By Matt Hrubes and Joshua Allen, CBRE

St. Louis is located at the crossroads of the U.S. at the intersection of I-55 (north/south) and I-70 (east/west), making it a prime location for industrial real estate users and developers alike. The Greater St. Louis area is separated by the Mississippi and Missouri rivers, giving it a natural division of industrial submarkets. Each side of the Mississippi River tells a different story as it relates to industrial real estate.

Metro East

To the east of the Mississippi River is the Metro East industrial submarket, which was the first in the area to offer real estate tax abatement, resulting in larger industrial developments ranging in size from 500,000 square feet to over 1 million square feet. Over the last decade, this area has seen some of the largest speculative developments in the region from national developers such as Panattoni, NorthPoint and Exeter, as well as local developers like TriStar.

Absorption had been at all-time highs with groups like Amazon, World Wide Technology, Geodis, Sam’s Club, P&G and Tesla leasing space as buildings were being completed. That is, until 2023 when a wave of space became available either through sublease, speculative development completions or tenants vacating. As a result, there is now just over 3 million square feet of space available in the submarket.

This trend persists today. Long-time tenant Dial vacated an 812,000-square-foot building while Walgreens is offering its 500,000-square-foot distribution facility for sublease. Spectrum Brands has its 624,000-square-foot facility up for sublease and LTR Products also has 326,000 square feet available for sublease.

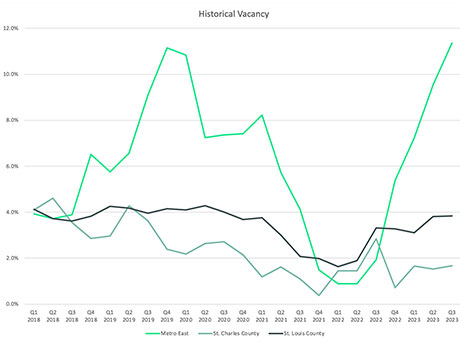

At the same time, speculative deliveries have added to the vacancy. In the past year, Exeter delivered an 802,000-square-foot building with 431,000 square feet available for lease and Panattoni delivered two buildings totaling 831,900 square feet. This has driven vacancy to historic levels, reaching 11.3 percent and causing asking rates to plateau at $4.31 per square foot in the third quarter of 2023.

While there is some recent tenant activity in the Metro East submarket, absorption remains at historic lows for 2023 (-1.8 million square feet year to date through December 2023) and new speculative development is not expected in this area for at least the next 12 months or until most of the existing space is absorbed.

St. Louis, St. Charles counties

Meanwhile, on the Missouri side of the river, St. Louis and St. Charles counties continue to see historically low industrial vacancy rates and healthy rent growth. St. Charles County has among the lowest vacancy in the region at 1.7 percent, driving average asking rates up to $6.55 per square foot.

St. Louis County vacancy clocks in slightly higher at 3.8 percent with average direct asking rates at $6.25 per square foot. Even with the low vacancy rate, rising interest rates, elevated cap rates and historically high construction costs have made developers reluctant to start any new speculative construction in the region.

Cities in St. Louis and St. Charles counties are now catching up with the Illinois side of the river by offering real estate tax abatement. This economic incentive tool is now a requirement for developers to consider when underwriting any land acquisition to level the playing field and keep overall all-in costs equal to what competing developments are offering.

Larger deals on the Missouri side are increasingly scarce in comparison to the historic run of 2020-2022, but there is still demand from tenants requiring anywhere between 20,000 square feet to 50,000 square feet to lease. This size range has contributed to the success of TriStar’s West Port Commerce Center off River Valley Drive in Maryland Heights, as it is the only speculative industrial development currently under construction in St. Louis County. The two buildings currently under construction in the development are approximately 256,024 square feet each and can accommodate tenants down to 42,000 square feet.

In St. Charles County, NorthPoint is completing the largest speculative development of 2023 with a 490,365-square-foot building at Lakeside Logistics Center 5. Other successful projects in proximity include NorthPoint’s three-building Riverport Trade Center development that is 95 percent leased, Hazelwood TradePort and Panattoni’s Aviator Business Park, as well as Premier 370 Business Park in St. Charles County. All these developers control land sites on both sides of the Missouri River that can accommodate large build-to-suits for users.

There are currently only four industrial developers in the St. Louis market with developable land sites as compared with other similar-sized cities throughout the Midwest. With so few in the market, there is tremendous opportunity to attract additional developers that have long overlooked this industrial hotbed. Land sites are available for development; however, until economic metrics improve, developers are not willing to spend time and money on land.

Looking forward

The St. Louis market’s conservative development in the last three years compared with competing Midwest markets has placed the metro area in a favorable position. Existing space will continue to slowly be absorbed at a premium due to historically low vacancy. As the macroeconomic picture begins to improve, so will developer confidence. Until then, higher lease rates and historically low vacancy on the Missouri side of the river will remain the new normal.

Matt Hrubes is a senior vice president and Joshua Allen is a research manager with CBRE. This article originally appeared in the January 2024 issue of Heartland Real Estate Business magazine.