— By Dylan Simon, executive vice president, Kidder Mathews —

This summer marked a major milestone in Seattle’s apartment market, demonstrating signs of vibrancy with increases in rental rates, growing liquidity and clarity in pricing in capital transactions. The city is gaining momentum and continues to bounce back from recent market fluctuations and the harsh impacts of the pandemic. Urbanization is here to stay — corporate employers are voting against Zoom as an effective tool — as we trend back toward human nature, which requires community and proximity.

With limited new construction breaking ground, the stage is set for sustained rental rate growth, which will invariably result in a surge in sales prices.

Transaction Activity on the Rise

Transaction activity is steadily on the rise in Seattle’s multifamily market, proving conviction from the investment community. This uptick offers greater clarity on property values as the market adjusts from peak interest rates back in fall 2023. For owners and potential sellers, this shift suggests pricing hit a bottom in the past nine months and the only direction in pricing from here is upward.

In our recently launched third-quarter Seattle market report, we’ve uncovered key sales insights that underscore this resurgence. During the second quarter of 2024, there were 28 multifamily sales in Seattle, totaling $735 million. This marks a bit of a bull run compared to the 21 sales worth $140 million during the same period last year.

Notably, the dollar volume in the first half of 2024 is already on par with the total volume recorded in 2023.

Cap Rates and Market Pricing

The average cap rate on buildings sold during the second quarter was 5.4 percent, up from 4.9 percent a year ago. This increase aligns with trends observed across the nation, indicating a market-wide adjustment as pricing resets. However, this trough in pricing certainly marks the bottom. Transactions getting under contract today are priced closer to a 5 percent cap rate and, in many cases, below.

Expect marketing of today’s multifamily properties to demonstrate strong cap rate compression as these sales close in the last half of the year, solidifying an upward trend in pricing.

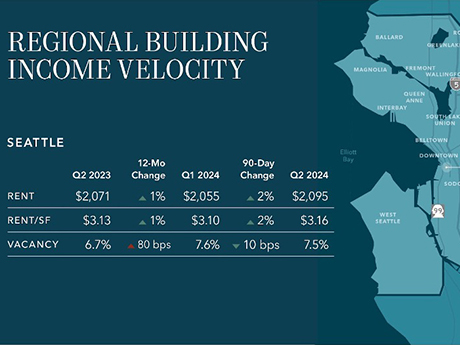

Rent and Vacancy Rates

Rents in Seattle have seen a steady increase year over year. This is encouraging, especially as the market continues to absorb a spate of newly delivered units. Overall vacancy has begun to tighten. Larger buildings (50+ units) currently have slightly higher vacancy rates than smaller buildings, correlating to many larger developments delivering in the past year. This development activity tracks directly to accommodative capital markets for institutional developers back in 2021 to 2022.

Looking ahead, we expect this vacancy gap to narrow as the construction pipeline continues to shrink. Higher financing and construction costs are leading to a decrease in new construction starts, which should help absorb the existing supply and stabilize vacancy rates across the board.

As the market adjusts, we anticipate a more balanced environment in early 2025, then a pronounced shift to strong rental rate growth in the back half of 2025 and assuredly through 2026.

This article was originally published in the September 2024 issue of Western Real Estate Business.