $40 billion facility and a major economic demand driver for the North Phoenix residential market.

Kyle McDonough and George Maravilla of Tower Capital arranged the financing on behalf of Empire Group. The direct lender was not disclosed, but the mortgage brokerage firm was able to secure multiple term sheets from lenders during due diligence.

“The BTR market continues to experience strong growth and demand from the lending community as single-family residential home sales volume declines because of rising mortgage rates and limited inventory,” says McDonough.

The fixed interest rate for a 30-year mortgage rate has jumped from 5.74 percent a year ago to 6.75 percent as of this writing, according to the Mortgage Bankers Association. In January 2022 that rate hovered around 3.31 percent.

Last month, Tower Capital arranged financing for two other BTR projects by Empire Group in the metro Phoenix market for a combined $120.5 million. The projects include Village at Pioneer Park, a newly constructed, 332-unit BTR community, as well as Village at Skyline Ranch, a 167-unit BTR currently under development.

“Last year was the strongest year on record for construction of BTRs, and we expect more of the same in 2023,” says McDonough. “Our pipeline of BTR financings certainly reflects that trend, as we have closed nearly $210 million in BTR financing this past month and have roughly $300 million more in the works to close this summer.”

Empire Group has developed and/or managed more than $2 billion in assets while stewarding the capital of more than 5,000 unique investors, according to the firm.

— John Nelson